Insider Sell Alert: COO Xianzhi Fan Sells 16,904 Shares of Rambus Inc (RMBS)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Rambus Inc (NASDAQ:RMBS), a prominent player in the semiconductor industry, witnessed a notable insider transaction. Xianzhi Fan, the company's Chief Operating Officer, sold 16,904 shares on December 11, 2023. This sale has caught the attention of market watchers and raises questions about the insider's perspective on the company's future.Who is Xianzhi Fan of Rambus Inc?Xianzhi Fan has been an integral part of Rambus Inc, serving as the Chief Operating Officer. Fan's role in the company involves overseeing the day-to-day operations and contributing to strategic planning, which gives him an in-depth understanding of the company's performance and potential. His actions in the stock market, particularly the sale or purchase of Rambus shares, are closely monitored as they may reflect his confidence in the company's future prospects.Rambus Inc's Business DescriptionRambus Inc is a technology company that specializes in providing semiconductor and IP products, spanning memory and interfaces to security, smart sensors, and lighting. The company's innovations are integral to the performance and security of today's electronics and are embedded in devices and systems used in a wide array of applications, including consumer electronics, data centers, and the Internet of Things (IoT). With a focus on innovation and a robust portfolio of patents, Rambus is a key player in the semiconductor industry.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe recent sale by Xianzhi Fan is part of a broader pattern of insider activity at Rambus Inc. Over the past year, Fan has sold a total of 34,213 shares and has not made any purchases. This one-sided transaction history could be interpreted in several ways. On one hand, it might suggest that insiders see the current stock price as an opportune moment to realize gains. On the other hand, it could also raise concerns about the insiders' long-term confidence in the company's stock performance.

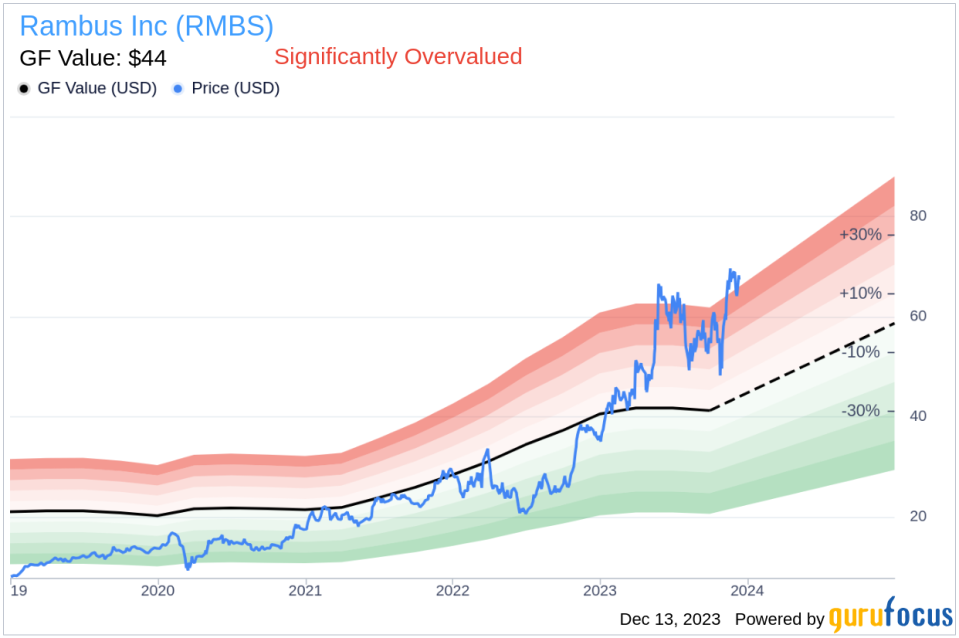

The insider trend image above provides a visual representation of the insider transactions over the past year. With 21 insider sells and no insider buys, there appears to be a consensus among insiders to reduce their holdings. This trend can influence investor sentiment and potentially impact the stock price.Valuation and Market ResponseOn the day of the insider's recent sale, shares of Rambus Inc were trading at $66.35, giving the company a market cap of $7.243 billion. The price-earnings ratio stood at 25.82, slightly lower than the industry median and the company's historical median price-earnings ratio. This could indicate that the stock is reasonably valued in comparison to its peers and its own trading history.However, when considering the GuruFocus Value, which is set at $44.00, Rambus Inc appears to be significantly overvalued with a price-to-GF-Value ratio of 1.51. This discrepancy between the market price and the GF Value could be a factor in the insider's decision to sell shares.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The fact that the stock is trading well above its GF Value suggests that the market may be pricing in optimistic future growth and performance that may or may not materialize.ConclusionThe sale of 16,904 shares by COO Xianzhi Fan is a significant event for Rambus Inc and its investors. While the insider's actions do not necessarily predict the future movement of the stock, they do offer insights into how those closest to the company view its valuation and prospects. With the stock currently deemed significantly overvalued based on the GF Value, investors should consider the implications of insider selling trends and valuation metrics when making investment decisions. As always, a comprehensive analysis that includes insider activity should be part of a broader investment strategy that takes into account market conditions, company performance, and individual financial goals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.