Insider Sell Alert: Director Frederick Nance Sells Shares of RPM International Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, RPM International Inc (NYSE:RPM) witnessed a notable insider sell that has caught the attention of the market. On November 10, 2023, Director Frederick Nance sold 1,266 shares of the company, a transaction that prompts a closer examination of the insider's actions and the potential implications for RPM International Inc's stock.

Who is Frederick Nance?

Frederick Nance is a distinguished member of the board of directors at RPM International Inc. His role within the company is crucial, as directors are responsible for guiding the company's strategic direction and ensuring that it adheres to good corporate governance practices. Nance's professional background and expertise provide valuable insights into RPM International Inc's operations and future prospects.

About RPM International Inc

RPM International Inc is a multinational company specializing in the manufacture, marketing, and sale of various specialty chemical product lines, including high-performance coatings, sealants, and building materials. The company operates through its subsidiaries in numerous industrial and consumer markets, catering to the needs of customers worldwide. RPM's commitment to innovation and quality has positioned it as a leader in the specialty chemicals industry.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, particularly sells, can be interpreted in various ways. While an insider sell does not always signal a lack of confidence in the company, it can raise questions among investors about the insider's view of the stock's future performance. In the case of Frederick Nance, the insider has sold 1,266 shares over the past year without purchasing any shares. This one-sided activity might suggest that the insider is taking profits or reallocating assets rather than reflecting a bearish stance on the company's future.

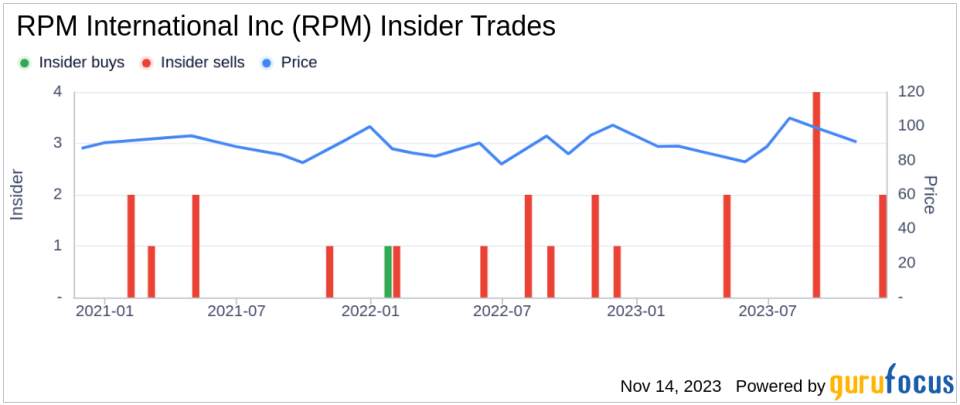

It is also important to consider the broader context of insider trading trends at RPM International Inc. Over the past year, there have been no insider buys but eight insider sells. This pattern of insider selling could indicate that those with intimate knowledge of the company see the current stock price as an opportune time to liquidate some of their holdings.

On the day of Nance's recent sell, shares of RPM International Inc were trading at $97.77, giving the company a market cap of $12.562 billion. The price-earnings ratio stood at 24.56, slightly above the industry median of 22.28 but below the company's historical median. This suggests that the stock is not excessively overvalued compared to its peers and its own trading history.

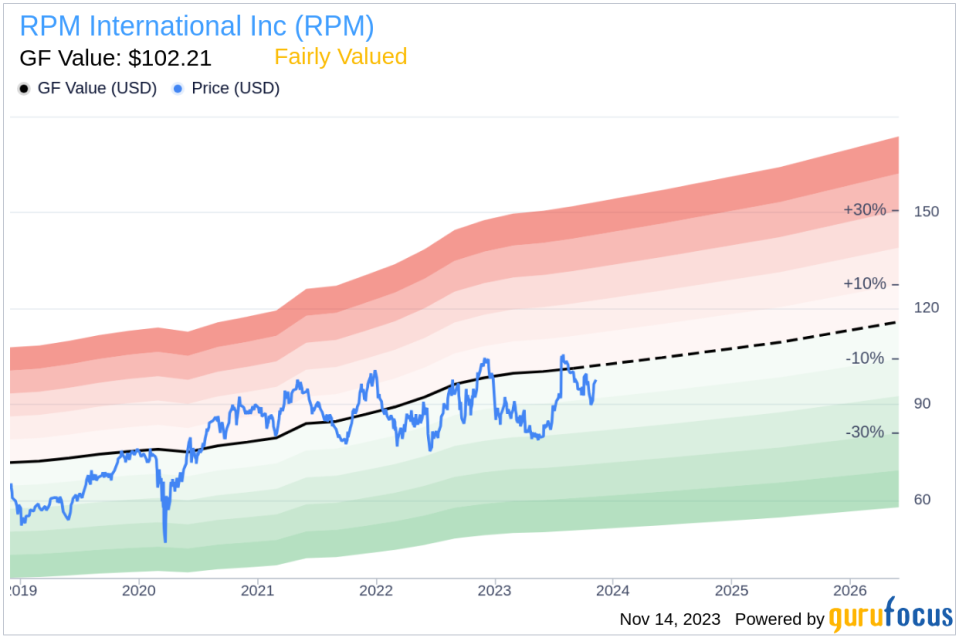

When assessing the stock's valuation, the price-to-GF-Value ratio is a critical metric. With a share price of $97.77 and a GuruFocus Value of $102.21, RPM International Inc's price-to-GF-Value ratio is 0.96, indicating that the stock is Fairly Valued. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders at RPM International Inc. The absence of buys and the presence of multiple sells could be a signal for investors to watch closely for any changes in insider sentiment that might suggest a shift in the company's outlook.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value. The close alignment of the stock price with the GF Value supports the notion that RPM International Inc is fairly valued at its current price, neither deeply undervalued nor overpriced.

Conclusion

Director Frederick Nance's recent sale of 1,266 shares of RPM International Inc is a transaction that warrants attention from investors. While insider sells can have various motivations, the consistent pattern of selling among insiders at RPM International Inc over the past year could be indicative of a collective sentiment about the stock's valuation. However, with the stock's price-to-GF-Value ratio suggesting fair valuation and the price-earnings ratio being within a reasonable range, investors may want to consider other factors such as the company's growth prospects, competitive position, and overall market conditions before making investment decisions.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It is essential for investors to conduct thorough research and consider a comprehensive range of indicators before drawing conclusions and making investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.