Insider Sell Alert: Director Frederic Moll Sells 79,000 Shares of PROCEPT BioRobotics Corp (PRCT)

In a notable insider transaction, Director Frederic Moll has parted with a significant number of shares in PROCEPT BioRobotics Corp (NASDAQ:PRCT). On December 6, 2023, the insider executed a sale of 79,000 shares of the company, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, and the potential implications for the stock's performance.

Who is Frederic Moll?

Frederic Moll is a renowned figure in the medical technology industry, known for his entrepreneurial spirit and contributions to the field of robotic-assisted surgery. As a director of PROCEPT BioRobotics Corp, Moll brings a wealth of experience and expertise to the table. His background includes founding several successful companies in the medical device sector, and he is widely recognized for his role in advancing minimally invasive surgical techniques. Moll's decision to sell a substantial portion of his holdings in PROCEPT BioRobotics Corp is therefore of particular interest to those following the company's trajectory.

PROCEPT BioRobotics Corp's Business Description

PROCEPT BioRobotics Corp is a pioneering company in the field of medical devices, specializing in the development and commercialization of robotic systems for the treatment of urological conditions. The company's flagship product, the AquaBeam Robotic System, is designed to provide an advanced, minimally invasive treatment for benign prostatic hyperplasia (BPH), a common condition affecting the prostate. With a focus on innovation and improving patient outcomes, PROCEPT BioRobotics Corp is at the forefront of the medical robotics industry, offering solutions that aim to reduce recovery times and enhance the quality of life for patients.

Analysis of Insider Buy/Sell and Relationship with Stock Price

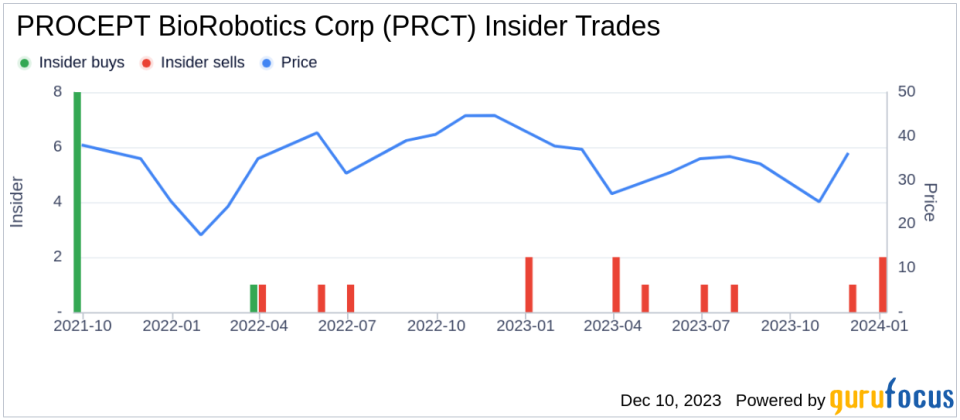

Insider transactions can provide valuable insights into a company's health and the sentiment of its key executives and directors. In the case of PROCEPT BioRobotics Corp, the insider trend over the past year has been characterized by a lack of insider purchases and a series of 11 insider sells. This pattern may raise questions about the insiders' confidence in the company's future prospects or could simply reflect personal financial management decisions by the insiders.

On the day of Frederic Moll's recent sale, PROCEPT BioRobotics Corp's shares were trading at $38.75, giving the company a market cap of $1.985 billion. The timing and size of Moll's sale could suggest a belief that the stock is currently fairly valued or potentially overvalued, prompting the insider to lock in profits. However, without additional context, it is challenging to draw definitive conclusions from a single transaction.

It is also important to consider the broader market conditions and company performance when analyzing insider transactions. If the company has been performing well, with strong financial results and positive growth prospects, insider sales might not necessarily indicate a lack of confidence. Conversely, if the company faces challenges or uncertainties, insider sales could be interpreted as a bearish signal.

Investors often monitor insider trends for patterns that could indicate the future direction of the stock price. While insider selling does not always lead to a decline in stock price, it can sometimes precede periods of underperformance, especially if multiple insiders are selling around the same time.

The insider trend image above provides a visual representation of the recent insider transactions at PROCEPT BioRobotics Corp. The absence of insider buys, coupled with consistent selling, may be noteworthy to investors who track such activities as part of their investment strategy.

Conclusion

Frederic Moll's recent sale of 79,000 shares of PROCEPT BioRobotics Corp represents a significant insider transaction that warrants attention. While the reasons behind the sale are not publicly disclosed, the pattern of insider activity over the past year suggests a lack of buying interest among insiders, which could be a point of consideration for current and potential investors.

As with any insider transaction, it is crucial to view this event within the larger context of the company's performance, industry trends, and overall market conditions. Investors should also consider a wide range of factors, including financial metrics, competitive positioning, and future growth prospects, before making investment decisions based on insider activity.

PROCEPT BioRobotics Corp's innovative approach to medical technology and its focus on improving patient care continue to position the company as a key player in the medical device industry. As the market digests the implications of Frederic Moll's stock sale, all eyes will be on the company's next steps and how they align with the insider's recent move.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.