Insider Sell Alert: Director Christopher Stratton Sells 100,000 Shares of Vertex Energy Inc (VTNR)

In a notable insider transaction, Director Christopher Stratton has parted with 100,000 shares of Vertex Energy Inc (NASDAQ:VTNR), a significant move that has caught the attention of investors and market analysts. This sale, executed on November 10, 2023, has raised questions about the insider's confidence in the company's future prospects and the potential implications for the stock's performance.

Who is Christopher Stratton of Vertex Energy Inc?

Christopher Stratton is a seasoned executive with a deep understanding of the energy sector. As a director of Vertex Energy Inc, Stratton has been involved in guiding the company through strategic decisions and overseeing its growth. His background and experience in the industry provide him with a unique perspective on the company's operations and market opportunities.

About Vertex Energy Inc

Vertex Energy Inc is a prominent player in the environmental services sector, specializing in the recycling of industrial waste streams and off-specification commercial chemical products. The company's core business revolves around the aggregation, processing, and refinement of petroleum-based products, transforming these materials into higher-value end products. Vertex Energy's commitment to sustainability and reducing environmental impact is central to its business model, as it contributes to the circular economy by repurposing waste into useful commodities.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by Christopher Stratton is part of a broader pattern of insider transactions at Vertex Energy Inc. Over the past year, Stratton has sold a total of 125,000 shares and has not made any purchases. This could be interpreted as a lack of bullish sentiment from the insider regarding the company's short-term growth potential or simply a personal financial decision.When examining the insider transaction history for Vertex Energy Inc, we observe that there has been only 1 insider buy in the past year, contrasted with 5 insider sells during the same period. This trend may suggest a cautious or bearish outlook among those with intimate knowledge of the company's inner workings.

The relationship between insider selling and stock price can be complex. While significant insider selling can sometimes lead to negative market reactions, it is not always indicative of a company's health or future performance. Investors should consider the context of the sale, including the insider's history of transactions and the company's overall financial position.

Valuation and Market Reaction

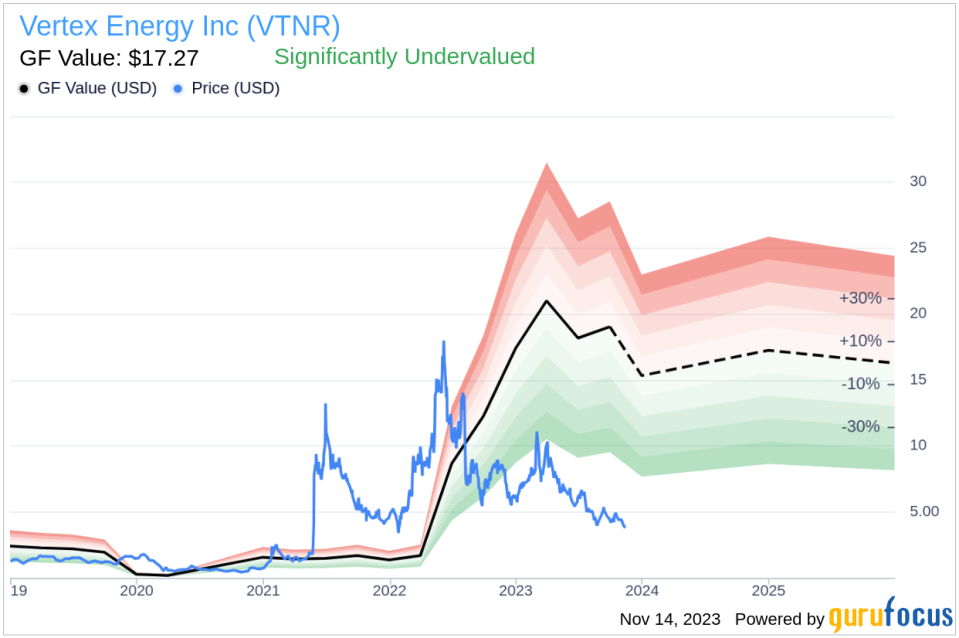

On the day of the insider's recent sale, Vertex Energy Inc's shares were trading at $3.93, giving the company a market cap of $352.549 million. The price-earnings ratio stands at 8.02, which is lower than both the industry median of 9.19 and the company's historical median price-earnings ratio. This could suggest that the stock is undervalued compared to its peers and its own historical valuation.Furthermore, with a price of $3.93 and a GuruFocus Value of $17.27, Vertex Energy Inc has a price-to-GF-Value ratio of 0.23. This indicates that the stock is Significantly Undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The significant discount to the GF Value could present an attractive entry point for value investors, assuming the company's fundamentals remain strong.

Conclusion

The sale of 100,000 shares by Director Christopher Stratton is a development that warrants attention from Vertex Energy Inc's shareholders and potential investors. While insider selling can be a red flag in some cases, it is essential to consider the broader context, including the company's valuation, market position, and future growth prospects.Vertex Energy Inc's current undervaluation, as suggested by the price-to-GF-Value ratio, may offer a compelling opportunity for those who believe in the company's long-term strategy and its role in the environmental services industry. As always, investors should conduct their due diligence and consider the insider's actions as one of many factors in their investment decision-making process.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.