Insider Sell Alert: Director Heather Fernandez Sells 3,000 Shares of Atlassian Corp (TEAM)

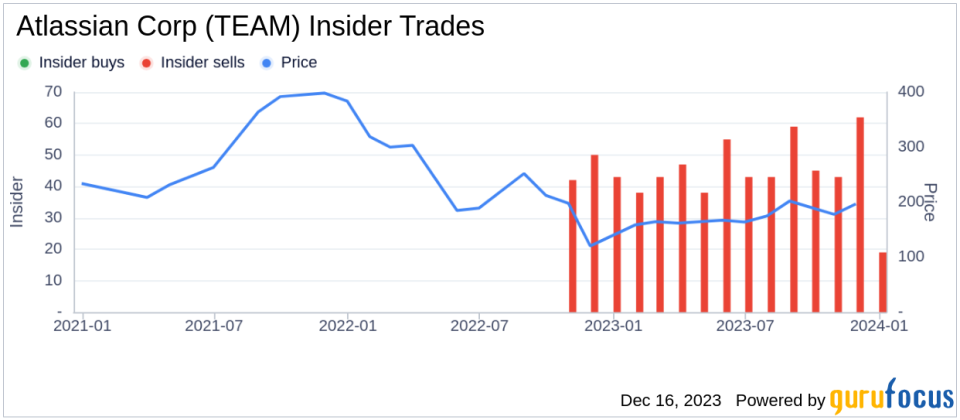

In the realm of insider trading, the actions of company executives, directors, and shareholders can provide valuable insights into their perspective on the company's future prospects. Recently, an insider sell event has caught the attention of investors as Heather Fernandez, a director at Atlassian Corp (NASDAQ:TEAM), sold 3,000 shares of the company. This transaction took place on December 14, 2023, and has prompted discussions regarding its implications for the company and its stock valuation.Who is Heather Fernandez at Atlassian Corp?Heather Fernandez is known for her role as a director at Atlassian Corp, a leading enterprise software company that specializes in products for software developers and project managers. With a background that includes various leadership positions and a keen understanding of the tech industry, Fernandez's actions in the market are closely watched by investors seeking to interpret the significance of her trades.About Atlassian Corp's BusinessAtlassian Corp is a globally recognized provider of collaboration, development, and issue tracking software for teams. With popular products like Jira, Confluence, Bitbucket, and Trello, Atlassian has become an integral part of many organizations' workflows, enabling teams to coordinate, communicate, and deliver projects more efficiently. The company's commitment to innovation and customer satisfaction has been a driving force behind its growth and success in the competitive software industry.Analysis of Insider Buy/Sell and Relationship with Stock PriceOver the past year, Heather Fernandez has sold a total of 6,000 shares and has not made any purchases of Atlassian Corp stock. This pattern of selling without corresponding buys could be interpreted in various ways. Some investors might see it as a lack of confidence in the company's short-term growth prospects, while others might consider it a normal part of personal financial management or portfolio diversification.The broader insider transaction history for Atlassian Corp shows a significant imbalance, with 557 insider sells and no insider buys over the past year. This trend could suggest that insiders, as a group, believe the stock may be fully valued or that they are taking profits after a period of appreciation.

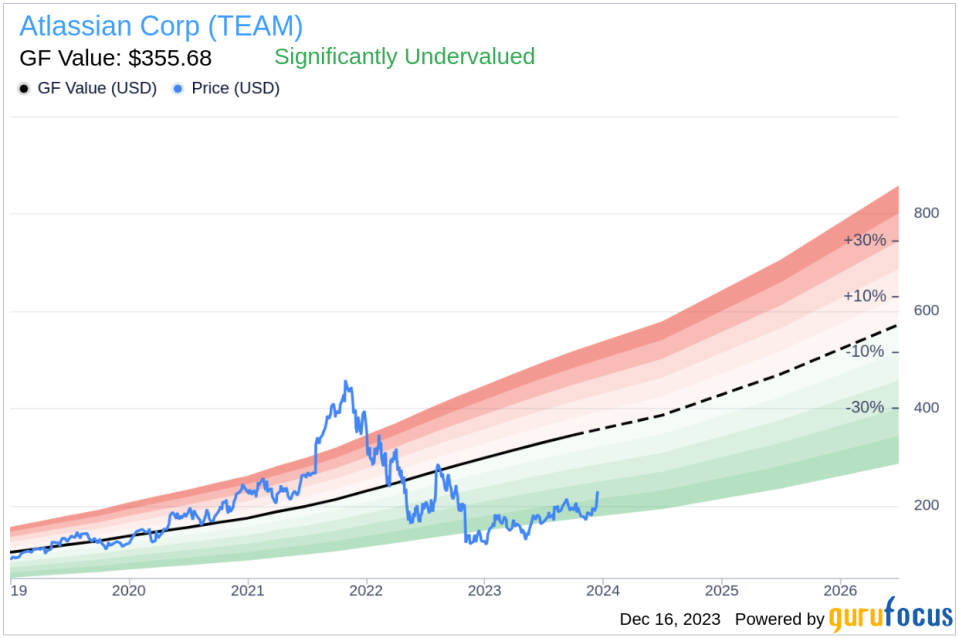

When analyzing the relationship between insider trading activity and stock price, it's important to consider the context of each transaction. Insider sells can occur for a variety of reasons unrelated to a company's health, such as personal financial planning, tax considerations, or diversifying investments. However, a consistent pattern of insider selling, especially when not accompanied by insider buys, can sometimes raise questions about the insiders' long-term confidence in the company's stock performance.Atlassian Corp's Valuation and Market CapOn the day of the insider's recent sell, Atlassian Corp's shares were trading at $225, giving the company a market cap of $59.25 billion. This valuation places Atlassian among the larger software companies in the market, reflecting its strong position and growth potential within the industry.GF Value and Stock Price AnalysisThe GF Value, an intrinsic value estimate developed by GuruFocus, is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. For Atlassian Corp, with a price of $225 and a GF Value of $355.68, the price-to-GF-Value ratio stands at 0.63, indicating that the stock is significantly undervalued based on its GF Value.

This discrepancy between the current stock price and the GF Value could suggest that Atlassian Corp's shares have room to grow and may represent a buying opportunity for investors who believe in the company's long-term prospects. However, it's essential to consider the insider selling activity in this context, as it may temper expectations for immediate price appreciation.ConclusionThe recent insider sell by Director Heather Fernandez at Atlassian Corp is a development that warrants attention from investors. While the company's strong market position and the GF Value suggest that the stock is undervalued, the pattern of insider selling over the past year could be a cause for a more cautious approach. Investors should weigh the potential for growth against the insider sentiment and conduct thorough due diligence before making investment decisions. As always, insider trading is just one piece of the puzzle, and a comprehensive analysis should include a review of the company's fundamentals, competitive landscape, and broader market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.