Insider Sell Alert: Director Braden Kelly Sells Shares of Fair Isaac Corp (FICO)

Fair Isaac Corporation, commonly known as FICO, is a data analytics company based in San Jose, California focused on credit scoring services. It is best known for its FICO score, a credit score model it developed which is used by financial institutions to make credit decisions. The company provides products and services to businesses, including analytics software and tools used in various industries such as financial services, insurance, telecommunications, and retail, among others.On November 16, 2023, an insider sell event caught the attention of market watchers. Director Braden Kelly sold 9,840 shares of Fair Isaac Corp (NYSE:FICO), a significant transaction that prompts a closer look into the insider's activity and the potential implications for the stock.Who is Braden Kelly of Fair Isaac Corp? While specific details about Kelly's role and background are not provided in the context of this article, as a director, Kelly would be part of the board that provides governance and oversight to the company's operations. Directors are privy to in-depth knowledge about the company's strategic direction, financial health, and operational challenges, making their trading activities particularly noteworthy.Over the past year, Braden Kelly has been active on the sell-side, offloading a total of 16,939 shares without any recorded purchases. This pattern of behavior could suggest a variety of things, including portfolio rebalancing, personal financial management, or a less optimistic outlook on the company's valuation or future performance.The insider transaction history for Fair Isaac Corp shows a clear trend: there have been zero insider buys and 21 insider sells over the past year. This one-sided activity might raise questions about the confidence insiders have in the stock's future performance.

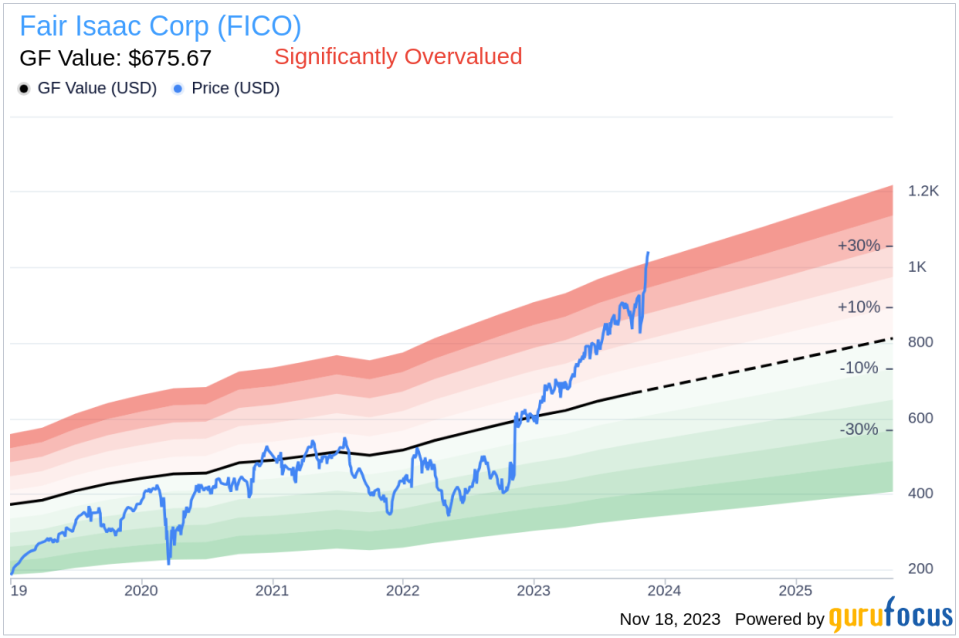

When analyzing insider transactions, it's crucial to consider the relationship between these activities and the stock price. Insider selling can sometimes be interpreted as a lack of confidence in the company's future prospects or as a signal that the stock might be overvalued. However, insiders might sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investments.On the day of the insider's recent sell, shares of Fair Isaac Corp were trading at $1,033.69, giving the company a market capitalization of $25.758 billion. The price-earnings ratio of 61.56 is significantly higher than the industry median of 26.59 and above the company's historical median price-earnings ratio. This elevated P/E ratio could indicate that the stock is priced at a premium compared to its peers and its own historical valuation.The price-to-GF-Value ratio stands at 1.53, with the stock being labeled as Significantly Overvalued based on its GF Value of $675.67. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

Given the current price-to-GF-Value ratio, investors might be cautious about the stock's valuation, considering it might not reflect the company's intrinsic value accurately. The significant overvaluation could be a contributing factor to the insider's decision to sell shares, as they might perceive the current market price as an opportune moment to realize gains.In conclusion, the recent insider sell by Director Braden Kelly of Fair Isaac Corp (NYSE:FICO) is a transaction that warrants attention. With a high price-earnings ratio and a price significantly above the GF Value, the stock appears to be trading at a premium. While insider sells are not always indicative of a stock's future decline, the lack of insider buying and the trend of insider sells over the past year could suggest that those with the most intimate knowledge of the company see the current valuation as overly optimistic. Investors should consider these factors alongside broader market analysis and individual investment strategies when evaluating Fair Isaac Corp as a potential investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.