Insider Sell Alert: Director Jack Ferguson Sells 3,000 Shares of PC Connection Inc (CNXN)

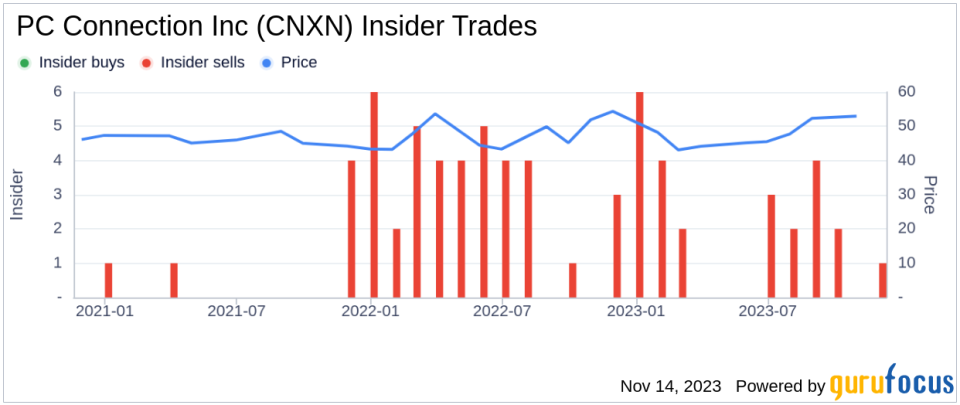

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Director Jack Ferguson made headlines by selling 3,000 shares of PC Connection Inc (NASDAQ:CNXN), a notable transaction that warrants a closer look.Who is Jack Ferguson of PC Connection Inc?Jack Ferguson is a seasoned member of the board of directors at PC Connection Inc. His role in the company provides him with a unique perspective on the company's operations, performance, and strategic direction. As a director, Ferguson is privy to the inner workings of the company, and his trading activities are closely monitored for insights into the company's health and future prospects.PC Connection Inc's Business DescriptionPC Connection Inc is a provider of a wide array of information technology (IT) solutions. The company caters to a variety of customers, including small- to medium-sized businesses, enterprise customers, government and educational institutions. PC Connection Inc's offerings span from IT hardware and software products to comprehensive IT services, ensuring that clients have access to the necessary tools and support to navigate the complex world of technology.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceJack Fergusons recent sale of 3,000 shares is part of a larger pattern of insider activity at PC Connection Inc. Over the past year, Ferguson has sold a total of 3,000 shares and has not made any purchases. This one-sided activity could be interpreted in several ways. On one hand, insiders might sell shares for personal financial reasons that do not necessarily reflect their outlook on the company's future. On the other hand, a lack of insider purchases could suggest that insiders are not seeing compelling value in the company's stock at current prices.The insider transaction history for PC Connection Inc shows a trend of more insider selling than buying over the past year, with 26 insider sells and no insider buys. This could indicate that insiders, as a group, believe the stock might not be undervalued or that they anticipate a potential downturn.

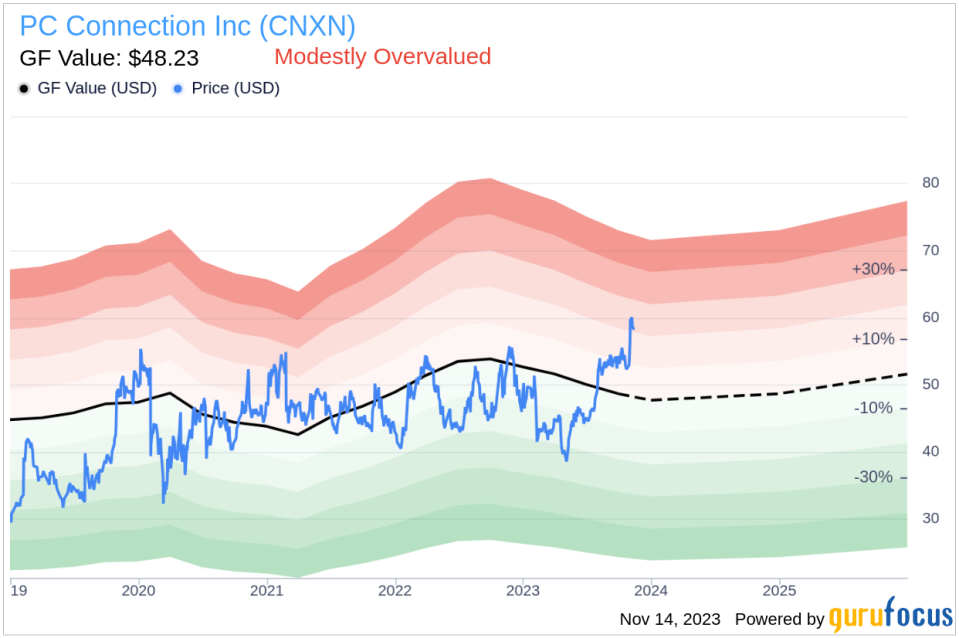

When examining the relationship between insider trading activity and the stock price, it's important to consider the context of the market and the company's performance. PC Connection Inc's stock was trading at $59.12 on the day of Fergusons sale, giving the company a market cap of $1.529 billion.The price-earnings ratio of 19.60 is slightly lower than the industry median of 21.64, which could suggest that the stock is reasonably valued compared to its peers. However, it is higher than the companys historical median price-earnings ratio, indicating that the stock might be more expensive than it has been historically.Valuation and GF Value AnalysisThe valuation of PC Connection Inc also presents an interesting picture. With a stock price of $59.12 and a GuruFocus Value (GF Value) of $48.23, the price-to-GF-Value ratio stands at 1.23. This indicates that the stock is modestly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The fact that PC Connection Inc is trading above its GF Value suggests that the market is currently assigning a premium to the stock, which could be a factor in Ferguson's decision to sell.ConclusionIn conclusion, the recent insider sell by Director Jack Ferguson at PC Connection Inc is a transaction that merits attention. While the reasons behind Ferguson's decision to sell are not publicly known, the broader pattern of insider selling, the company's valuation relative to the industry, and its GF Value all provide context for investors. As with any insider activity, it's essential for investors to consider the full picture, including company performance, market conditions, and individual financial circumstances, before drawing conclusions or making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.