Insider Sell Alert: Director James Hawkins Sells Shares of iRadimed Corp (IRMD)

In a notable insider transaction, Director James Hawkins has parted with 10,468 shares of iRadimed Corp (NASDAQ:IRMD) on December 14, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is James Hawkins of iRadimed Corp?

James Hawkins is a key figure at iRadimed Corp, serving as a Director. His role in the company gives him a deep understanding of the business, its operations, and its strategic direction. Insider trades made by individuals in such positions are closely monitored, as they may reflect the insider's confidence in the company's future performance.

About iRadimed Corp

iRadimed Corp is a healthcare company that specializes in developing innovative magnetic resonance imaging (MRI) medical devices. The company is known for its MRI-compatible IV infusion pump systems and MRI-compatible patient vital signs monitoring systems. These products are designed to deliver safe, reliable, and accurate medication dosing and patient monitoring during MRI procedures, which is a niche but critical aspect of modern healthcare.

Analysis of Insider Buy/Sell and Relationship with Stock Price

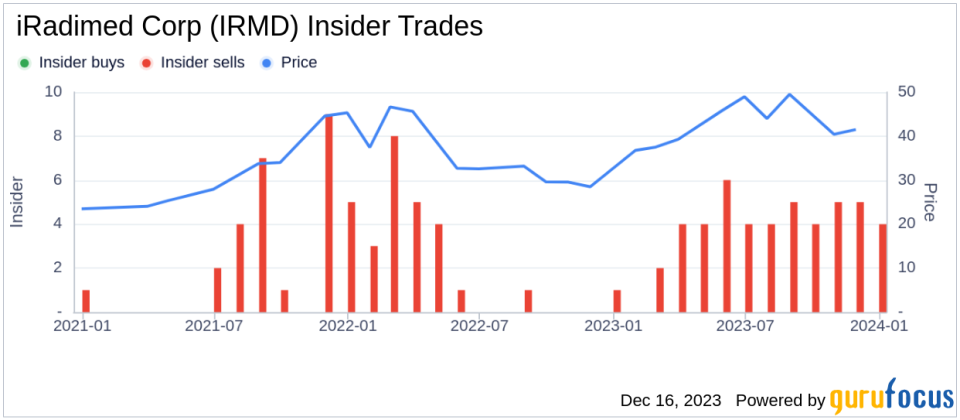

The insider's recent transaction follows a pattern observed over the past year, where James Hawkins has sold a total of 20,000 shares and has not made any purchases. This could be interpreted in various ways; however, without additional context, it is challenging to determine the exact motivation behind these sales. It is important to consider that insiders may sell shares for personal financial planning, diversification, or other reasons not directly related to their outlook on the company's future.The broader insider transaction history for iRadimed Corp shows a trend of more insider selling than buying, with 47 insider sells and no insider buys over the past year. This trend could suggest that insiders, on balance, have been choosing to decrease their holdings in the company.

When analyzing the relationship between insider transactions and stock price, it is crucial to consider the timing and size of the trades. Insider selling that occurs when a stock is perceived as overvalued could signal that insiders believe the stock price has peaked or that growth prospects are not as strong as the market expects. Conversely, insider selling at undervalued prices may not necessarily indicate a lack of confidence but could be motivated by personal financial considerations.

Valuation and Market Response

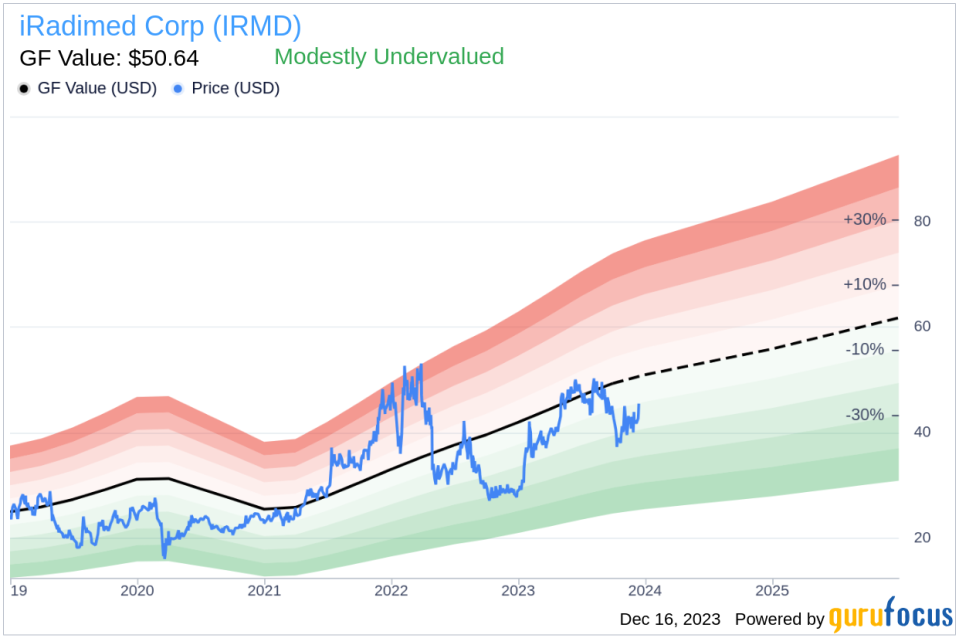

On the day of the insider's recent sale, shares of iRadimed Corp were trading at $43.6, giving the company a market cap of $575.823 million. The price-earnings ratio of 35.41 is slightly above the industry median of 30.715, suggesting a premium valuation compared to peers. However, it is below the company's historical median price-earnings ratio, which could indicate that the stock is not as overvalued as it has been in the past.The price-to-GF-Value ratio of 0.86, with a GF Value of $50.64, indicates that iRadimed Corp is modestly undervalued. This assessment is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The GF Value is a proprietary metric that aims to determine a stock's intrinsic value by considering historical trading multiples, adjustments based on the company's past performance, and analyst estimates of future business performance. When the stock price is below the GF Value, it suggests that the stock may be undervalued, presenting a potential buying opportunity for investors.

Conclusion

The recent insider sale by Director James Hawkins of iRadimed Corp warrants attention from investors and market analysts. While the insider's actions may not necessarily reflect a negative outlook on the company, the trend of more insider selling than buying over the past year could be a point of consideration for potential investors. However, with iRadimed Corp's stock currently trading below its GF Value, the market may be offering an attractive entry point for those who believe in the company's fundamentals and long-term growth prospects. As always, investors should conduct their due diligence and consider the broader market context when interpreting insider transactions and their potential impact on stock prices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.