Insider Sell Alert: Director James Hawkins Sells Shares of iRadimed Corp (IRMD)

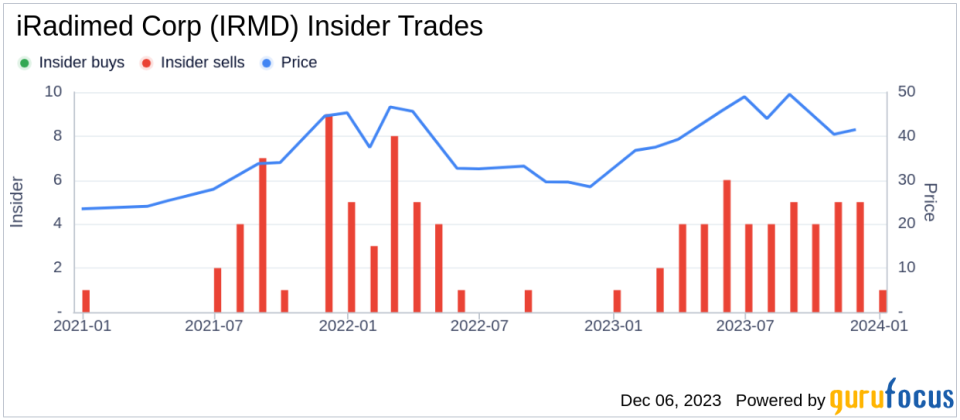

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Director James Hawkins made headlines with a notable transaction in the medical devices sector. On December 4, 2023, the insider sold 9,532 shares of iRadimed Corp (NASDAQ:IRMD), a company known for its innovative non-magnetic intravenous (IV) infusion pump systems designed for use in MRI environments.James Hawkins is a seasoned executive with a wealth of experience in the medical technology industry. As a director of iRadimed Corp, Hawkins has been part of the company's journey in revolutionizing patient care within the MRI suite. His role in the company involves providing strategic guidance and oversight, ensuring that iRadimed continues to innovate and maintain its competitive edge in the market.iRadimed Corp's business description highlights its specialization in developing unique medical devices that cater to the specific needs of MRI safety. The company's flagship product, the MRidium series of IV infusion pumps, is designed to be safe for use in the high magnetic fields of MRI systems. This niche focus has allowed iRadimed to carve out a significant position in the medical devices market, particularly in areas where traditional metallic equipment would pose safety risks and operational challenges.The recent insider sell by James Hawkins has caught the attention of investors and analysts alike. Over the past year, Hawkins has sold a total of 9,532 shares and has not made any purchases of the company's stock. This activity is part of a broader trend within iRadimed Corp, where there have been no insider buys but 44 insider sells over the same timeframe. Such a pattern of insider selling can sometimes raise questions about the insiders' confidence in the company's future prospects.

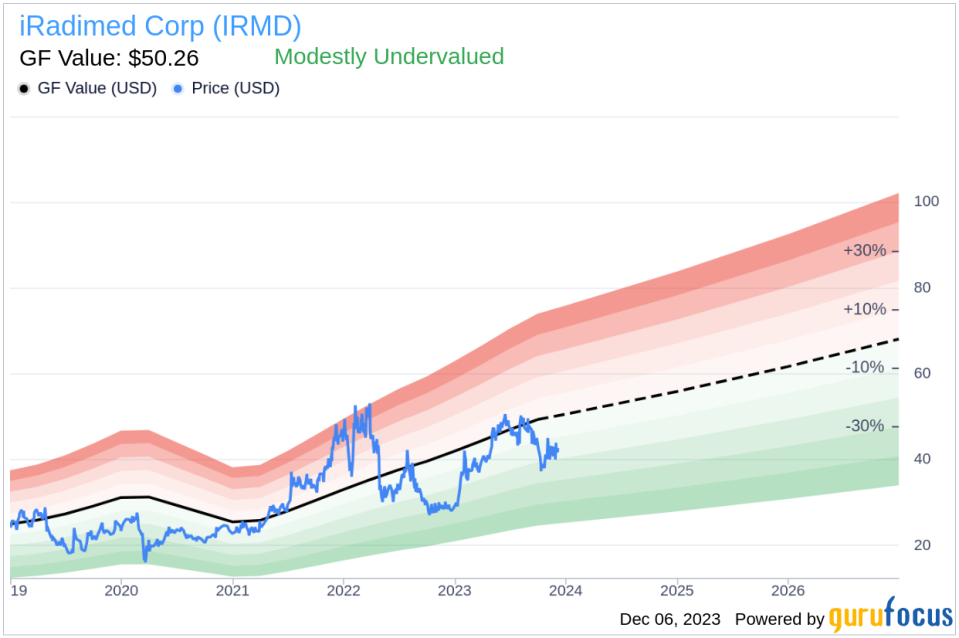

When examining the relationship between insider trading activity and stock price, it's important to consider the context and potential motivations behind the transactions. Insider sells can occur for various reasons, including personal financial planning, diversification of assets, or other non-company related factors. However, a consistent pattern of selling by multiple insiders could signal that those with the most intimate knowledge of the company's workings may anticipate a downturn or believe the stock is currently overvalued.In the case of iRadimed Corp, the stock was trading at $43.02 per share on the day of Hawkins's recent sell, giving the company a market cap of $538.763 million. The price-earnings ratio stands at 33.13, which is higher than the industry median of 29.94 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is not at an all-time high relative to its own historical valuations.The valuation picture becomes more interesting when considering the GuruFocus Value (GF Value) of $50.26 for iRadimed Corp. With a price-to-GF-Value ratio of 0.86, the stock appears to be modestly undervalued, indicating that it may be an attractive buy for value investors. The GF Value is a composite measure that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

Given the modestly undervalued status of iRadimed Corp based on its GF Value, the insider selling activity may not necessarily reflect a lack of confidence in the company's future. Instead, it could be a strategic decision by the insider to capitalize on the current market price, which is close to the intrinsic value estimate.Investors should consider the broader market conditions, the company's growth prospects, and the potential impact of ongoing innovation within iRadimed's product offerings when interpreting insider trading activity. While insider sells can provide valuable insights, they are just one piece of the puzzle in the complex decision-making process of stock market investing.In conclusion, the recent insider sell by James Hawkins at iRadimed Corp warrants attention but should be evaluated alongside other financial metrics and market indicators. As always, investors are encouraged to conduct their own due diligence and consider the full spectrum of information available before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.