Insider Sell Alert: Director BURKE JAMES J JR Offloads Shares of Lincoln Educational Services Corp

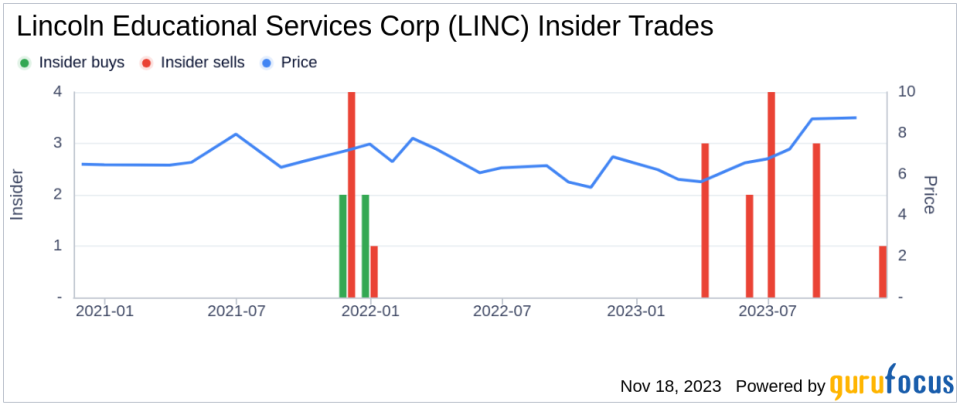

In a notable insider transaction, Director BURKE JAMES J JR has sold 19,776 shares of Lincoln Educational Services Corp (NASDAQ:LINC) on November 14, 2023. This move comes as part of a series of sales by the insider over the past year, which has seen a total of 64,212 shares sold, with no recorded purchases in the same period. The recent sale by the insider has raised questions among investors and market analysts about the potential implications for the stock's future performance.BURKE JAMES J JR is a seasoned member of the board at Lincoln Educational Services Corp, bringing valuable experience and insights to the company's strategic direction. The insider's decision to sell a significant number of shares may be interpreted in various ways, but it is essential to consider the broader context of the company's business and financials to understand the potential impact on the stock price.Lincoln Educational Services Corp is a provider of diversified career-oriented post-secondary education. The company offers high-quality programs in automotive technology, health sciences, skilled trades, business and IT, culinary, and spa and cosmetology. With a focus on hands-on learning and practical skills, Lincoln Educational Services Corp aims to empower students to achieve professional success and fill the growing demand for skilled professionals in various industries.The insider transaction history for Lincoln Educational Services Corp reveals a pattern of insider selling, with 14 insider sells and no insider buys over the past year. This trend could suggest that insiders, including BURKE JAMES J JR, may perceive the stock as being fully valued or may have concerns about the company's near-term prospects.

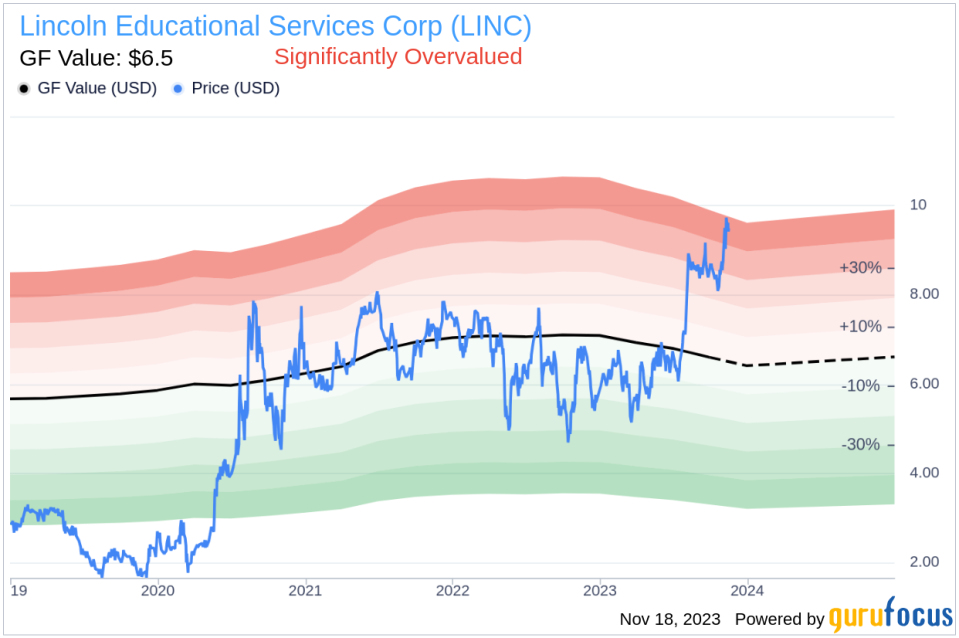

When analyzing the relationship between insider trading activity and stock price, it is crucial to consider the company's valuation metrics. On the day of the insider's recent sale, shares of Lincoln Educational Services Corp were trading at $9.6, giving the company a market cap of $296.971 million. The price-earnings ratio stood at 10.45, lower than the industry median of 18.77, indicating that the stock may be undervalued compared to its peers. However, it is higher than the company's historical median price-earnings ratio, suggesting that the stock may be more expensive than its historical average.The valuation analysis becomes more intriguing when considering the GuruFocus Value (GF Value). With a stock price of $9.6 and a GF Value of $6.50, Lincoln Educational Services Corp has a price-to-GF-Value ratio of 1.48, indicating that the stock is Significantly Overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current price-to-GF-Value ratio suggests that the stock may be trading at a premium to its intrinsic value, which could be a contributing factor to the insider's decision to sell shares.In conclusion, the recent insider sell by Director BURKE JAMES J JR at Lincoln Educational Services Corp is a significant event that warrants attention from investors. While the insider's actions alone should not dictate investment decisions, they can provide valuable context when combined with a thorough analysis of the company's valuation and business prospects. As the stock is currently deemed Significantly Overvalued based on the GF Value, shareholders and potential investors should closely monitor the company's performance and any further insider trading activity to make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.