Insider Sell Alert: Director Brad Hively Sells 47,000 Shares of The Oncology Institute Inc (TOI)

In a notable insider transaction, Director Brad Hively has parted with 47,000 shares of The Oncology Institute Inc (NASDAQ:TOI), a significant move that warrants a closer look by investors and market analysts. The sale, which took place on November 13, 2023, has sparked interest in the company's stock performance and the implications of such insider activity.

Who is Brad Hively of The Oncology Institute Inc?

Brad Hively serves as a Director at The Oncology Institute Inc, bringing with him a wealth of experience and knowledge in the healthcare sector. His role at TOI involves providing strategic guidance and oversight, ensuring that the company's operations align with its long-term goals. Hively's insider status makes his trading activities particularly noteworthy, as they may reflect his confidence in the company's future prospects or response to its current financial standing.

The Oncology Institute Inc's Business Description

The Oncology Institute Inc is a pioneering healthcare company that specializes in providing comprehensive oncology care. The company's approach integrates patient treatment plans with cutting-edge therapies, research, and a compassionate care model. TOI's focus on value-based care and its expansive network of clinics ensure that patients receive personalized and effective cancer treatment services. The company's commitment to innovation and patient outcomes positions it as a leader in the oncology field.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by Brad Hively has caught the attention of investors, as insider transactions can often provide valuable insights into a company's internal perspective. Over the past year, Hively's trading record shows a disposition of 47,000 shares and no recorded purchases. This could signal a variety of things, including portfolio rebalancing, personal financial management, or a less optimistic outlook on the company's share price potential.

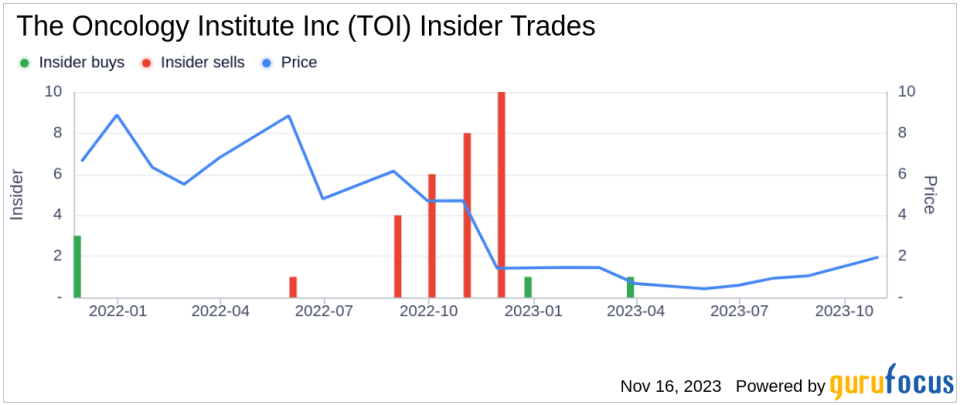

When analyzing insider buy and sell patterns, it's crucial to consider the overall trend. The Oncology Institute Inc has seen a total of 2 insider buys over the past year, compared to just 1 insider sell, indicating a generally positive sentiment among those with intimate knowledge of the company. However, the recent sale by Hively may raise questions about the stock's near-term performance.

On the day of Hively's sale, TOI shares were trading at $2.52, valuing the company at a market cap of $162.852 million. While the market cap provides a snapshot of the company's value, the insider transactions can sometimes precede movements in the stock price, either upward or downward. Investors often monitor such sales to gauge whether insiders might be acting on information that suggests future stock price declines or if they simply are cashing in on recent stock price appreciation.

It's also important to consider the context of the sale. If the insider sells after a significant run-up in the stock price, it might be less concerning than a sale during a period of decline, which could be interpreted as a lack of confidence in the company's ability to rebound. In the case of TOI, the stock's performance leading up to the sale, as well as the company's recent financial results and forecasts, should be examined to fully understand the potential implications of Hively's decision to sell.

The insider trend image above provides a visual representation of the buying and selling activities of insiders at The Oncology Institute Inc. This chart can be a useful tool for investors to discern patterns or shifts in insider sentiment over time. A predominance of insider buying could suggest that those with the most knowledge of the company's inner workings are bullish on its future, while a trend of selling might indicate the opposite.

Conclusion

In conclusion, the sale of 47,000 shares by Director Brad Hively is a transaction that should not go unnoticed by current or potential investors of The Oncology Institute Inc. While insider sales can have various motivations, they are always worth investigating as part of a broader investment analysis. It is essential for investors to consider the insider trading trends, the company's valuation, and the stock's recent performance when making investment decisions. As always, such insider activity should be viewed as one piece of a larger puzzle when evaluating the attractiveness of a stock as an investment.

Investors should continue to monitor insider transactions and other significant financial news related to The Oncology Institute Inc to stay informed about potential changes in market sentiment or company fundamentals. By doing so, they can make more informed decisions that align with their investment strategies and risk tolerance.

For more detailed analysis and up-to-date information on insider transactions, stay tuned to gurufocus.com, where we provide comprehensive coverage of stock market activities and investment insights.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.