Insider Sell Alert: Director Dennis St Sells 7,005 Shares of Veeco Instruments Inc (VECO)

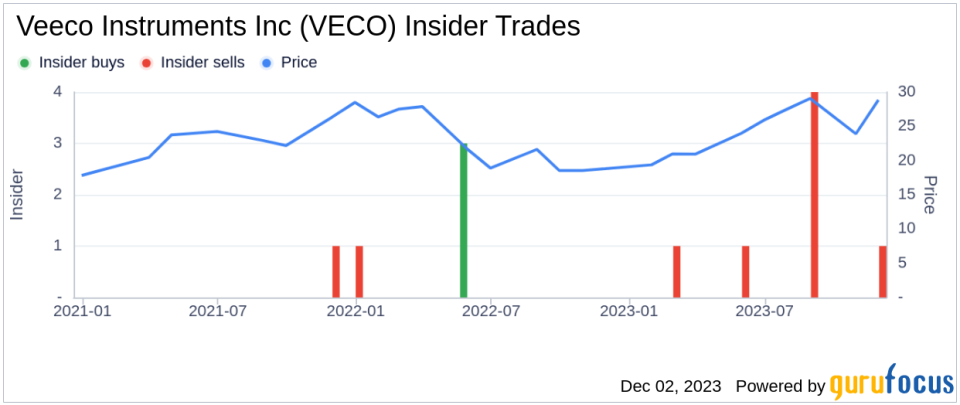

Veeco Instruments Inc (NASDAQ:VECO), a leading provider of semiconductor and thin film process equipment, has recently witnessed a notable insider sell by Director Dennis St. On November 30, 2023, the insider executed a sale of 7,005 shares of the company, a transaction that has caught the attention of investors and market analysts alike.Who is Dennis St?Dennis St is a seasoned member of Veeco Instruments Inc's board of directors. Directors like Dennis St are responsible for overseeing the strategic direction of the company and ensuring that it adheres to good corporate governance practices. Their insight into the company's operations and future prospects is invaluable, and their trading activities are often scrutinized for hints about the company's health and potential future performance.About Veeco Instruments IncVeeco Instruments Inc specializes in manufacturing equipment used in the production of LEDs, power electronics, hard drives, MEMS (micro-electromechanical systems), and wireless chips. The company's products are critical in the process of creating thin film coatings and advanced semiconductor devices. Veeco's technology is known for its precision and efficiency, which are essential in the highly competitive and rapidly evolving tech industry.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sale by Dennis St is part of a broader pattern of insider selling at Veeco Instruments Inc. Over the past year, there have been zero insider buys and eight insider sells, indicating that insiders may believe the stock is fully valued or potentially overvalued at current levels. This pattern of selling could signal caution to potential investors, as insider sales are often considered a bearish indicator.

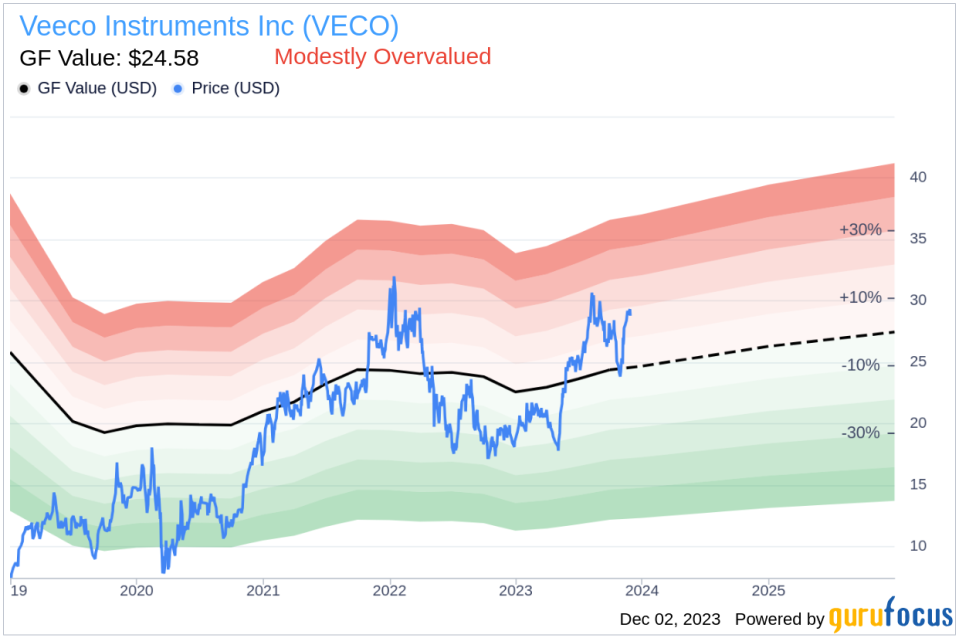

When analyzing insider transactions, it's important to consider the context and magnitude of the trades. Dennis St's sale of 7,005 shares is a significant amount and could be interpreted as a lack of confidence in the company's short-term growth prospects or valuation. However, without additional information about the insider's personal financial situation or the rationale behind the sale, it's difficult to draw definitive conclusions.Veeco Instruments Inc's Market Cap and ValuationOn the day of the insider's recent sale, Veeco Instruments Inc's shares were trading at $28.52, giving the company a market cap of $1.615 billion. The price-earnings ratio of 29.27 is slightly higher than the industry median of 27.1, suggesting that the stock may be somewhat overpriced compared to its peers.The GF Value, an intrinsic value estimate developed by GuruFocus, stands at $24.58 for Veeco Instruments Inc. With the stock trading at $28.52, this results in a price-to-GF-Value ratio of 1.16, indicating that the stock is modestly overvalued.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. When the stock's price exceeds the GF Value, it suggests that the market may be expecting higher growth or performance than what these traditional valuation metrics imply.ConclusionThe insider selling activity at Veeco Instruments Inc, particularly the recent sale by Director Dennis St, provides investors with information that may influence their investment decisions. While insider sales are not always indicative of a company's decline, they can suggest that insiders believe the stock may not offer significant upside potential in the near term.Investors should consider the insider trends, the company's valuation, and the broader market context when evaluating Veeco Instruments Inc's stock. While the company holds a strong position in the semiconductor equipment industry, the current valuation metrics and insider activity suggest a cautious approach may be warranted. As always, investors are encouraged to conduct their own due diligence and consider their investment goals and risk tolerance before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.