Insider Sell Alert: Director Eliza Mcfadden Sells 11,977 Shares of Stride Inc (LRN)

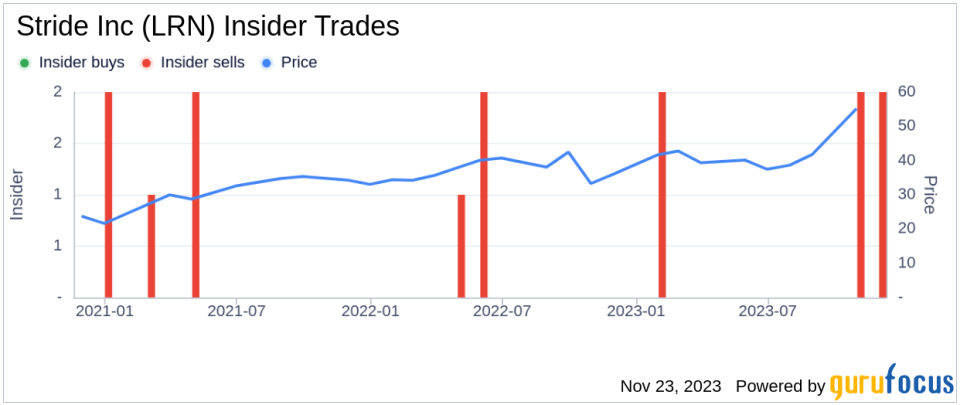

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Stride Inc (NYSE:LRN), a leader in providing innovative education solutions, has seen a notable insider transaction. Director Eliza Mcfadden sold 11,977 shares of the company on November 21, 2023. This sale has caught the attention of market analysts and investors alike, as insider behaviors can provide insights into a company's financial health and future prospects.Who is Eliza Mcfadden of Stride Inc?Eliza Mcfadden serves as a Director at Stride Inc, bringing with her a wealth of experience and knowledge. Directors play a crucial role in shaping the strategic direction of a company, and their trading activities are closely monitored for any implications they may have on the company's future. Although the reasons behind Mcfadden's decision to sell shares are not publicly disclosed, such transactions can stem from a variety of personal or professional reasons.Stride Inc's Business DescriptionStride Inc, formerly known as K12 Inc, is an education technology company that has been revolutionizing the way students learn through digital, online, and blended learning programs. The company provides proprietary and third-party curriculum, platforms, and services to students ranging from kindergarten through 12th grade, as well as career learning programs for adults. Stride's mission is to help learners of all ages achieve their full potential through inspired teaching and personalized learning.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe insider transaction history for Stride Inc shows a pattern of more insider sells than buys over the past year, with 6 insider sells and 0 insider buys. This could suggest that insiders are taking profits or reallocating their investments, which might raise questions about their confidence in the company's near-term growth prospects.

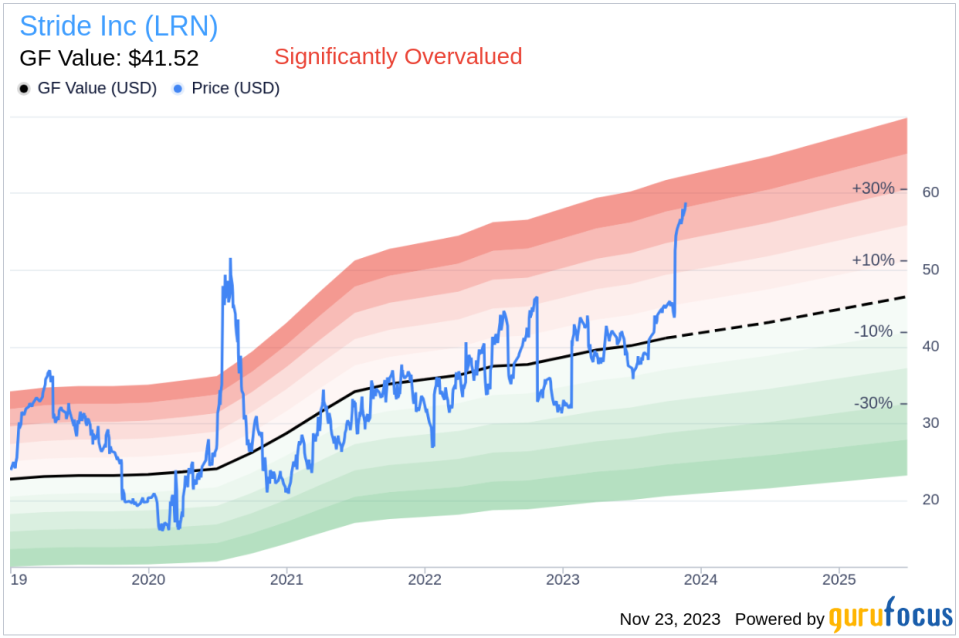

When analyzing the relationship between insider trading activity and stock price, it's important to consider the context of each transaction. Insider sells do not always indicate a lack of confidence in the company. They can often be part of a planned trading program or related to personal financial management. However, a consistent pattern of insider selling, especially when the stock is perceived as overvalued, can be a red flag for investors.Valuation and Market CapOn the day of Mcfadden's recent sale, shares of Stride Inc were trading at $57.7, giving the company a market cap of $2.548 billion. This valuation places the company in a strong position within the education technology sector.The price-earnings ratio of Stride Inc stands at 16.29, which is lower than both the industry median of 19.23 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings potential, which might typically be seen as a buying opportunity.However, with a price of $57.7 and a GuruFocus Value of $41.52, Stride Inc has a price-to-GF-Value ratio of 1.39, suggesting that the stock is Significantly Overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When the price-to-GF-Value ratio is above 1, it indicates that the stock may be overvalued relative to its intrinsic value.ConclusionThe recent insider sell by Director Eliza Mcfadden at Stride Inc has sparked interest among investors and analysts. While the company's lower price-earnings ratio compared to the industry might suggest an undervalued stock based on earnings, the price-to-GF-Value ratio indicates that the stock is currently overvalued. Investors should consider these mixed signals alongside the broader context of insider trading patterns and the company's strategic direction. As always, individual investment decisions should be made based on thorough research and personal financial goals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.