Insider Sell Alert: Director CHANG KUO WEI HERBERT Sells Shares of Monolithic Power Systems Inc ...

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep an eye on to gauge the confidence levels of a company's executives and directors in their own firm's prospects. Recently, Monolithic Power Systems Inc (NASDAQ:MPWR), a leading player in the semiconductor industry, witnessed a notable insider sell event that has caught the attention of market watchers.

Director CHANG KUO WEI HERBERT, a key insider of Monolithic Power Systems Inc, executed a sale of 400 shares on November 14, 2023. This transaction has added to the series of insider sell activities observed over the past year. Before delving into the implications of this sell-off, let's explore who CHANG KUO WEI HERBERT is and what Monolithic Power Systems Inc does.

Who is CHANG KUO WEI HERBERT?

CHANG KUO WEI HERBERT serves as a Director at Monolithic Power Systems Inc. Directors play a crucial role in shaping the strategic direction of a company and are privy to in-depth knowledge about the firm's operations, financial health, and future prospects. Their trading activities are closely monitored as they can provide insights into their personal assessment of the company's valuation and potential.

Monolithic Power Systems Inc's Business Description

Monolithic Power Systems Inc is a renowned name in the semiconductor industry, specializing in the design, development, and manufacture of integrated power solutions. The company's products are used in a wide array of applications, including consumer electronics, industrial systems, cloud computing, automotive, and telecommunications. With a focus on delivering energy-efficient power solutions, Monolithic Power Systems Inc has established itself as a leader in its field, catering to a global customer base.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Over the past year, CHANG KUO WEI HERBERT has sold a total of 1,000 shares and has not made any purchases. This one-sided activity could be interpreted in various ways. While some may view it as a lack of confidence in the company's future growth, others might consider it a part of personal financial management or portfolio diversification.

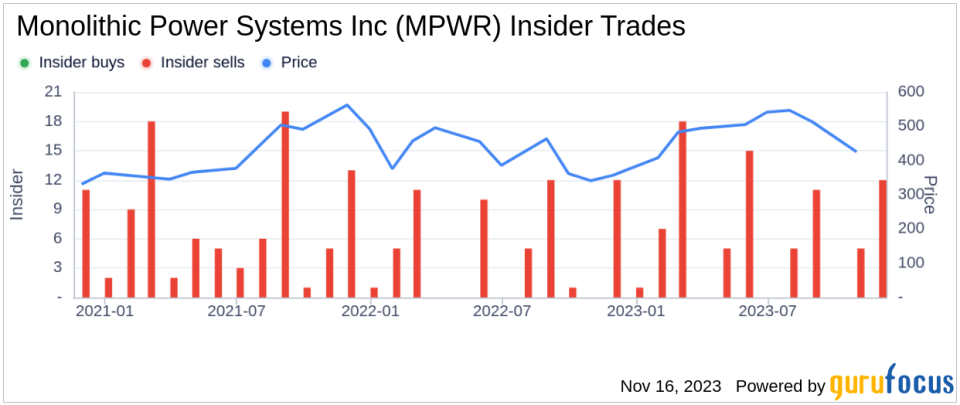

The broader insider transaction history for Monolithic Power Systems Inc shows a trend with 0 insider buys and 80 insider sells over the past year. This pattern of more frequent selling than buying among insiders might raise questions about the stock's future performance. However, it is essential to consider that insider sells can be motivated by numerous factors and do not always signal a bearish outlook.

On the day of the insider's recent sell, shares of Monolithic Power Systems Inc were trading at $523.64, giving the company a market cap of $25.619 billion. The price-earnings ratio stood at 57.93, which is above the industry median of 24.57 but below the company's historical median price-earnings ratio. This suggests that while the stock is trading at a premium compared to the industry, it may be undervalued relative to its own historical performance.

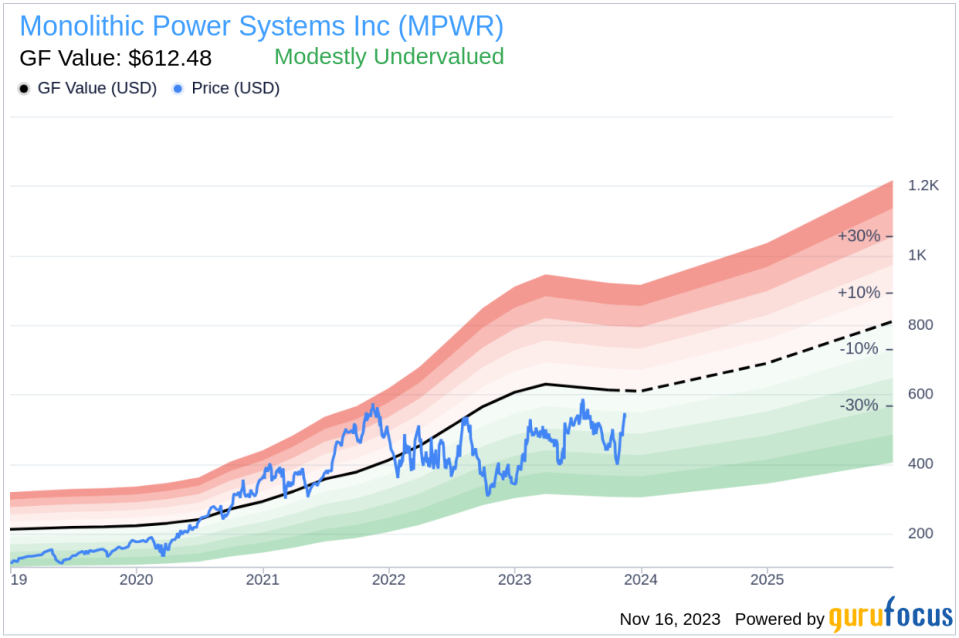

With a current price of $523.64 and a GuruFocus Value (GF Value) of $612.48, Monolithic Power Systems Inc has a price-to-GF-Value ratio of 0.85, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the insider trading activities, reinforcing the predominance of selling transactions over buying ones. This visual data can be a useful tool for investors trying to understand the sentiment of company insiders.

The GF Value image further illustrates the stock's valuation status. When the price is below the GF Value line, as it is in this case, it suggests that the stock may be undervalued, potentially offering an attractive entry point for investors.

Conclusion

The recent insider sell by Director CHANG KUO WEI HERBERT at Monolithic Power Systems Inc is a development that investors should consider within the broader context of the company's financial performance, industry position, and valuation metrics. While insider sells can provide valuable insights, they are just one piece of the puzzle. Investors should also consider other fundamental and technical analysis aspects before making investment decisions.

Monolithic Power Systems Inc's position as a leader in the semiconductor industry, combined with its current valuation metrics, suggests that the company may have room for growth. However, the insider selling trend warrants a cautious approach. As always, a well-rounded investment strategy should involve a thorough assessment of all available information, including insider trading patterns, to make informed decisions aligned with one's investment goals and risk tolerance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.