Insider Sell Alert: Director David Richardson Sells 8,056 Shares of Ambarella Inc (AMBA)

Recent filings with the SEC have revealed that David Richardson, a director of Ambarella Inc (NASDAQ:AMBA), has sold a total of 8,056 shares of the company's stock on December 6, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Who is David Richardson at Ambarella Inc?

David Richardson serves as a member of the board of directors at Ambarella Inc. His role involves providing strategic guidance and oversight to the company's management team. Directors like Richardson are privy to in-depth knowledge about the company's operations, financials, and strategic plans, making their trading activities a point of interest for investors seeking to understand the internal perspective on the company's performance and potential.

Ambarella Inc's Business Description

Ambarella Inc is a leading developer of low-power, high-definition (HD) and Ultra HD video compression and image processing solutions. The company's products are used in a variety of human and computer vision applications, including security cameras, automotive cameras, drones, and wearable devices. Ambarella's technology is renowned for its ability to deliver high-quality video footage while consuming minimal power, making it ideal for devices where battery life and image quality are critical.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can be a double-edged sword when it comes to interpreting their impact on a company's stock price. On one hand, insiders may sell shares for various reasons that do not necessarily reflect their outlook on the company's future, such as personal financial planning or diversifying their investments. On the other hand, a pattern of insider selling could be indicative of internal concerns about the company's valuation or growth prospects.

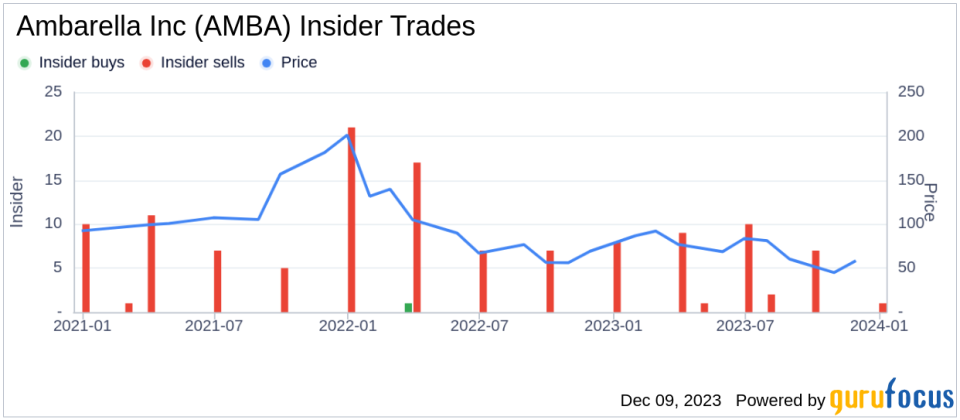

In the case of Ambarella Inc, the insider transaction history over the past year shows a significant imbalance between sells and buys. With 38 insider sells and no insider buys, investors might be inclined to view this activity as a bearish signal. However, it is essential to consider the context of these transactions and the overall performance of the company.

On the day of the insider's recent sale, Ambarella Inc's shares were trading at $58.75, giving the company a market cap of $2.305 billion. This price point is notably lower than the GuruFocus Value (GF Value) of $77.59, suggesting that the stock is modestly undervalued.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 0.76, Ambarella Inc's stock appears to be trading below its intrinsic value, which could indicate an attractive entry point for investors.

However, the insider's decision to sell at a price below the GF Value could be interpreted in several ways. It might suggest that the insider believes the stock is unlikely to reach its estimated intrinsic value in the near term, or it could simply be a personal decision unrelated to the company's valuation.

The insider trend image above provides a visual representation of the selling pattern over the past year. The consistent selling could raise questions among investors, but without additional context, it is challenging to draw definitive conclusions from this data alone.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value. This divergence could be a signal for value investors to consider the stock, assuming the company's fundamentals remain strong and the market has not fully recognized its potential.

Conclusion

David Richardson's recent sale of 8,056 shares of Ambarella Inc is a notable event that warrants attention from the investment community. While the insider's actions may raise questions, it is crucial to analyze the broader context, including the company's valuation, business performance, and market conditions. As with any insider activity, investors should use this information as one of many factors in their decision-making process and conduct thorough research before making any investment decisions.

For those interested in Ambarella Inc, the current stock price relative to the GF Value presents an opportunity to invest in a company that appears to be undervalued. However, potential investors should also consider the insider selling trend and seek to understand the motivations behind these transactions. As always, a balanced and informed approach is key to successful investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.