Insider Sell Alert: Director Jorge Valladares Offloads 16,000 Shares of TransDigm Group Inc

In a notable insider transaction, Director Jorge Valladares has parted with 16,000 shares of TransDigm Group Inc (NYSE:TDG), a significant move that has caught the attention of investors and market analysts. This sale, executed on November 15, 2023, has raised questions about the insider's confidence in the company's future prospects and its current valuation.

Who is Jorge Valladares of TransDigm Group Inc?

Jorge Valladares is a key figure at TransDigm Group Inc, serving as a Director. His role in the company involves oversight and strategic guidance, helping to shape the direction of the aerospace manufacturing firm. Valladares's insider status provides him with a deep understanding of the company's operations, financial health, and market position, making his trading activities particularly noteworthy to those following TransDigm's stock.

TransDigm Group Inc's Business Description

TransDigm Group Incorporated is a leading global designer, producer, and supplier of highly engineered aerospace components, systems, and subsystems. The company's products are essential for the operation and performance of commercial and military aircraft. With a focus on proprietary products and a diverse customer base, TransDigm has established itself as a key player in the aerospace industry, known for its innovation, quality, and reliability.

Analysis of Insider Buy/Sell and Relationship with Stock Price

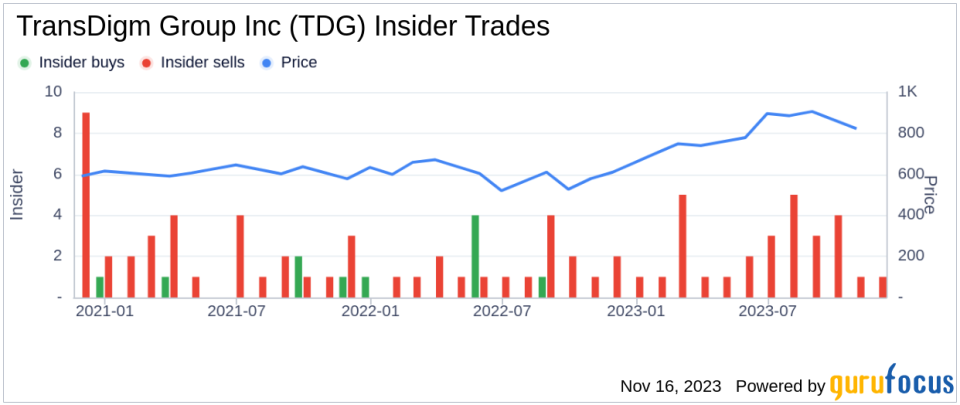

The recent sale by Valladares is part of a broader pattern of insider selling at TransDigm Group Inc. Over the past year, Valladares has sold a total of 68,000 shares, without making any purchases. This one-sided transaction history could signal a lack of buying interest at current price levels among those with intimate knowledge of the company.The insider transaction history for TransDigm Group Inc shows a total absence of insider buys over the past year, contrasted with 30 insider sells during the same period. This trend suggests that insiders may perceive the stock as being fully valued or potentially overvalued, prompting them to lock in gains or reallocate their investments.

When analyzing the relationship between insider trading activity and stock price, it's important to consider the context of the transactions. Insider sales can be motivated by various factors, including diversification of personal portfolios, tax planning, or liquidity needs, and do not always indicate a bearish outlook on the company's future. However, persistent selling by multiple insiders could be a red flag for investors.

Valuation and Market Reaction

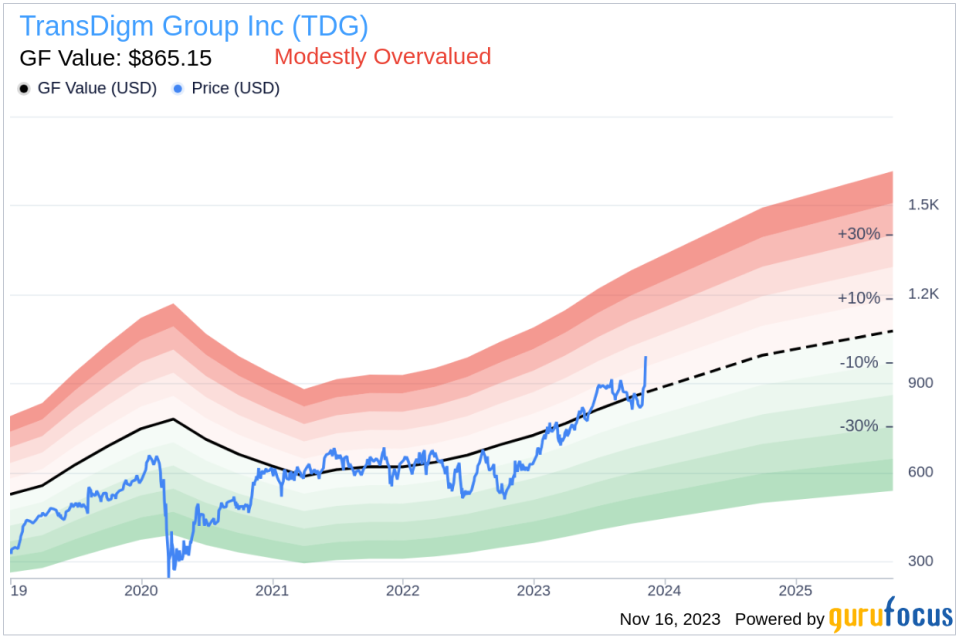

On the day of Valladares's recent sale, TransDigm Group Inc's shares were trading at $996.32, giving the company a market capitalization of $54.592 billion. The price-earnings ratio of 44.82 is higher than both the industry median of 31.93 and the company's historical median, suggesting a premium valuation compared to its peers and its own trading history.The stock's price-to-GF-Value ratio of 1.15 indicates that TransDigm is modestly overvalued based on GuruFocus's proprietary valuation model. The GF Value, which stands at $865.15, is derived from historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The market's reaction to insider selling can vary, but when a stock is perceived as overvalued, insider sales can contribute to bearish sentiment. Investors often monitor insider transactions as part of their due diligence, considering them alongside other fundamental and technical analysis tools.

Conclusion

Director Jorge Valladares's decision to sell 16,000 shares of TransDigm Group Inc is a significant event that warrants attention from the investment community. While the reasons behind the sale may be personal and not necessarily indicative of a negative outlook on the company, the pattern of insider selling, coupled with the stock's valuation metrics, suggests that caution may be warranted.Investors should consider the broader context of the aerospace industry, TransDigm's competitive position, and overall market conditions when interpreting insider trading activity. As always, a diversified investment approach and thorough research are key to making informed decisions in the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.