Insider Sell Alert: Director Eric Wu Sells 70,201 Shares of Opendoor Technologies Inc (OPEN)

In a notable insider transaction, Director Eric Wu of Opendoor Technologies Inc (NASDAQ:OPEN) has sold 70,201 shares of the company on November 15, 2023. This move comes amidst a period of significant insider selling activity at the company, with Wu being a prominent figure in the recent sell-off. As a financial stock market writer for GuruFocus.com, we delve into the details of this transaction, the insider's history, and what it could mean for investors.

Who is Eric Wu of Opendoor Technologies Inc?

Eric Wu is a co-founder of Opendoor Technologies Inc and has served as a key executive and board member since the company's inception. His role has been pivotal in shaping the company's strategic direction and operational execution. Wu's insider status provides him with a deep understanding of the company's business model, growth prospects, and challenges.

Opendoor Technologies Inc's Business Description

Opendoor Technologies Inc is a digital platform for residential real estate that simplifies the process of buying and selling homes. The company leverages technology to provide instant offers to sellers, enabling a quick and hassle-free sale. For buyers, Opendoor offers a seamless online experience, with the ability to discover, tour, and purchase homes directly through its platform. The company's innovative approach to real estate transactions has disrupted the traditional home buying and selling process, positioning it as a leader in the industry's digital transformation.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

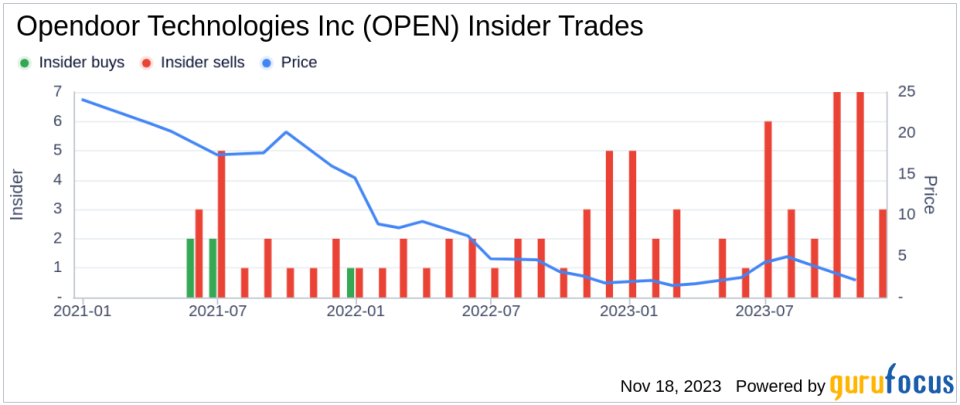

The insider transaction history for Opendoor Technologies Inc shows a distinct pattern of insider selling, with no insider buys recorded over the past year. In total, there have been 41 insider sells, indicating a trend where insiders may perceive the stock's current price as an opportune time to liquidate part of their holdings. Eric Wu's recent sale of 70,201 shares is part of this broader trend.

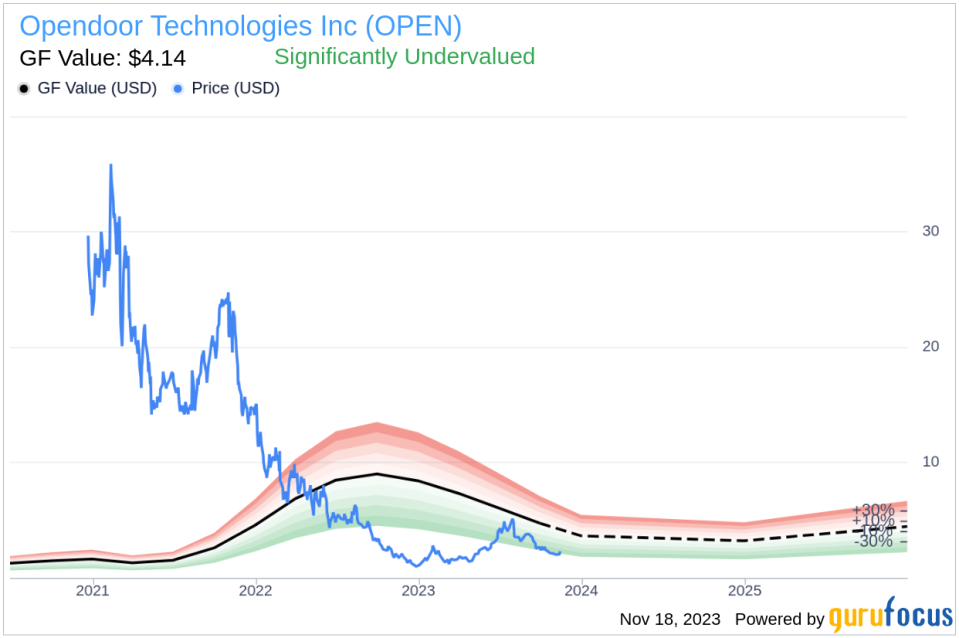

On the day of the insider's recent sale, shares of Opendoor Technologies Inc were trading at $2.46, giving the company a market cap of $1.641 billion. This valuation is particularly interesting when considering the company's price-to-GF-Value ratio of 0.59, suggesting that the stock is significantly undervalued based on its GF Value of $4.14.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The significant undervaluation indicated by the GF Value raises questions about the timing of the insider's decision to sell, as it may suggest potential upside for the stock that the insider is not waiting for.

However, insider selling can be motivated by a variety of factors that are not necessarily related to the company's valuation or performance. Insiders may sell shares for personal financial planning, diversification, or other reasons that do not reflect their outlook on the company's future.

It is also important to consider the volume of shares sold by the insider in the context of their overall holdings. Over the past year, Eric Wu has sold a total of 12,334,090 shares and has not made any purchases. This level of selling activity could indicate a desire to reduce exposure to the company's stock, but without additional context, it is difficult to draw definitive conclusions.

The insider trend image above provides a visual representation of the selling activity over time. The concentration of sell transactions without corresponding buys may be a signal to investors to monitor insider activity closely, as it could provide insights into the insiders' collective sentiment about the company's prospects.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value. This divergence presents a potential opportunity for investors who believe in the company's long-term value proposition and are willing to take a contrarian view against the insider selling trend.

Conclusion

In summary, the recent insider sell by Director Eric Wu is part of a larger pattern of insider selling at Opendoor Technologies Inc. While the company appears significantly undervalued based on the GF Value, the consistent insider selling raises questions about the stock's near-term prospects. Investors should weigh the insider activity against other fundamental and technical factors when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should be conducted to fully understand the investment landscape of Opendoor Technologies Inc.

For those interested in following insider transactions and gaining insights into the potential implications for stock performance, GuruFocus.com provides detailed data and analysis tools to track and interpret these important market signals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.