Insider Sell Alert: COO Qasim Saifee Unloads Shares of ZipRecruiter Inc

In a notable insider transaction, Qasim Saifee, the Chief Operating Officer of ZipRecruiter Inc (NYSE:ZIP), sold 32,804 shares of the company on December 14, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's internal perspective.

Who is Qasim Saifee at ZipRecruiter Inc?

Qasim Saifee is a seasoned executive with a track record of driving growth and operational excellence. As the COO of ZipRecruiter, Saifee has been instrumental in scaling the company's operations and enhancing its product offerings. His role involves overseeing the day-to-day administrative and operational functions, ensuring that the company remains agile and responsive to the dynamic job market.

ZipRecruiter Inc's Business Description

ZipRecruiter Inc is a leading online employment marketplace that leverages Artificial Intelligence (AI)-powered smart matching technology to connect millions of job seekers with employers across various industries. The platform simplifies the hiring process by actively connecting job seekers to relevant opportunities and enabling employers to efficiently find and recruit qualified candidates. With a focus on innovation and user experience, ZipRecruiter has become a go-to resource for both job seekers and employers in a competitive job market.

Analysis of Insider Buy/Sell and Relationship with Stock Price

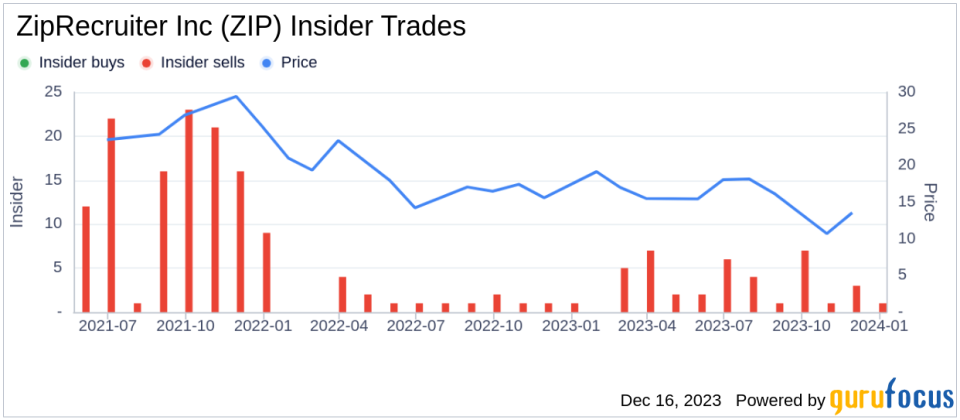

The recent sale by Qasim Saifee is part of a broader pattern of insider selling at ZipRecruiter Inc. Over the past year, Saifee has sold a total of 62,596 shares and has not made any purchases. This could be interpreted in several ways. On one hand, insiders might sell shares for personal financial reasons that do not necessarily reflect their outlook on the company's future. On the other hand, consistent selling by insiders, especially without any offsetting buys, might suggest that those with the most intimate knowledge of the company see limited upside in the stock's future performance.The insider transaction history for ZipRecruiter Inc shows a total of 40 insider sells over the past year, with no insider buys during the same timeframe. This trend of insider selling could be a signal to investors that insiders are taking profits or diversifying their investment portfolios.

When analyzing the relationship between insider transactions and stock price, it's important to consider the context of each sale. The stock was trading at $14.18 on the day of the insider's recent sale, giving the company a market cap of $1.381 billion. The price-earnings ratio of 23.69 is higher than the industry median of 17.175 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is relatively undervalued based on its own historical standards.Investors often look at insider selling as a negative indicator, particularly when the company's valuation metrics appear to be favorable. However, it's crucial to consider that insiders might have various reasons for selling that are unrelated to their outlook on the company's valuation or performance.

Conclusion

The insider's recent sale of shares in ZipRecruiter Inc is a development that warrants attention from investors. While the reasons behind Qasim Saifee's decision to sell are not publicly known, the pattern of insider selling at the company could be a factor for investors to consider in their analysis. It's essential to look at the broader picture, including the company's business model, market position, and financial performance, when evaluating the potential impact of insider transactions on the stock price.Investors should also keep an eye on future insider transactions and any changes in the company's fundamentals that might influence the stock's valuation. As always, a diversified investment approach and thorough due diligence are recommended when considering any stock for one's portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.