Insider Sell Alert: Director Frederick Leonberger Sells 75,000 Shares of Lightwave Logic Inc (LWLG)

In a notable insider transaction, Director Frederick Leonberger sold 75,000 shares of Lightwave Logic Inc (NASDAQ:LWLG) on December 13, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Frederick Leonberger of Lightwave Logic Inc?

Frederick Leonberger is a key figure at Lightwave Logic Inc, serving as a member of the company's board of directors. His background includes extensive experience in the field of photonics and optoelectronics, which aligns with Lightwave Logic's business focus. Leonberger's expertise in the industry and his position within the company make his trading activities particularly noteworthy to investors seeking to understand the internal perspective on the company's performance and future.

Lightwave Logic Inc's Business Description

Lightwave Logic Inc is a technology company that operates within the burgeoning field of photonics. The company specializes in the development of advanced materials and integrated optical devices that have applications in high-speed fiber-optic data communications and telecommunications. Lightwave Logic's proprietary electro-optic polymers are designed to enhance the performance and efficiency of optical modulators, which are critical components in optical data transmission. The company's innovations aim to meet the increasing demand for faster and more reliable data transmission solutions, a market that continues to grow with the expansion of global internet infrastructure and the proliferation of data-intensive applications.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

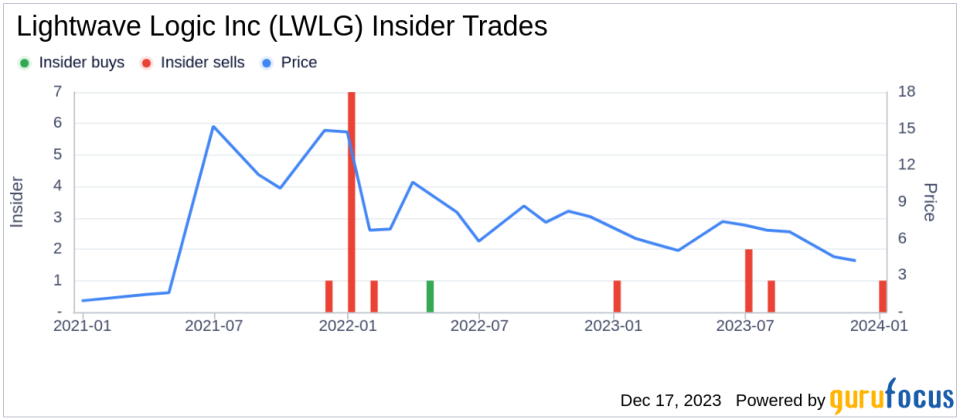

Insider trading activities, such as buys and sells, can be a barometer for a company's health and future prospects. When insiders purchase shares, it is often interpreted as a sign of confidence in the company's future performance. Conversely, when insiders sell shares, it can raise questions about their confidence in the company's valuation or future growth potential.

Frederick Leonberger's recent sale of 75,000 shares follows a pattern of insider selling at Lightwave Logic Inc. Over the past year, Leonberger has sold a total of 124,000 shares and has not made any purchases. This one-sided activity could suggest that insiders, including Leonberger, may believe the stock is fully valued or that they are taking profits after a period of appreciation.

It is important to consider the context of these sales. If the insider sells a small portion of their holdings, it may not necessarily indicate a lack of confidence but rather personal financial management. However, consistent selling by multiple insiders over time could be a red flag for investors.

The relationship between insider selling and stock price can be complex. While insider sales can sometimes lead to a decrease in stock price due to perceived negative sentiment, this is not always the case. The market may have already priced in the insider's knowledge, or the sales may not be significant enough to impact the stock price. In the case of Lightwave Logic Inc, the stock was trading at $4.67 on the day of Leonberger's recent sale, giving the company a market cap of $611.319 million.

It is also worth noting that insider transactions are just one piece of the puzzle when evaluating a stock. Investors should also consider the company's fundamentals, industry trends, and broader market conditions when making investment decisions.

The insider trend image above provides a visual representation of the insider trading activities at Lightwave Logic Inc. The absence of insider buys over the past year, coupled with the presence of insider sells, may lead some investors to question the insiders' outlook on the company's valuation and growth prospects.

Conclusion

Frederick Leonberger's recent sale of 75,000 shares of Lightwave Logic Inc is a significant event that warrants attention from investors and market analysts. While insider selling does not always convey a negative outlook, the lack of insider buying at Lightwave Logic Inc over the past year, in contrast to the insider selling, could be a cause for a more cautious approach to the stock. As always, investors should consider a comprehensive analysis of the company, including its financial health, industry position, and potential for future growth, before making any investment decisions.

For those invested in or considering an investment in Lightwave Logic Inc, monitoring insider trading activity will continue to be an important aspect of understanding the stock's potential. As the market digests this latest insider transaction, it will be crucial to watch for any further insider activity and to assess its implications in the context of the company's overall performance and market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.