Insider Sell Alert: Director Joseph Saffire Sells 25,000 Shares of Extra Space Storage Inc (EXR)

Extra Space Storage Inc (NYSE:EXR), a leading figure in the self-storage industry, has recently witnessed a significant insider transaction. Director Joseph Saffire has parted with 25,000 shares of the company's stock. This move, executed on December 13, 2023, has caught the attention of investors and market analysts alike, prompting a closer examination of the implications of such insider activity.

Who is Joseph Saffire?

Joseph Saffire serves as a key director at Extra Space Storage Inc. His role in the company provides him with an intimate understanding of the firm's operations, strategic direction, and financial health. Directors like Saffire are often privy to the most current and sensitive information, making their trading activities a focal point for those looking to glean insights into the company's prospects.

Extra Space Storage Inc's Business Description

Extra Space Storage Inc is a real estate investment trust (REIT) that operates as a self-administered and self-managed company. It is one of the largest operators of self-storage facilities in the United States. The company owns, operates, and manages a vast portfolio of self-storage properties, offering customers a variety of units for personal and business storage needs. Extra Space Storage has built a reputation for providing secure, accessible, and convenient storage solutions, which has translated into a robust business model with a significant presence across the country.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as those of Joseph Saffire, can provide valuable clues about a company's internal perspective on its stock's value. Over the past year, Saffire has sold a total of 25,000 shares and has not made any purchases. This one-sided activity could suggest that the insider perceives the stock's current price as an opportune moment to realize gains.

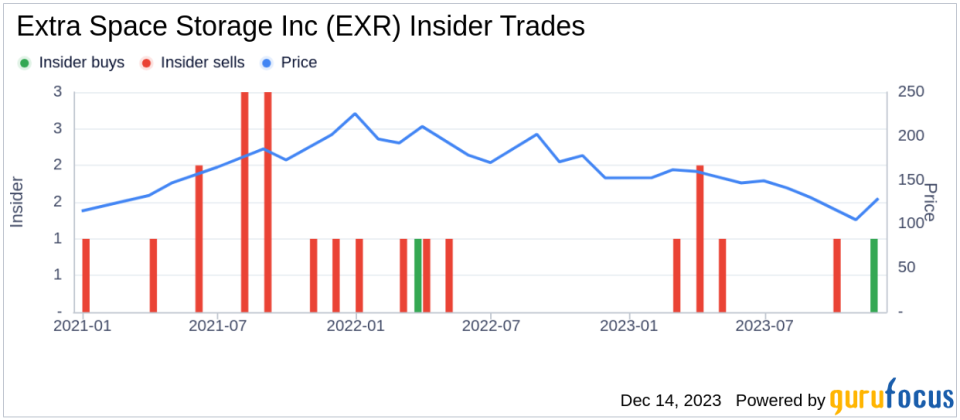

When examining the broader insider transaction history for Extra Space Storage Inc, we observe that there has been a predominance of selling over buying, with 6 insider sells and only 1 insider buy over the past year. This trend may indicate a consensus among insiders that the stock's valuation is relatively high, prompting them to lock in profits.

On the day of Saffire's recent sale, shares of Extra Space Storage Inc were trading at $141.52, giving the company a market cap of $32.69 billion. This valuation places the stock at a price-earnings ratio of 28.44, which is above the industry median of 17.38. However, it is worth noting that this ratio is lower than the company's historical median price-earnings ratio, suggesting that the stock may not be as overvalued as it has been in the past.

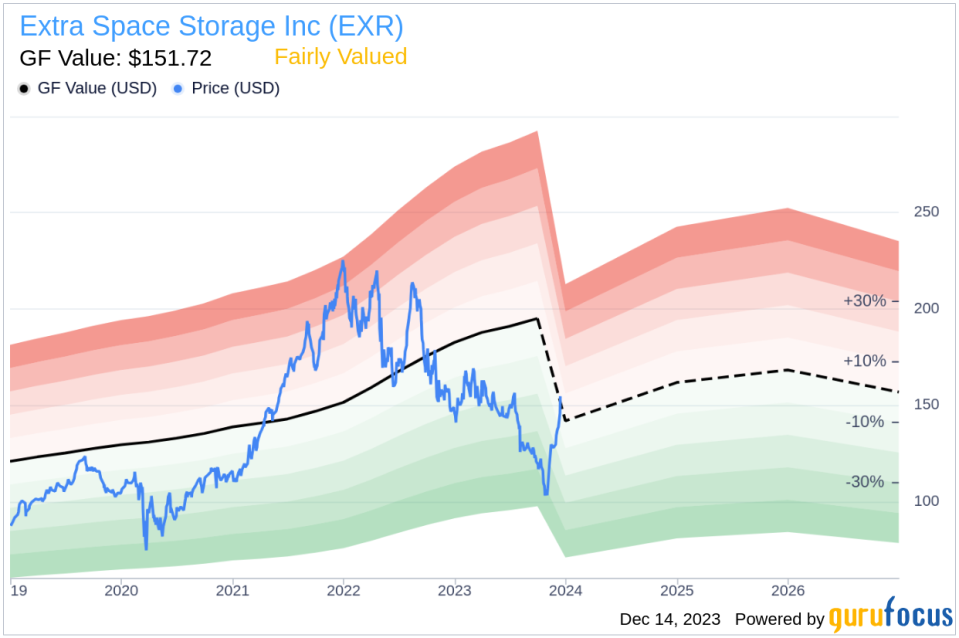

Regarding the stock's valuation relative to intrinsic value estimates, the price-to-GF-Value ratio stands at 0.93, with a GF Value of $151.72. This indicates that Extra Space Storage Inc is fairly valued based on GuruFocus's proprietary valuation model, which considers historical trading multiples, an adjustment factor for past performance, and future business performance estimates.

The insider trend image above provides a visual representation of the recent insider trading activities, reinforcing the notion that selling has been more prevalent than buying among insiders.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value, supporting the assessment that the stock is fairly valued.

Conclusion

Joseph Saffire's decision to sell a substantial number of shares may raise questions among investors about the stock's future trajectory. While the insider's actions do not necessarily predict short-term price movements, they can offer a perspective on the stock's long-term value. With Extra Space Storage Inc's stock being fairly valued according to the GF Value and the company's solid position in the self-storage industry, investors should weigh the insider trading trends alongside broader market conditions and individual investment strategies.

As always, it is crucial for investors to conduct their own due diligence and consider multiple factors, including insider trading patterns, when making investment decisions. Joseph Saffire's recent sell-off is just one piece of the puzzle in the complex and ever-changing landscape of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.