Insider Sell Alert: Director Greg Trojan Offloads Shares of BJ's Restaurants Inc

BJ's Restaurants Inc (NASDAQ:BJRI), a renowned name in the casual dining sector, has recently witnessed a notable insider transaction. Director Greg Trojan has parted with 3,281 shares of the company on December 11, 2023. This move by a key insider has sparked interest among investors and market analysts, prompting a closer look at the implications of such insider activities on the stock's performance and valuation.

Who is Greg Trojan of BJ's Restaurants Inc?

Greg Trojan is a seasoned executive with a wealth of experience in the restaurant industry. As a director of BJ's Restaurants Inc, Trojan has been instrumental in steering the company through the competitive landscape of casual dining. His insights and leadership have been valuable assets to the company, contributing to its strategic decisions and growth initiatives. Prior to his role at BJ's Restaurants, Trojan has held various executive positions, showcasing his expertise in operations, marketing, and business development within the sector.

BJ's Restaurants Inc's Business Description

BJ's Restaurants Inc operates a chain of casual dining restaurants across the United States. Known for its deep-dish pizza, handcrafted beers, and a broad menu featuring appetizers, entrees, pastas, sandwiches, specialty salads, and desserts, BJ's Restaurants has carved out a niche for itself in the casual dining space. The company prides itself on providing a high-quality dining experience with a focus on innovation and customer satisfaction. With its inviting atmosphere and commitment to excellence, BJ's Restaurants continues to attract a diverse clientele seeking a memorable dining experience.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving buying and selling of shares, can provide valuable insights into a company's internal perspective on its stock's valuation and future prospects. In the case of BJ's Restaurants Inc, the insider transaction history over the past year shows a pattern that leans more towards selling than buying. With 7 insider sells and only 1 insider buy, it suggests that insiders might perceive the stock's current price as being on the higher end of its value spectrum, or they may have personal financial planning reasons for the sales.

On the day of the insider's recent sale, shares of BJ's Restaurants Inc were trading at $32.5, giving the company a market cap of $771.932 million. This price point is particularly interesting when considering the company's price-earnings ratio of 50.33, which is significantly higher than the industry median of 22.905. Such a high P/E ratio could indicate that the market has high expectations for the company's future earnings growth, or it could suggest that the stock is overvalued relative to its peers.

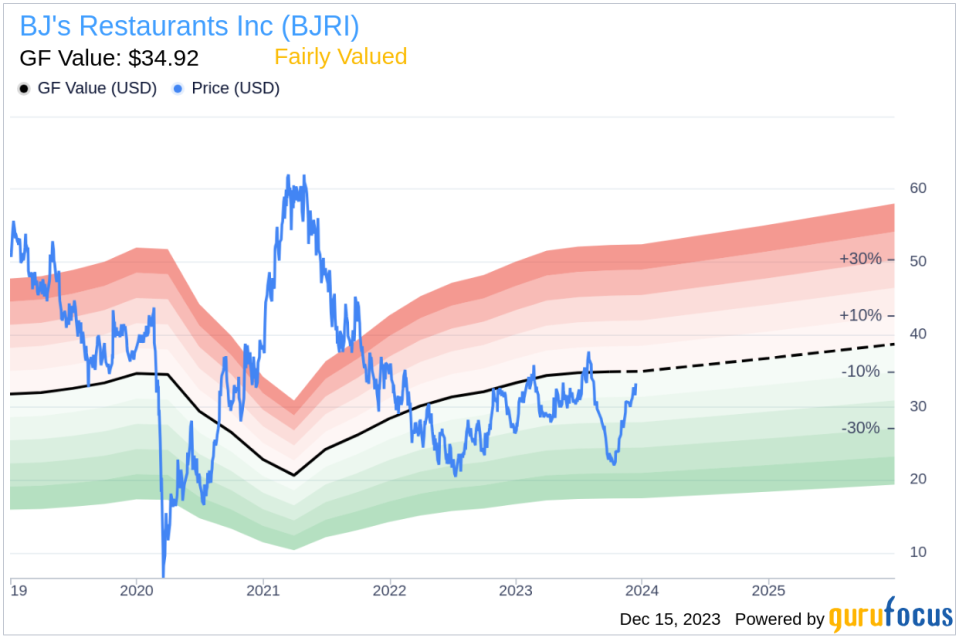

However, when we look at the GF Value, which stands at $34.92, BJ's Restaurants Inc appears to be Fairly Valued with a price-to-GF-Value ratio of 0.93. The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the recent insider transactions, highlighting the predominance of selling activities over buying. This trend can often lead investors to question the confidence insiders have in the company's future performance.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value estimate. Despite the insider selling trend, the stock's current market price hovers around the GF Value, suggesting that the market's perception of the stock's worth aligns with the intrinsic value calculated by GuruFocus.

Conclusion

The recent insider sell by Director Greg Trojan at BJ's Restaurants Inc has brought the company into the spotlight. While insider sells can sometimes raise concerns about a stock's future, it is essential to consider the broader context, including the company's valuation metrics and market performance. In the case of BJ's Restaurants, the stock appears to be fairly valued according to the GF Value, despite a high P/E ratio and a trend of insider selling. Investors should continue to monitor insider transactions, along with other fundamental and technical indicators, to make informed decisions about their investments in BJRI.

As always, it is crucial for investors to conduct their own due diligence and not rely solely on insider trading patterns when making investment decisions. Insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financial health, competitive position, and growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.