Insider Sell Alert: Director Howard Xia Offloads Shares of Coherent Corp (COHR)

In a recent transaction on December 14, 2023, Director Howard Xia sold 3,440 shares of Coherent Corp (NYSE:COHR), a significant move that has caught the attention of investors and market analysts. This sale is part of a series of insider transactions that can provide valuable insights into the company's financial health and future prospects.

Who is Howard Xia of Coherent Corp?

Howard Xia serves as a Director at Coherent Corp, a company specializing in lasers and laser-based technology for scientific, commercial, and industrial customers. Xia's role involves overseeing strategic decisions and providing guidance on the company's growth and operational efficiency. His insider perspective is invaluable for understanding the company's trajectory, making his trading activities a focal point for those following Coherent Corp's stock.

Coherent Corp's Business Description

Coherent Corp is a global company that designs, manufactures, and markets a variety of lasers, laser-based technologies, and related accessories for a wide range of applications. The company's products are used in scientific research, semiconductor manufacturing, material processing, and other high-technology industries. Coherent Corp's commitment to innovation and quality has positioned it as a leader in the laser technology sector.

Analysis of Insider Buy/Sell and Relationship with Stock Price

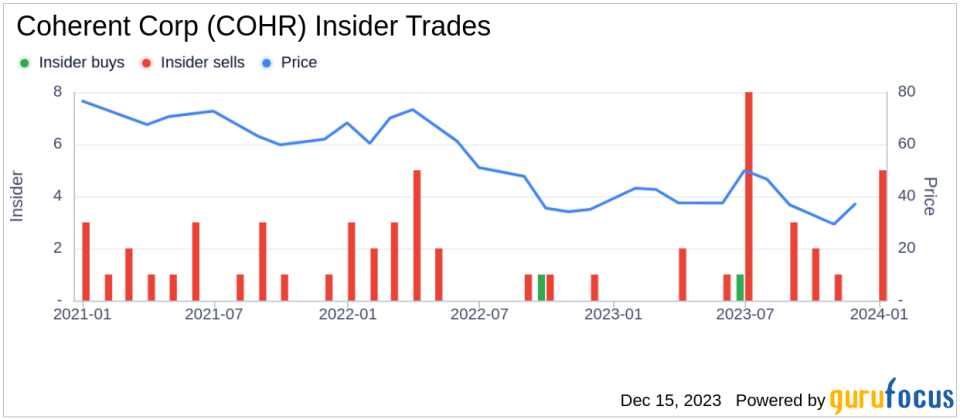

Insider trading activities, such as those of Howard Xia, can provide investors with clues about a company's internal perspective on its stock's value. Over the past year, Xia has sold a total of 9,710 shares and has not made any purchases. This pattern of selling without corresponding buys could signal a lack of confidence in the company's short-term growth potential or a belief that the stock is currently overvalued.

The broader insider transaction history for Coherent Corp shows a trend of more insider sells than buys over the past year, with 23 sells and only 1 buy. This trend may suggest that insiders, on the whole, are taking a cautious stance on the company's valuation or future performance.

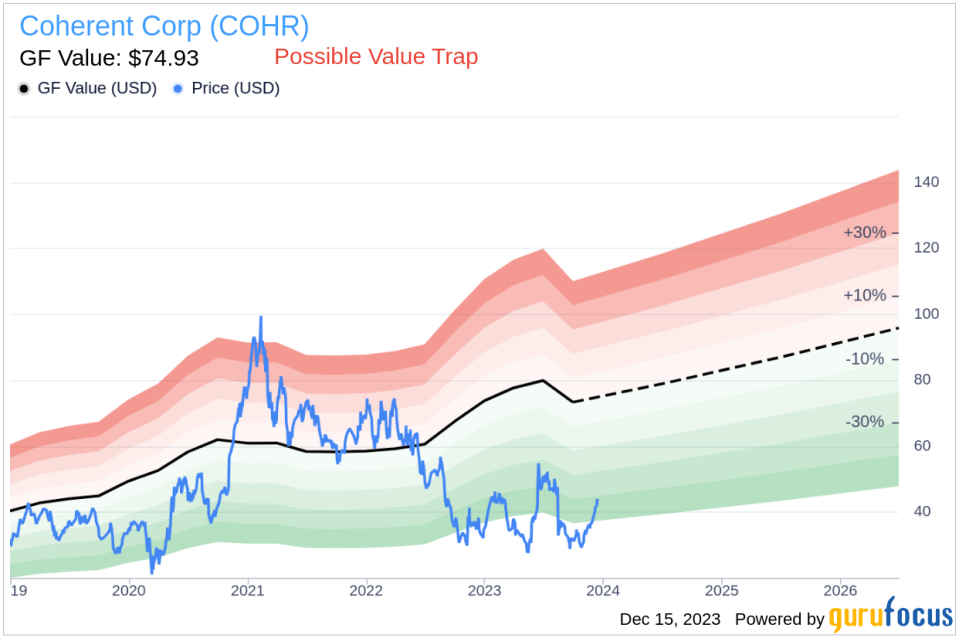

On the day of Xia's recent sale, Coherent Corp's shares were trading at $42.8, giving the company a market cap of $6.640 billion. This price point is significantly below the GuruFocus Value (GF Value) of $74.93, indicating that the stock might be undervalued.

However, with a price-to-GF-Value ratio of 0.57, Coherent Corp is labeled as a "Possible Value Trap, Think Twice" based on its GF Value. This suggests that while the stock appears cheap, there may be underlying issues or challenges that could hinder its performance.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above illustrates the recent insider trading activities within Coherent Corp, providing a visual representation of the selling and buying patterns over time.

The GF Value image provides a snapshot of Coherent Corp's valuation relative to its intrinsic value, as estimated by GuruFocus. This comparison can be a useful tool for investors considering whether the current stock price offers a buying opportunity or if caution is warranted.

Conclusion

Director Howard Xia's recent sale of Coherent Corp shares is part of a broader pattern of insider selling at the company. While the stock's current price is below the GF Value, suggesting potential undervaluation, the price-to-GF-Value ratio indicates that investors should approach with caution. As with any insider trading activity, it is essential for investors to consider the context of these transactions and to conduct their own due diligence before making investment decisions.

Insider trading patterns, along with comprehensive valuation metrics like the GF Value, can provide a more nuanced understanding of a stock's potential risks and rewards. For Coherent Corp, the mixed signals from insider activities and valuation estimates underscore the importance of a careful analysis of the company's financial health, market position, and growth prospects.

Investors should continue to monitor insider trading activities and other financial indicators to gain insight into Coherent Corp's future direction. As always, insider trades are just one piece of the puzzle when it comes to evaluating a company's stock, and they should be considered alongside other fundamental and technical analysis tools.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.