Insider Sell Alert: COO Michael Bruen Sells 5,000 Shares of Bowman Consulting Group Ltd (BWMN)

Michael Bruen, the Chief Operating Officer of Bowman Consulting Group Ltd (NASDAQ:BWMN), has recently sold 5,000 shares of the company's stock. The transaction took place on November 15, 2023, and has caught the attention of investors and analysts alike. This insider sell event provides an opportunity to delve into the details of the insider's trading history, the company's business description, and the relationship between insider trading activities and the stock's price.

Who is Michael Bruen?

Michael Bruen serves as the Chief Operating Officer of Bowman Consulting Group Ltd. His role involves overseeing the day-to-day operational functions of the company, ensuring that the business runs efficiently and effectively. Bruen's decisions and leadership are critical to the success of Bowman Consulting Group, as he works closely with other executives to implement the company's strategic plans and initiatives.

Bowman Consulting Group Ltd's Business Description

Bowman Consulting Group Ltd is a professional services firm providing innovative engineering solutions to customers across various sectors. The company specializes in civil engineering, planning, landscape architecture, surveying, environmental consulting, and other related services. With a focus on sustainability and excellence, Bowman Consulting Group Ltd has established itself as a trusted partner for clients looking to navigate complex projects and achieve their development goals.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

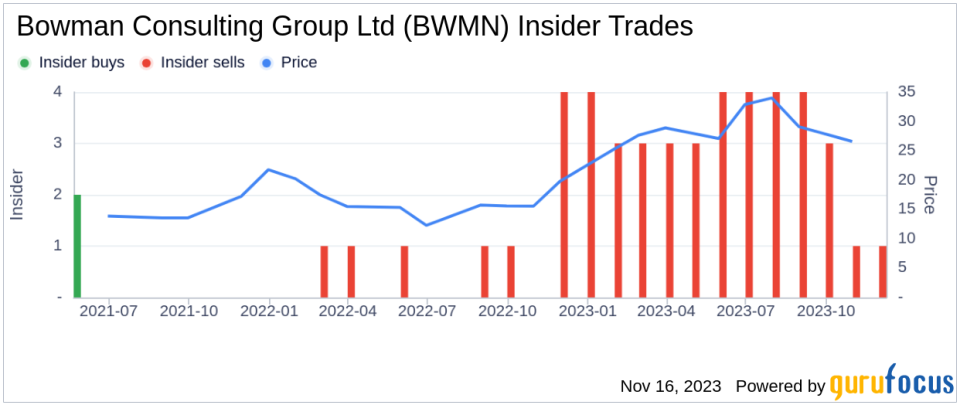

Insider trading activities, such as the recent sell by Michael Bruen, can provide valuable insights into a company's internal perspective on its stock's value. Over the past year, Bruen has sold a total of 63,500 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that insiders might believe the stock is fully valued or potentially overvalued at current prices.

The insider transaction history for Bowman Consulting Group Ltd shows a significant imbalance between sells and buys. There have been zero insider buys and 37 insider sells over the past year. This trend could indicate that insiders are taking advantage of the stock's price to realize gains or reallocate their investments.

On the day of Bruen's recent sell, shares of Bowman Consulting Group Ltd were trading at $29.11, giving the company a market cap of $392.436 million. The price-earnings ratio stands at a lofty 267.90, substantially higher than the industry median of 14.37 and the company's historical median. This elevated P/E ratio suggests that the stock may be overpriced compared to its peers and its own trading history.

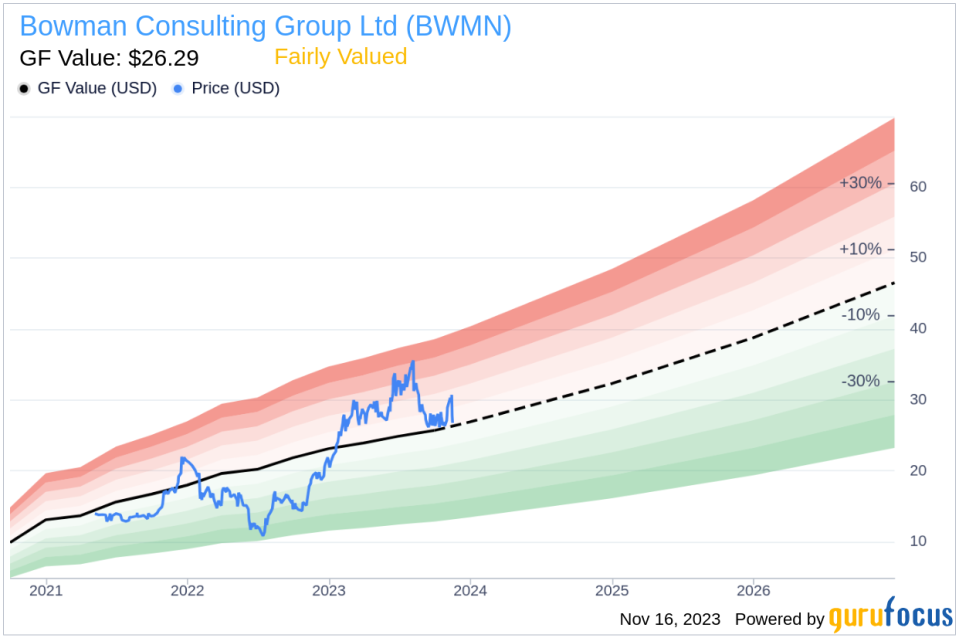

However, when considering the GuruFocus Value (GF Value) of $26.29, Bowman Consulting Group Ltd appears to be Fairly Valued with a price-to-GF-Value ratio of 1.11. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above illustrates the recent selling activity by insiders, which could be interpreted as a lack of confidence in the stock's future appreciation or simply a part of individual financial planning strategies.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current Fairly Valued status suggests that the stock is trading close to what GuruFocus considers its true worth, based on the factors mentioned earlier.

Conclusion

Michael Bruen's recent insider sell of 5,000 shares of Bowman Consulting Group Ltd adds to a pattern of insider selling over the past year. While the company's stock appears to be Fairly Valued according to the GF Value, the high price-earnings ratio and the lack of insider buying may raise questions among investors. As always, insider trading is just one piece of the puzzle, and investors should consider a comprehensive analysis of the company's financials, market position, and growth prospects before making investment decisions.

It's important to note that insider trading activities can be influenced by various factors, including personal financial needs, tax planning, and portfolio diversification, and do not always reflect the insider's view on the company's future performance. Therefore, while insider trends can provide useful hints, they should not be the sole basis for investment decisions.

Investors interested in Bowman Consulting Group Ltd should continue to monitor insider trading activities, along with other key financial metrics and market news, to make informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.