Insider Sell Alert: Director Andrew Cogan Sells Shares of American Woodmark Corp (AMWD)

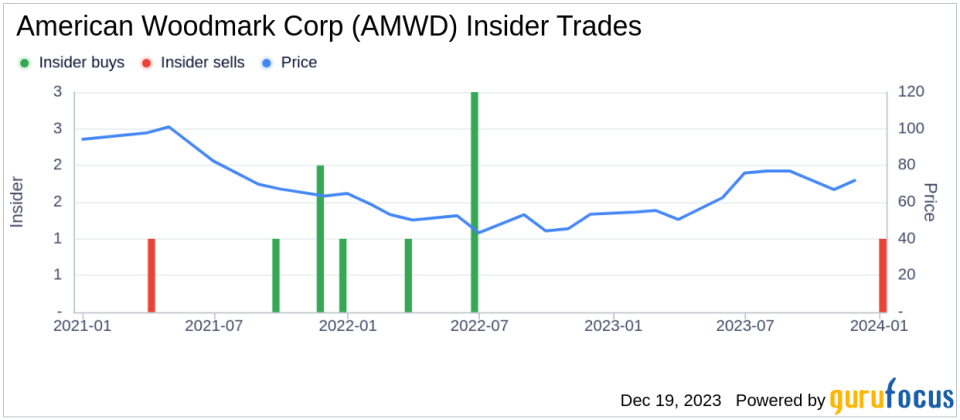

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Director Andrew Cogan of American Woodmark Corp (NASDAQ:AMWD) made a notable move by selling 1,152 shares of the company's stock. This transaction, which took place on December 15, 2023, has sparked interest among shareholders and potential investors as they seek to understand the implications of such insider actions.Who is Andrew Cogan?Andrew Cogan has been a key figure at American Woodmark Corp, serving as a director. His role in the company gives him a unique perspective on the business's operations, performance, and strategic direction. Insider trades, especially from high-ranking executives like Cogan, are closely monitored because they can provide insights into the insider's confidence in the company's future prospects.About American Woodmark CorpAmerican Woodmark Corp is a leading manufacturer and distributor of kitchen cabinets and vanities for the remodeling and new home construction markets. With a rich history and a commitment to craftsmanship, the company has established a reputation for quality and service. American Woodmark Corp offers a wide array of products under various brand names, catering to a diverse customer base that includes home centers, builders, and independent dealers and distributors.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sale by Andrew Cogan is particularly interesting when considering the broader context of insider trading activity at American Woodmark Corp. Over the past year, Cogan has sold a total of 1,152 shares and has not made any purchases. This could be interpreted in several ways, but without additional context, it's challenging to draw definitive conclusions.When analyzing insider trading patterns, it's crucial to consider the overall trend. According to the data, there have been no insider buys at American Woodmark Corp over the past year, while there have been two insider sells during the same period. This trend might suggest a cautious or bearish sentiment among insiders regarding the company's stock, but it's essential to look at the broader picture, including the company's performance and market conditions.

On the day of Cogan's recent sale, shares of American Woodmark Corp were trading at $91.57, giving the company a market cap of $1.446 billion. The price-earnings ratio stood at 13.25, lower than both the industry median of 18.68 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings, which might typically encourage buying rather than selling.However, when considering the GuruFocus Value (GF Value), the picture changes. With a stock price of $91.57 and a GF Value of $66.79, American Woodmark Corp has a price-to-GF-Value ratio of 1.37, suggesting that the stock is significantly overvalued based on its intrinsic value estimate.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. When the price-to-GF-Value ratio is above 1, it indicates that the stock may be overpriced relative to its intrinsic value, which could be a factor in Cogan's decision to sell shares.ConclusionThe insider trading activity by Andrew Cogan at American Woodmark Corp presents a complex picture. While the lower price-earnings ratio might suggest an undervalued stock, the GF Value indicates that the shares are significantly overvalued. This mixed signal could be a reason for Cogan's sale, as insiders might act on information or perspectives that are not fully available to the public.Investors should consider insider trading as one of many factors in their investment decisions. It's essential to conduct thorough research, considering a company's financial health, market position, and broader economic conditions before making any investment choices. As for American Woodmark Corp, the insider trading trend and valuation metrics provide a starting point for further analysis and discussion among the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.