Insider Sell Alert: Director Frances Sevilla-Sacasa Sells Shares of Camden Property Trust (CPT)

In the realm of real estate investment trusts (REITs), insider transactions are often closely monitored by investors seeking clues about a company's financial health and future prospects. Recently, Frances Sevilla-Sacasa, a director at Camden Property Trust (NYSE:CPT), executed a notable sale of shares in the company. On November 28, 2023, the insider sold 4,314 shares of Camden Property Trust, a transaction that warrants a closer look to understand its potential implications for investors.

Who is Frances Sevilla-Sacasa?

Frances Sevilla-Sacasa is a seasoned executive with a wealth of experience in the financial services industry. Her background includes leadership roles at various prestigious institutions, and she has been serving as a director at Camden Property Trust. Her insights and decisions as part of the company's board are influential, and her trading activities are often considered a reflection of her confidence in the company's future.

Camden Property Trust's Business Description

Camden Property Trust is a publicly traded REIT that focuses on the ownership, management, development, and acquisition of multifamily apartment communities across the United States. With a portfolio that includes numerous properties in some of the country's most dynamic markets, Camden Property Trust is known for its commitment to providing high-quality living experiences for its residents. The company's strategic investments and property management practices have positioned it as a leader in the residential real estate sector.

Analysis of Insider Buy/Sell and Relationship with Stock Price

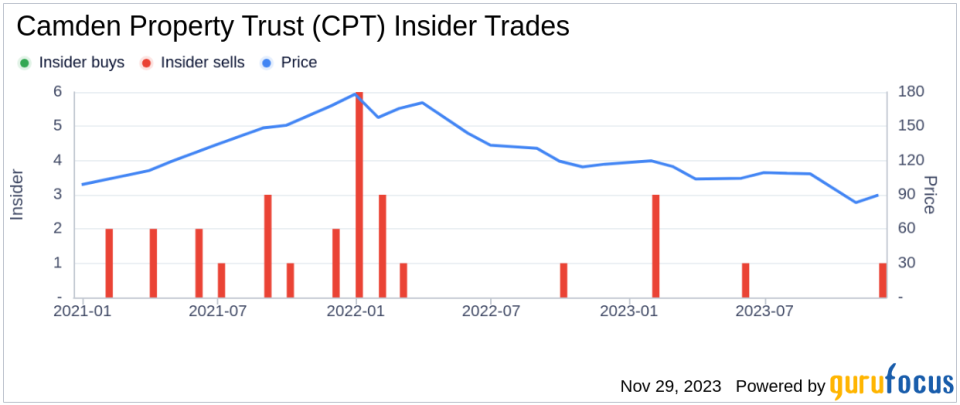

The recent sale by Frances Sevilla-Sacasa is part of a broader pattern of insider trading activity at Camden Property Trust. Over the past year, the insider has sold a total of 4,314 shares and has not made any purchases. This one-sided transaction history could be interpreted in various ways by market observers.When insiders sell shares, it can sometimes signal a lack of confidence in the company's future performance or a belief that the stock is currently overvalued. However, it's important to consider that insiders may have diverse reasons for selling shares, such as personal financial planning or diversification of assets, which are not necessarily related to their outlook on the company.The insider transaction history for Camden Property Trust shows no insider buys over the past year, with a total of 5 insider sells during the same timeframe. This trend could suggest a cautious stance among insiders regarding the company's stock, although it is not definitive evidence of the company's trajectory.

On the day of the insider's recent sale, shares of Camden Property Trust were trading at $89.55, giving the company a market cap of $9.582 billion. The price-earnings ratio stands at 42.94, which is higher than both the industry median of 17.37 and the company's historical median price-earnings ratio. This elevated P/E ratio could indicate that the stock is priced at a premium compared to its peers and its own historical valuation.

Valuation and GF Value Analysis

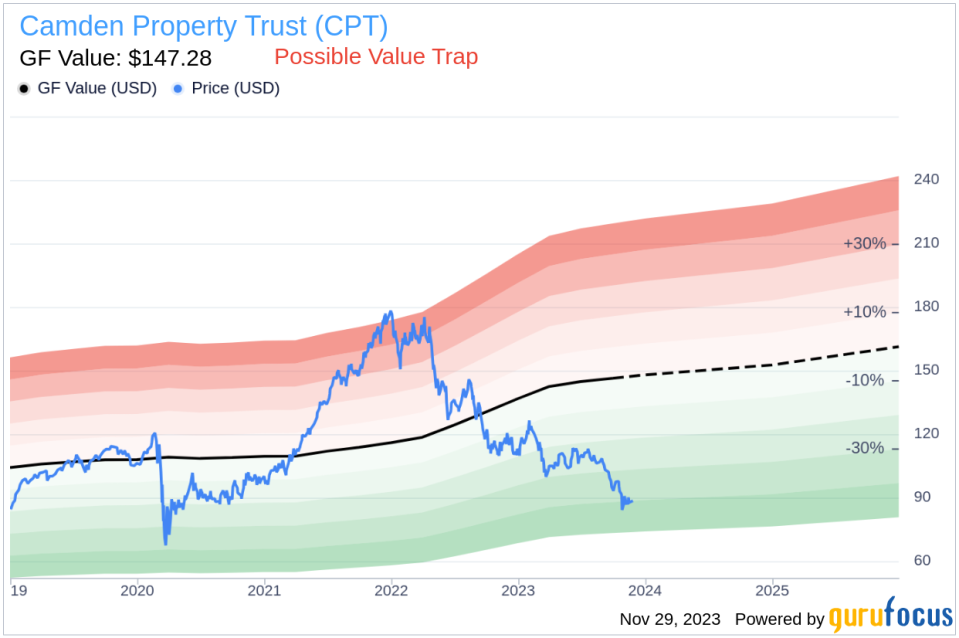

The valuation of Camden Property Trust, as reflected by its price-to-GF-Value ratio of 0.61, suggests that the stock might be a possible value trap and warrants caution before investing. The GF Value, an intrinsic value estimate developed by GuruFocus, is currently set at $147.28 for Camden Property Trust. This valuation is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

Considering the GF Value, the stock's current price appears to be undervalued, which could attract investors looking for a bargain. However, the label of "Possible Value Trap, Think Twice" indicates that there may be underlying issues or challenges that are not immediately apparent from the valuation metrics alone.In conclusion, the recent insider sale by Frances Sevilla-Sacasa at Camden Property Trust raises questions about the stock's valuation and future prospects. While the company's market cap and P/E ratio suggest a strong position within the industry, the insider trading activity and GF Value analysis provide a more nuanced picture that investors should consider. As always, it's essential for investors to conduct their own due diligence and consider a range of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.