Insider Sell Alert: Director Daren Shaw Sells Shares of Ensign Group Inc (ENSG)

Director Daren Shaw has recently made a significant move in the stock market by selling 2,000 shares of Ensign Group Inc (NASDAQ:ENSG), a key player in the healthcare services industry. This transaction, which took place on November 15, 2023, has caught the attention of investors and market analysts alike, prompting a closer look at the implications of such insider activity.

Who is Daren Shaw?

Daren Shaw is known for his role as a director at Ensign Group Inc. His position within the company grants him an intimate understanding of the firm's operations, strategic direction, and financial health. Directors like Shaw are often privy to information that the general public may not have, making their trading activities a focal point for those looking to glean insights into the company's prospects.

Ensign Group Inc's Business Description

Ensign Group Inc is a prominent name in the healthcare sector, primarily focusing on providing skilled nursing, rehabilitative care services, and assisted living services. The company operates through a network of facilities that are designed to offer a range of healthcare services to meet the diverse needs of their patients and residents. Ensign Group's commitment to quality care and patient satisfaction has positioned it as a leader in a highly competitive and regulated industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sale by Daren Shaw, can provide valuable clues about a company's internal dynamics and future performance. Over the past year, Shaw has sold a total of 12,000 shares and has not made any purchases. This one-sided activity could suggest that the insider may perceive the stock's current price as being on the higher end of its value spectrum, or it could be part of a personal financial strategy.

The broader insider transaction history for Ensign Group Inc shows a pattern of more sells than buys over the past year, with 20 insider sells and no insider buys. This trend could indicate that insiders collectively view the stock as being fully valued or may be taking profits after a period of appreciation.

On the day of Shaw's recent sale, shares of Ensign Group Inc were trading at $105.78, giving the company a market cap of $6.062 billion. The price-earnings ratio stood at 24.74, slightly lower than the industry median of 26.25, but higher than the company's historical median price-earnings ratio. This suggests that the stock is trading at a reasonable valuation relative to its peers and its own trading history.

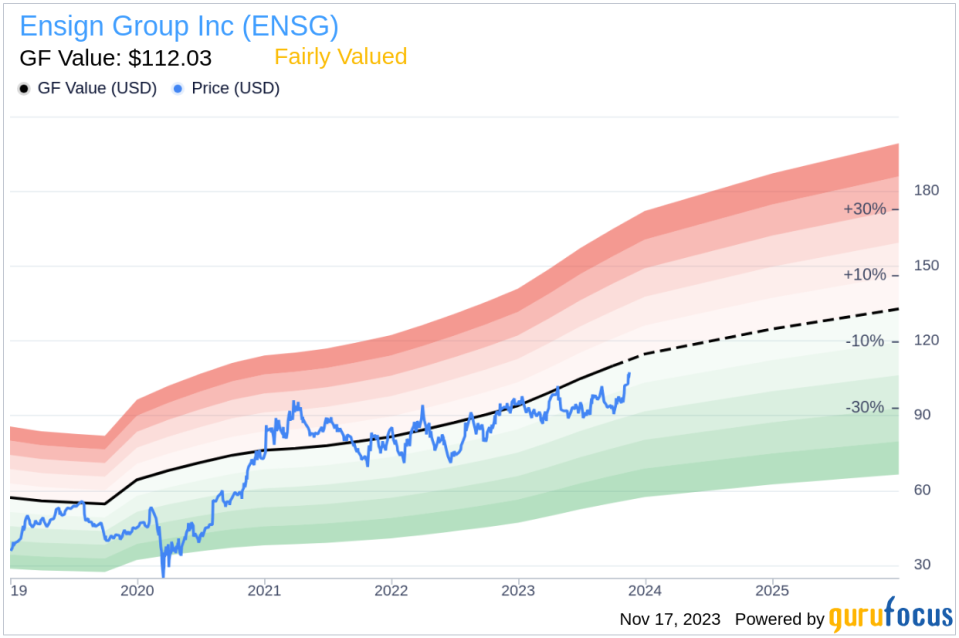

When considering the price-to-GF-Value ratio of 0.94, with a GF Value of $112.03, Ensign Group Inc appears to be Fairly Valued. The GF Value, an intrinsic value estimate developed by GuruFocus, takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. The absence of buys and the presence of consistent sells could be interpreted in various ways, but it often suggests that insiders might believe the stock is not undervalued at current levels.

The GF Value image further supports the notion that Ensign Group Inc's stock is trading close to its fair value, as determined by GuruFocus's proprietary valuation model. This alignment with the GF Value indicates that the stock is not significantly overvalued or undervalued at the current price.

Conclusion

The recent insider sell by Director Daren Shaw of Ensign Group Inc is a transaction that warrants attention from investors. While the insider's sell-off does not necessarily predict a downturn for the company, it does raise questions about the stock's valuation and future prospects. Given the company's solid position in the healthcare industry and its fair valuation as per the GF Value, investors should weigh these insider activities within the broader context of their investment strategy and the company's long-term potential.

As always, it is important for investors to conduct their own due diligence and consider multiple factors, including insider trading patterns, company fundamentals, industry trends, and broader market conditions, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.