Insider Sell Alert: Director Christopher Patterson Sells Shares of Modine Manufacturing Co

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Modine Manufacturing Co (NYSE:MOD) witnessed a notable insider sell that has caught the attention of the market. Director Christopher Patterson sold 6,400 shares of the company on December 8, 2023, a transaction that prompts a closer examination of the insider's actions and the potential implications for the stock.

Who is Christopher Patterson of Modine Manufacturing Co?

Christopher Patterson is a member of the board of directors at Modine Manufacturing Co, a company with a rich history in thermal management technology. Directors like Patterson play a crucial role in steering the company's strategic direction and are privy to in-depth knowledge about the company's operations and prospects. Their trading activities are closely monitored as they can provide insights into their confidence in the company's future performance.

Modine Manufacturing Co's Business Description

Modine Manufacturing Co is a global leader in thermal management solutions and components, manufacturing cooling and heating products for a variety of markets, including automotive, industrial, and commercial sectors. The company's innovative technologies and commitment to sustainability have positioned it as a key player in its industry, with a diverse product lineup that addresses the evolving needs of its customers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

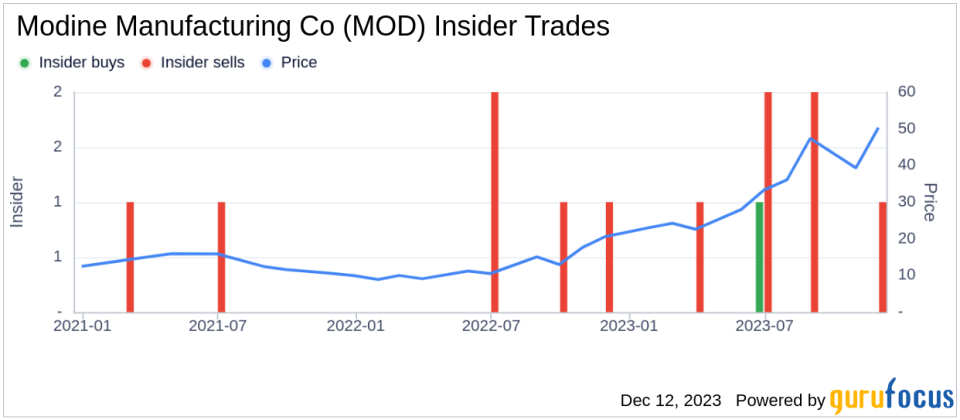

Insider trading patterns, such as those of Christopher Patterson, can provide valuable context for the stock's performance. Over the past year, Patterson has sold a total of 6,400 shares and purchased 400 shares. This net selling activity may raise questions among investors about the insider's long-term confidence in the company's stock.

When examining the broader insider transaction history for Modine Manufacturing Co, we observe that there has been only 1 insider buy in the past year, contrasted with 7 insider sells over the same timeframe. This trend of more frequent selling than buying by insiders could be interpreted as a cautious signal by market observers.

On the day of Patterson's recent sell, shares of Modine Manufacturing Co were trading at $53.04, giving the company a market cap of $2.777 billion. The price-earnings ratio stood at 13.74, lower than both the industry median of 17.2 and the company's historical median price-earnings ratio. This suggests that the stock was trading at a discount compared to its peers and its own historical valuation.

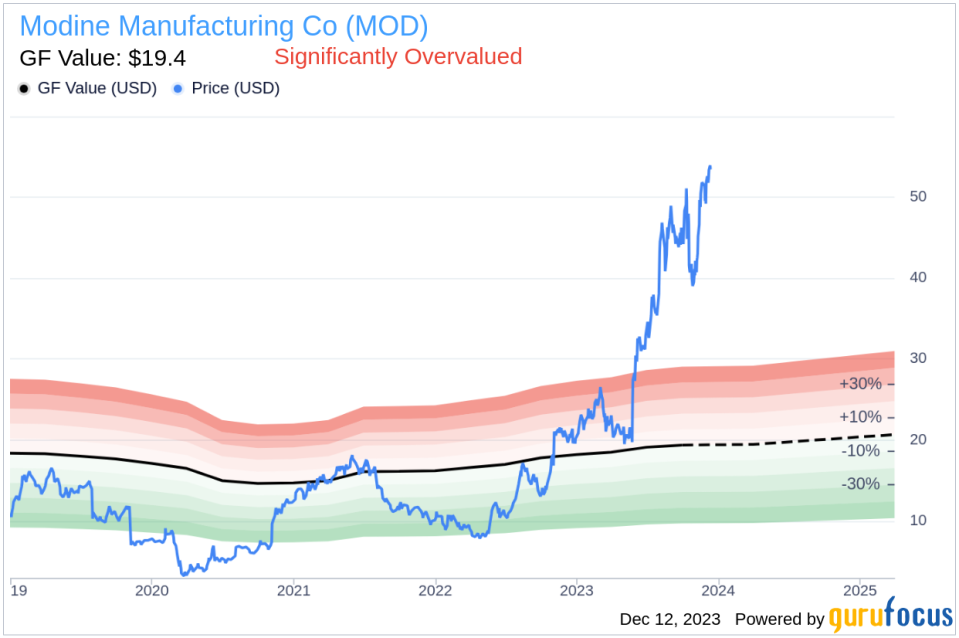

However, despite the seemingly attractive price-earnings ratio, the stock's valuation in relation to the GuruFocus Value (GF Value) tells a different story. With a price of $53.04 and a GF Value of $19.40, Modine Manufacturing Co has a price-to-GF-Value ratio of 2.73, indicating that the stock is Significantly Overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The significant overvaluation suggested by the GF Value could be a contributing factor to Patterson's decision to sell shares.

The insider trend image above provides a visual representation of the insider trading activities at Modine Manufacturing Co, further emphasizing the predominance of selling transactions over buying ones among insiders.

The GF Value image complements the analysis by illustrating the disparity between the current stock price and the estimated intrinsic value, reinforcing the notion that the stock may be overpriced at current levels.

Conclusion

Christopher Patterson's recent sell transaction, in the context of the overall insider trading trend and the company's valuation metrics, presents a complex picture for investors. While the lower price-earnings ratio could be appealing, the significant overvaluation based on the GF Value metric and the insider selling trend may suggest caution. Investors would do well to consider these factors, along with broader market conditions and company-specific developments, when making investment decisions regarding Modine Manufacturing Co.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It's important for investors to conduct thorough due diligence, considering a range of financial and non-financial factors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.