Insider Sell Alert: Director Kevin Mcginty Sells 5,000 Shares of Thermon Group Holdings Inc (THR)

Director Kevin Mcginty of Thermon Group Holdings Inc (NYSE:THR) has recently made a significant change to his holdings in the company. On November 16, 2023, the insider sold 5,000 shares of the company, a move that has caught the attention of investors and market analysts alike. This transaction has prompted a closer look into the insider's trading history, the company's business operations, and the potential implications of such insider activity on the stock's valuation and performance.

Who is Kevin Mcginty?

Kevin Mcginty is a member of the board of directors at Thermon Group Holdings Inc. Directors play a crucial role in shaping the strategic direction of a company and are often privy to detailed information about the company's operations and prospects. Their trading activities are closely monitored as they can provide insights into their confidence in the company's future performance.

Thermon Group Holdings Inc's Business Description

Thermon Group Holdings Inc is a global leader in the engineering, design, and manufacture of industrial process heating solutions. The company provides a comprehensive range of products and services aimed at optimizing the performance of process industries, including energy, chemical processing, and power generation. Thermon's expertise lies in delivering fully integrated heating systems that enhance safety, improve efficiency, and reduce operational costs for its clients.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as buys and sells, can be indicative of an insider's belief in the company's future prospects. Over the past year, Kevin Mcginty has sold a total of 5,000 shares and has not made any purchases. This could suggest that the insider may perceive the current stock price as a favorable selling point or may have personal financial reasons for the sale.

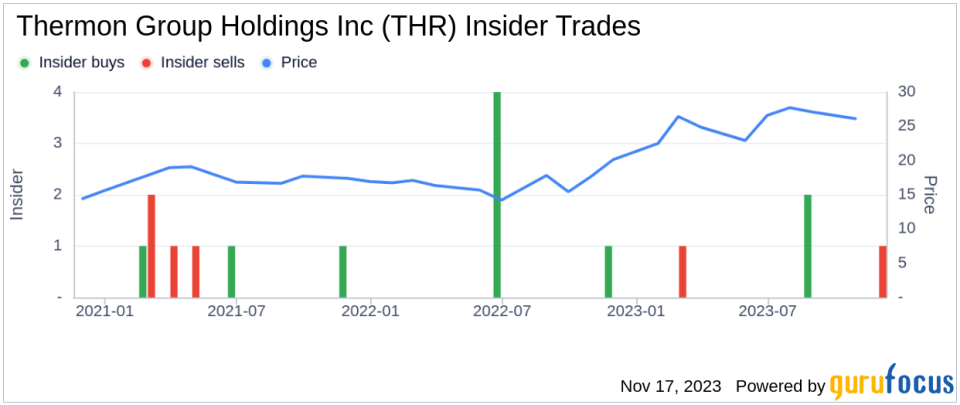

It is important to consider the overall insider trend at Thermon Group Holdings Inc. The company has seen 2 insider buys and 2 insider sells over the past year. This balanced activity does not point to a clear consensus among insiders, which means that investors should look at other factors, such as the company's performance and market conditions, to gauge the stock's potential.

On the day of Kevin Mcginty's recent sale, shares of Thermon Group Holdings Inc were trading at $32, giving the company a market cap of $1.090 billion. This valuation places the stock at a price-earnings ratio of 26.32, which is higher than the industry median of 21.78 but lower than the company's historical median price-earnings ratio. This suggests that the stock may be fairly valued or slightly overvalued compared to its peers and its own trading history.

When considering the GF Value, which stands at $26.18, the price-to-GF-Value ratio is 1.22. This indicates that Thermon Group Holdings Inc is modestly overvalued based on its GF Value. The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the insider trading activities at Thermon Group Holdings Inc, which can be a useful tool for investors when analyzing the potential impact of insider transactions on stock price.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value estimate, helping investors determine whether the stock is trading at a premium or discount to its estimated fair value.

Conclusion

Director Kevin Mcginty's recent sale of 5,000 shares of Thermon Group Holdings Inc may raise questions among investors about the stock's valuation and future prospects. While the insider's trading activity alone does not provide a definitive direction for the stock, it is one of many factors that investors should consider. The company's market cap, price-earnings ratio, and GF Value all suggest that the stock is currently trading at a modest premium to its intrinsic value. As always, investors should conduct their own due diligence and consider a wide range of factors before making investment decisions.

It is also worth noting that insider trading activities can be influenced by various personal and financial considerations that may not necessarily reflect the insider's view of the company's future performance. Therefore, while insider transactions are an important piece of the puzzle, they should not be the sole basis for investment decisions.

Investors interested in Thermon Group Holdings Inc should continue to monitor insider trading activities, company announcements, and broader market trends to make informed investment choices. The relationship between insider transactions and stock price is complex, and a comprehensive analysis should take into account the full spectrum of available information.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.