Insider Sell Alert: Director Frederick Hudson Sells 9,093 Shares of Supernus Pharmaceuticals ...

Supernus Pharmaceuticals Inc (NASDAQ:SUPN), a biopharmaceutical company focused on developing and commercializing products for the treatment of central nervous system diseases, has recently seen a significant insider sell by one of its directors. Frederick Hudson, a seasoned member of the Supernus Pharmaceuticals team, sold 9,093 shares of the company on November 15, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Frederick Hudson?

Frederick Hudson has been a key figure at Supernus Pharmaceuticals Inc, serving as a director. His role in the company involves oversight and strategic guidance, which means his actions in the stock market are closely watched. Directors like Hudson are privy to in-depth knowledge about the company's operations, potential challenges, and upcoming opportunities, making their trading activities a point of interest for investors.

Supernus Pharmaceuticals Inc's Business Description

Supernus Pharmaceuticals Inc is a company that prides itself on its commitment to addressing unmet medical needs in the field of central nervous system (CNS) diseases. The company has a diverse portfolio that includes treatments for epilepsy, Parkinson's disease, and attention deficit hyperactivity disorder (ADHD), among others. Supernus aims to leverage its proprietary technologies to develop novel solutions that improve patient care and outcomes.

Analysis of Insider Buy/Sell and Relationship with Stock Price

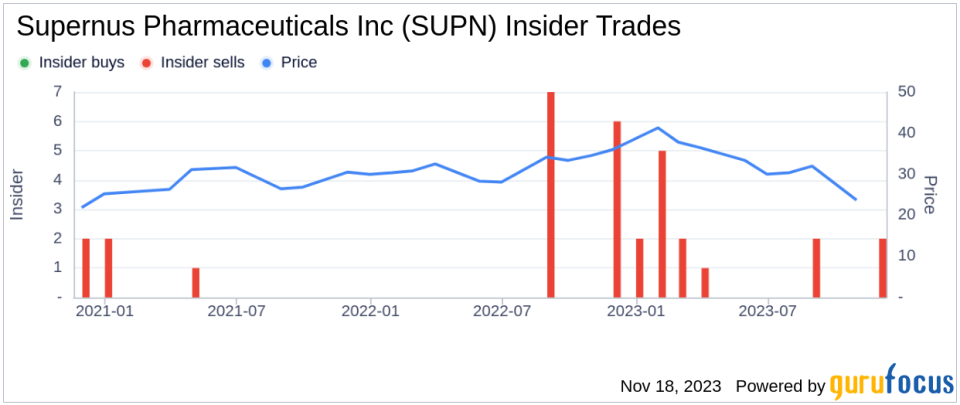

Over the past year, Frederick Hudson's trading activities have been exclusively on the sell-side, with a total of 9,093 shares sold and no shares purchased. This could be interpreted in various ways; however, without additional context, it is challenging to draw definitive conclusions. It is worth noting that there have been 17 insider sells and no insider buys for Supernus Pharmaceuticals over the same period, which may suggest a pattern among insiders that could be worth further investigation.

On the day of the insider's recent sell, shares of Supernus Pharmaceuticals Inc were trading at $28.5, giving the company a market cap of $1.498 billion. This valuation places the company in a strong position within the biopharmaceutical industry, though the insider's decision to sell could raise questions among investors.

The price-earnings ratio of Supernus Pharmaceuticals stands at 66.90, significantly higher than the industry median of 23.51 and above the company's historical median. This elevated P/E ratio could indicate that the stock is overvalued based on earnings, which might be a factor in the insider's decision to sell shares.

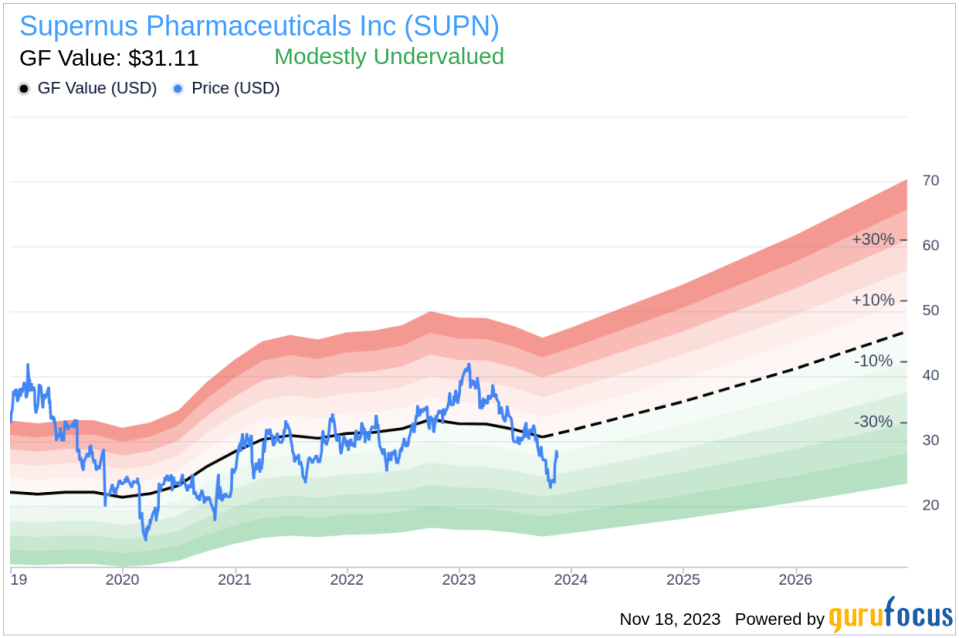

However, when considering the GuruFocus Value (GF Value) of $31.11, Supernus Pharmaceuticals Inc appears to be modestly undervalued with a price-to-GF-Value ratio of 0.92. The GF Value is a comprehensive measure that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This discrepancy between the P/E ratio and GF Value could suggest that the stock has room for growth, despite the insider's recent sell-off.

The insider trend image above provides a visual representation of the insider trading activities at Supernus Pharmaceuticals Inc. The absence of insider buys coupled with a consistent pattern of sells could be indicative of insiders' sentiment about the stock's future performance.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. The modest undervaluation based on the GF Value suggests that the stock may be a good buy for investors looking for long-term growth potential, despite the recent insider sell.

Conclusion

Director Frederick Hudson's recent sell of 9,093 shares of Supernus Pharmaceuticals Inc has certainly raised eyebrows in the investment community. While the company's strong market cap and modest undervaluation based on GF Value present a positive outlook, the high P/E ratio and consistent insider selling pattern may give investors pause. As with any insider trading activity, it is essential for investors to consider the broader context and conduct their own due diligence before making investment decisions. The actions of insiders like Frederick Hudson can provide valuable insights, but they are just one piece of the complex puzzle that is the stock market.

Investors should continue to monitor insider trends and valuation metrics closely, as they can often be early indicators of a company's future performance. With its focus on CNS diseases and a robust product portfolio, Supernus Pharmaceuticals Inc remains a company to watch in the biopharmaceutical space.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.