Insider Sell Alert: Director Emil Hassan Sells 7,500 Shares of National Healthcare Corp (NHC)

Director Emil Hassan has recently made a significant change to his holdings in National Healthcare Corp (NHC) by selling 7,500 shares of the company's stock. This transaction, which took place on December 4, 2023, has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Emil Hassan?

Emil Hassan is a seasoned member of the board of directors at National Healthcare Corp. His extensive experience in the healthcare industry and his role within the company give him a unique perspective on its operations and future prospects. As a director, Hassan is privy to in-depth information about the company's strategic plans and financial health, making his trading activities particularly noteworthy to investors seeking insights into the company's performance.

National Healthcare Corp's Business Description

National Healthcare Corp is a diversified healthcare services provider that operates long-term health care centers, assisted living facilities, independent living facilities, and homecare programs. The company is known for its commitment to delivering high-quality care to patients and residents, with a focus on skilled nursing, rehabilitation, and hospice services. NHC's dedication to excellence in the healthcare sector has established it as a respected name among patients, families, and healthcare professionals alike.

Analysis of Insider Buy/Sell and Relationship with Stock Price

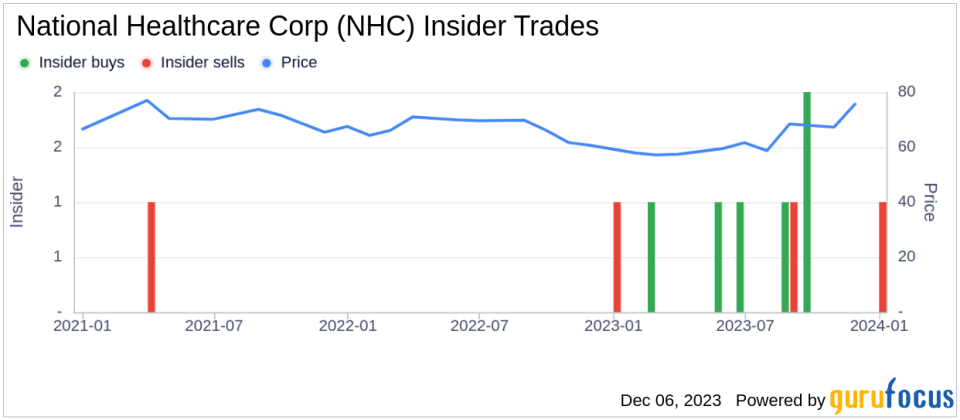

Insider trading activities, such as buys and sells, can provide valuable clues about a company's internal perspective on its stock's value. In the case of National Healthcare Corp, the insider transaction history over the past year shows a pattern of more insider buys than sells, with 6 insider buys and only 2 insider sells. This could suggest a general confidence among insiders about the company's future performance.

However, the recent sale by Emil Hassan of 7,500 shares could signal a shift in this trend. It's important to consider the context and possible motivations behind the insider's decision to sell. While insider sells can sometimes indicate a lack of confidence in the company's future prospects, they can also be motivated by personal financial planning or diversification strategies that are not necessarily reflective of the company's outlook.

On the day of the insider's recent sale, shares of National Healthcare Corp were trading at $85.5 each, giving the stock a market cap of $1.339 billion. This price point is significant when considering the company's valuation metrics.

The price-earnings ratio of National Healthcare Corp stands at 30.03, which is higher than both the industry median of 26.32 and the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is priced on the higher end compared to its earnings, potentially influencing the insider's decision to sell.

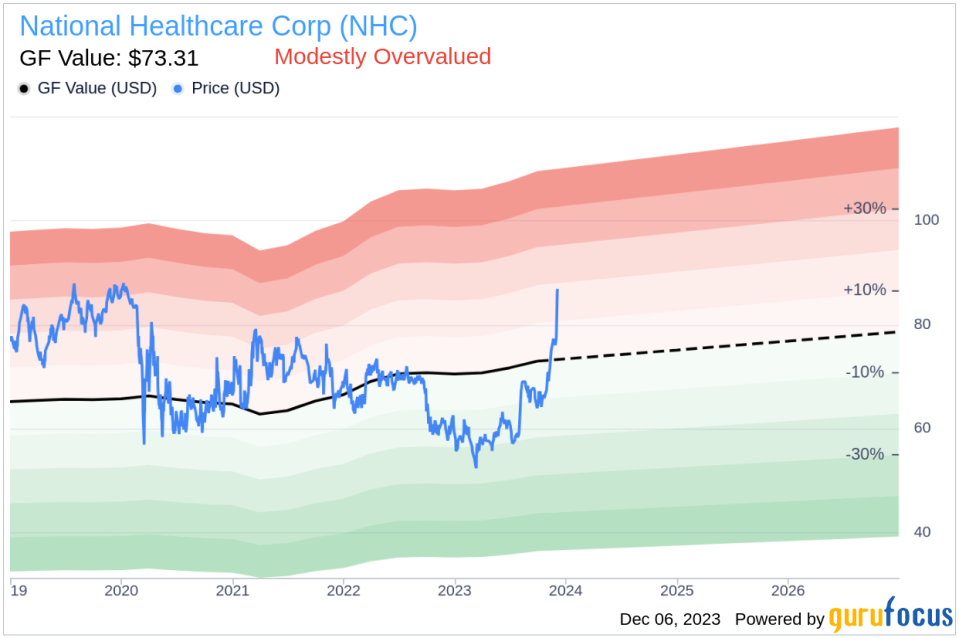

Adding another layer to the valuation analysis, the price-to-GF-Value ratio of 1.17 indicates that National Healthcare Corp is modestly overvalued based on its GF Value of $73.31. The GF Value, an intrinsic value estimate developed by GuruFocus, takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The current price-to-GF-Value ratio above 1 suggests that the stock may not be as attractive at its current price, possibly contributing to the insider's choice to reduce their stake.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at National Healthcare Corp. This graphical insight, combined with the valuation data, can help investors make more informed decisions regarding their investments in NHC.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value, reinforcing the notion that the stock may be trading at a premium to what is considered its fair value.

Conclusion

The recent insider sell by Director Emil Hassan of National Healthcare Corp is a development that warrants attention from investors. While the company's business model remains robust within the healthcare industry, the insider's sell-off, in conjunction with the stock's valuation metrics, suggests that there may be concerns about the stock's current pricing. As always, investors should consider insider trends, valuation metrics, and their own research when evaluating their investment strategies.

It is also crucial to remember that insider transactions are just one piece of the puzzle when it comes to assessing a stock's potential. Market conditions, company performance, and broader economic factors all play a role in determining the future movement of a stock's price. Therefore, while insider activity such as Emil Hassan's recent sell can provide valuable insights, it should be considered alongside a comprehensive analysis of all relevant factors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.