Insider Sell Alert: Criteo SA's Chief Legal Officer Ryan Damon Offloads 8,804 Shares

In the realm of insider trading, the actions of company executives can provide valuable insights into the potential future direction of a stock. Recently, Ryan Damon, the Chief Legal Officer of Criteo SA (NASDAQ:CRTO), sold a significant number of shares, which may prompt investors to take a closer look at the company's stock performance and valuation.

Who is Ryan Damon?

Ryan Damon has been serving as the Chief Legal Officer at Criteo SA, a pivotal role that involves overseeing the company's legal affairs and ensuring compliance with regulatory requirements. Damon's position places him in a strategic spot to understand the inner workings of the company, making his trading activities particularly noteworthy to investors and market analysts.

About Criteo SA

Criteo SA is a global technology company that provides marketing and monetization services on the internet. Specializing in highly targeted, programmatic advertising, Criteo helps advertisers reach their audiences more effectively by leveraging large amounts of data to deliver ads across various channels, including web, mobile, and video. The company's sophisticated algorithms and deep understanding of consumer behavior have made it a leader in the dynamic field of online advertising.

Analysis of Insider Buy/Sell and Relationship with Stock Price

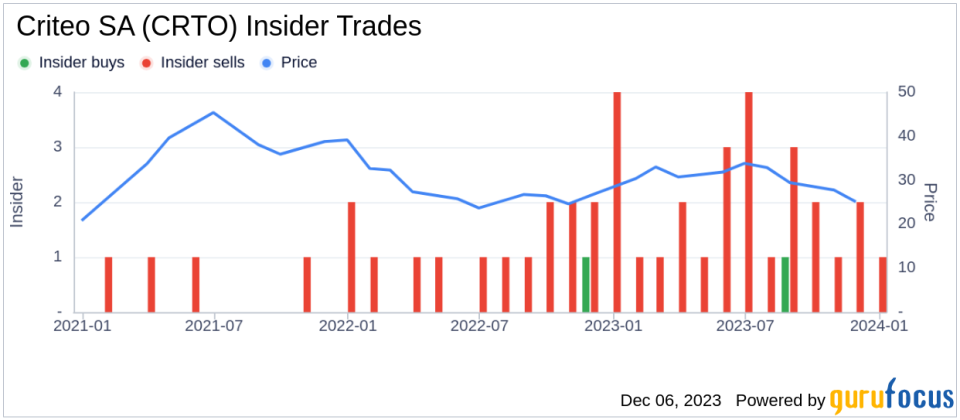

Insider trading patterns can be a barometer for a company's health and future stock performance. Over the past year, Ryan Damon has sold a total of 46,604 shares and has not made any purchases. This one-sided activity could signal a lack of confidence in the company's short-term growth prospects or simply personal financial planning on the part of the insider.

Comparatively, the broader insider transaction history for Criteo SA shows a disparity between buys and sells, with only 1 insider buy versus 25 insider sells over the past year. This trend might raise questions about the insiders' collective outlook on the stock's valuation and future performance.

On the day of the insider's recent sale, shares of Criteo SA were trading at $24.88, giving the company a market cap of $1.409 billion. This price point is significant as it reflects investor sentiment and market conditions at the time of the transaction.

The price-earnings ratio of Criteo SA stands at a lofty 227.09, substantially higher than the industry median of 17.54 and the company's historical median. This elevated ratio could suggest that the stock is overvalued compared to its peers, or it may reflect expectations of higher future earnings growth that are not yet realized.

However, when considering the GuruFocus Value (GF Value) of $29.74, Criteo SA appears to be modestly undervalued with a price-to-GF-Value ratio of 0.84. The GF Value is a proprietary metric that takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business estimates from analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. A consistent pattern of insider selling, as seen in the case of Criteo SA, can be interpreted in various ways, but it often leads investors to scrutinize the reasons behind such sales.

The GF Value image further illustrates the perceived undervaluation of Criteo SA's stock. If the company's fundamentals remain strong and the market corrects this discrepancy, there could be an opportunity for investors to capitalize on the current modest undervaluation.

Conclusion

Insider trading, such as the recent sale by Ryan Damon, provides market participants with data that can influence investment decisions. While a high volume of insider selling can be a red flag, it is essential to consider the broader context, including the company's valuation metrics and market performance. In the case of Criteo SA, the mixed signals of high price-earnings ratio and modest undervaluation according to GF Value suggest that investors should conduct thorough due diligence and consider both the insider trading trends and fundamental analysis before making any investment decisions.

As always, insider trading is just one piece of the puzzle when evaluating a stock's potential. It's crucial for investors to look at a comprehensive set of factors, including financial health, industry position, and macroeconomic conditions, to make informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.