Insider Sell Alert: COO Shravan Goli Sells 24,925 Shares of Coursera Inc (COUR)

In a notable insider transaction, Shravan Goli, the Chief Operating Officer of Coursera Inc (NYSE:COUR), sold 24,925 shares of the company on December 1, 2023. This sale is part of a series of transactions over the past year, where the insider has sold a total of 622,931 shares and made no purchases. The recent sale has caught the attention of investors and market analysts, prompting a closer look at the insider's trading patterns and the potential implications for Coursera's stock.

Who is Shravan Goli?

Shravan Goli is an experienced executive with a strong background in technology and education. As the Chief Operating Officer of Coursera Inc, Goli plays a pivotal role in overseeing the company's operations, product development, and growth strategies. His expertise in scaling businesses and leading innovative initiatives has been instrumental in Coursera's expansion in the competitive online learning space.

About Coursera Inc

Coursera Inc is a leading online learning platform that offers a wide range of courses, specializations, certificates, and degrees from top universities and companies. The company's mission is to provide universal access to world-class education, enabling learners to acquire new skills and advance their careers. Coursera's platform caters to individuals, businesses, and governments, offering a diverse portfolio of content across various disciplines, including data science, business, computer science, and personal development.

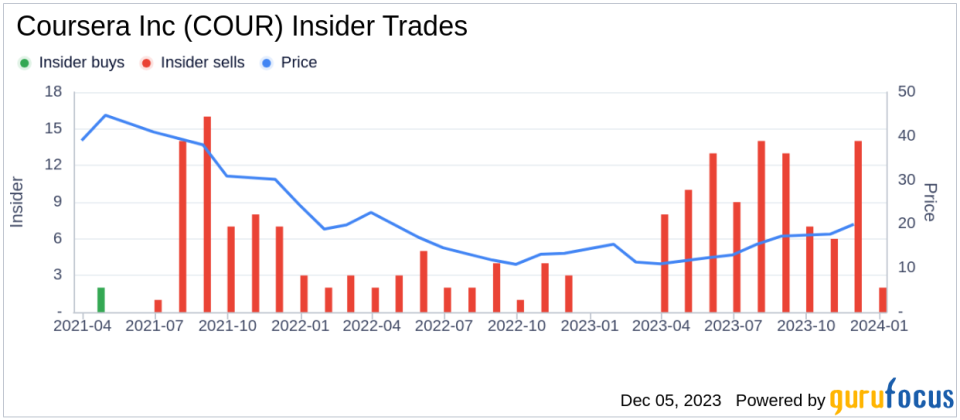

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly sales, can provide valuable insights into a company's internal perspective on its stock's valuation. In the case of Coursera Inc, the absence of insider purchases over the past year, coupled with 96 insider sells, may raise questions about the insiders' confidence in the company's near-term growth prospects. However, it is essential to consider that insider sales can be motivated by various factors, such as diversification of personal portfolios, tax planning, or liquidity needs, and do not necessarily indicate a negative outlook on the company's future.

The relationship between insider trading activity and stock price can be complex. While significant insider selling could potentially signal that the stock is overvalued, it is also important to analyze the context of these transactions. For instance, if the sales are part of a pre-determined trading plan or occur after a substantial run-up in the stock price, they may not necessarily reflect a bearish sentiment.

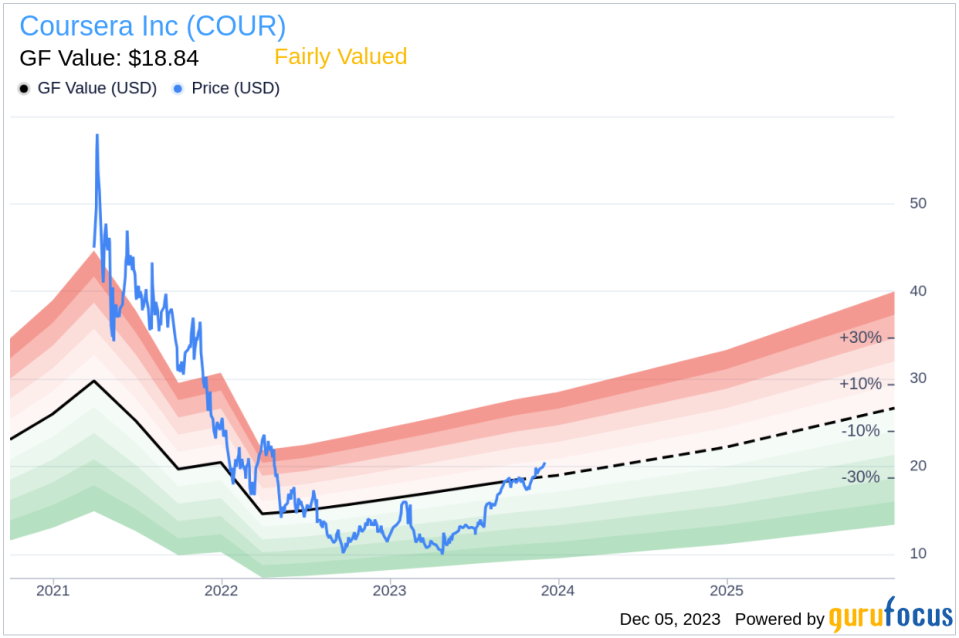

On the day of the insider's recent sale, Coursera Inc's shares were trading at $20.05, giving the company a market cap of $3.121 billion. This price point is slightly above the GuruFocus Value (GF Value) of $18.84, indicating that the stock is Fairly Valued based on its intrinsic value estimate. The GF Value is derived from historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

It is noteworthy that the price-to-GF-Value ratio stands at 1.06, suggesting that the stock is trading at a fair value relative to its estimated intrinsic value. This assessment aligns with the broader market's valuation of the company and may provide some reassurance to investors concerned about the insider's selling activity.

The insider trend image above illustrates the pattern of insider transactions over time. A visual analysis of this trend can help investors discern whether the recent sales are part of a consistent pattern or an anomaly. In Coursera's case, the consistent selling over the past year could be indicative of insiders taking profits or managing their investment holdings rather than a lack of confidence in the company's future performance.

The GF Value image provides a graphical representation of Coursera Inc's stock price relative to its intrinsic value over time. This comparison can be a useful tool for investors to determine whether the stock is currently undervalued or overvalued. As the stock is trading close to its GF Value, it suggests that the market's perception of the company's worth is in line with the intrinsic value estimate.

Conclusion

The recent insider sale by COO Shravan Goli of Coursera Inc is a significant event that warrants attention from investors and market analysts. While the pattern of insider selling over the past year may initially appear bearish, a deeper analysis reveals that the stock is trading at a fair value relative to its estimated intrinsic worth. Investors should consider the broader context of insider transactions, including the possible personal motivations behind the sales, and not solely rely on these activities as an indicator of the company's future performance. As always, a well-rounded investment decision should be based on a comprehensive evaluation of the company's fundamentals, market conditions, and other relevant factors.

For those interested in Coursera Inc's stock, it is advisable to keep an eye on insider trading activity as part of a broader investment strategy, while also staying informed about the company's operational performance and growth initiatives. By doing so, investors can better position themselves to make informed decisions in the dynamic landscape of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.