Insider Sell Alert: Director Frank Watkins Sells 3,000 Shares of ShockWave Medical Inc (SWAV)

ShockWave Medical Inc (NASDAQ:SWAV), a pioneer in the development and commercialization of intravascular lithotripsy to treat complex calcified cardiovascular disease, has recently witnessed a notable insider transaction. Director Frank Watkins sold 3,000 shares of the company's stock on November 20, 2023. This sale has caught the attention of investors and analysts alike, as insider transactions can often provide valuable insights into a company's prospects.

Who is Frank Watkins of ShockWave Medical Inc?

Frank Watkins is a seasoned member of the ShockWave Medical Inc board, bringing with him a wealth of experience in the medical device industry. His role as a director involves providing strategic guidance and oversight to the company's operations and growth initiatives. Watkins's insider transactions are closely monitored, as they can reflect his confidence in the company's future performance and strategic direction.

ShockWave Medical Inc's Business Description

ShockWave Medical Inc specializes in medical devices that address the challenges posed by calcified cardiovascular disease. The company's innovative technology, intravascular lithotripsy, uses sonic pressure waves to safely break up calcified plaque, which can then be removed, thereby improving blood flow. This minimally invasive approach has the potential to transform the treatment landscape for patients suffering from cardiovascular diseases, offering a new lease on life for many.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

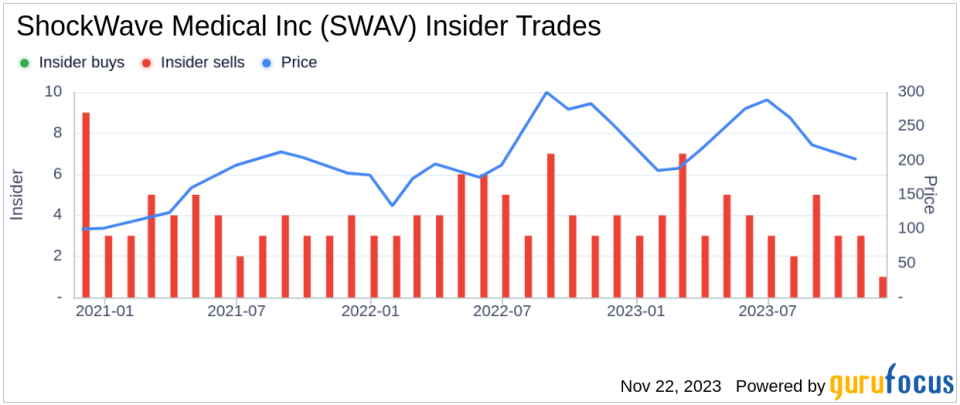

Insider transactions, particularly those involving sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future, it is important to consider the context and magnitude of the transactions. In the case of Frank Watkins, the sale of 3,000 shares follows a pattern of selling activity over the past year, with a total of 40,000 shares sold and no shares purchased.

It is crucial to analyze these transactions alongside the company's stock performance. On the day of Watkins's recent sale, ShockWave Medical Inc's shares were trading at $173.35, giving the company a market cap of $6.372 billion. This price point is significantly lower than the company's historical median price-earnings ratio, suggesting that the stock may be undervalued relative to its earnings potential.

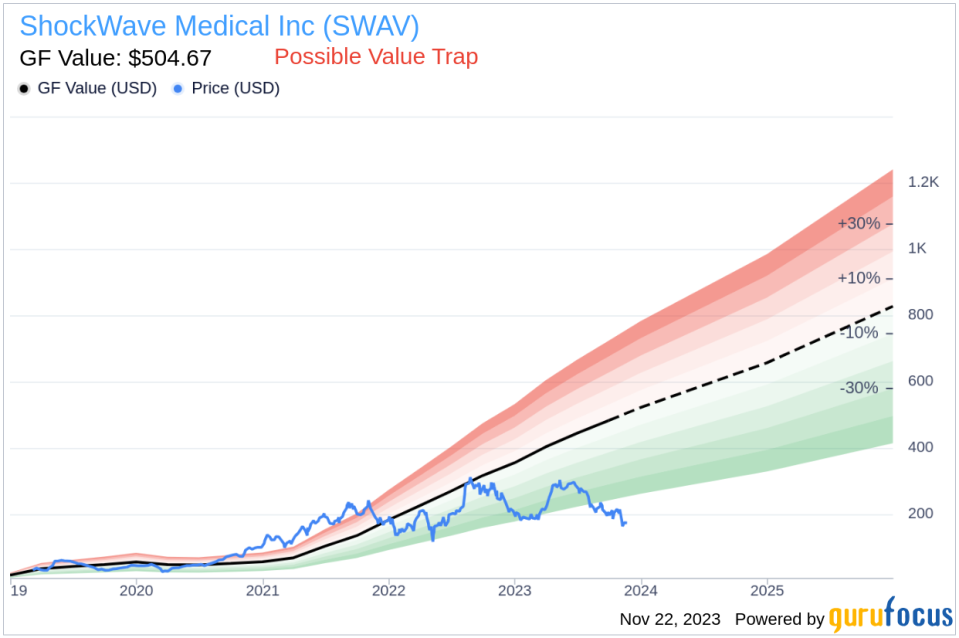

However, the price-to-GF-Value ratio of 0.34 indicates that the stock is considered a Possible Value Trap, Think Twice, based on its GF Value. This assessment suggests that investors should exercise caution and conduct further analysis before making investment decisions.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This comprehensive approach to valuation aims to provide a more accurate picture of a stock's intrinsic value.

The insider trend image above illustrates the pattern of insider transactions over the past year. The absence of insider buys and the prevalence of insider sells could be indicative of various factors, including personal financial planning or portfolio diversification by the insiders. It is essential to consider these factors alongside the company's financial health and market conditions.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value estimate. The current price-to-GF-Value ratio suggests that the market may not be fully recognizing the company's growth prospects or earnings potential.

Conclusion

Director Frank Watkins's recent sale of 3,000 shares of ShockWave Medical Inc is a transaction that warrants attention from investors. While the insider selling trend may raise questions, it is important to analyze these actions within the broader context of the company's valuation and market performance. ShockWave Medical Inc's innovative approach to treating cardiovascular disease positions it as a potential leader in the medical device industry. However, the current valuation metrics suggest that investors should approach the stock with caution and conduct thorough due diligence before making investment decisions.

As with any investment, insider transactions are just one piece of the puzzle. A comprehensive analysis that includes financial performance, industry trends, and broader economic factors is essential for making informed investment choices. Investors are encouraged to keep a close eye on insider activity, as it can often provide early signals about a company's future direction and potential.

For those interested in following ShockWave Medical Inc and other insider transactions, staying informed through reliable financial news sources and analysis platforms is key to making strategic investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.