Insider Sell Alert: Director Krouse George R Jr Sells Shares of SBA Communications Corp (SBAC)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep an eye on. Recently, Director Krouse George R Jr of SBA Communications Corp (NASDAQ:SBAC) made a notable move by selling 500 shares of the company on November 20, 2023. This transaction has caught the attention of market analysts and investors alike, as insider sales can provide insights into how the company's top brass views the stock's valuation and future prospects.

Who is Krouse George R Jr?

Krouse George R Jr is a member of the board of directors at SBA Communications Corp. Directors play a crucial role in shaping the strategic direction of a company and are privy to in-depth knowledge about the firm's operations, challenges, and opportunities. Their trading activities are closely monitored because they can reflect the insider's confidence in the company's future performance.

About SBA Communications Corp

SBA Communications Corp is a leading independent owner and operator of wireless communications infrastructure in the Americas. The company leases antenna space on multi-tenant communication towers to a variety of wireless service providers under long-term lease contracts. SBA Communications Corp's business model focuses on acquiring and developing communication sites that can accommodate multiple tenants, which provides a steady stream of revenue and the potential for growth as the demand for wireless services increases.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Over the past year, Krouse George R Jr has sold a total of 871 shares and has not made any purchases. This could be interpreted in several ways, but without additional context, it's challenging to draw a definitive conclusion. It's important to consider that insiders may sell shares for various reasons, such as diversifying their portfolio, personal financial planning, or other non-company related factors.

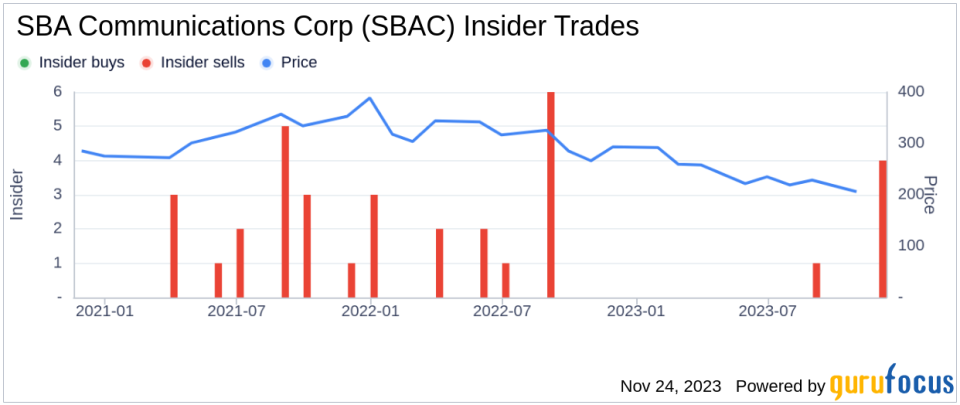

The insider transaction history for SBA Communications Corp shows a pattern of more insider selling than buying over the past year, with 6 insider sells and 0 insider buys. This trend could suggest that insiders, on the whole, believe the shares might be fully valued or that they see better investment opportunities elsewhere.

On the day of the insider's recent sale, shares of SBA Communications Corp were trading at $234.43, giving the company a market cap of $25.16 billion. The price-earnings ratio of 51.37 is higher than the industry median of 17.48, indicating that the stock may be trading at a premium compared to its peers. However, it's lower than the company's historical median price-earnings ratio, which could imply that the stock is currently undervalued based on its own historical standards.

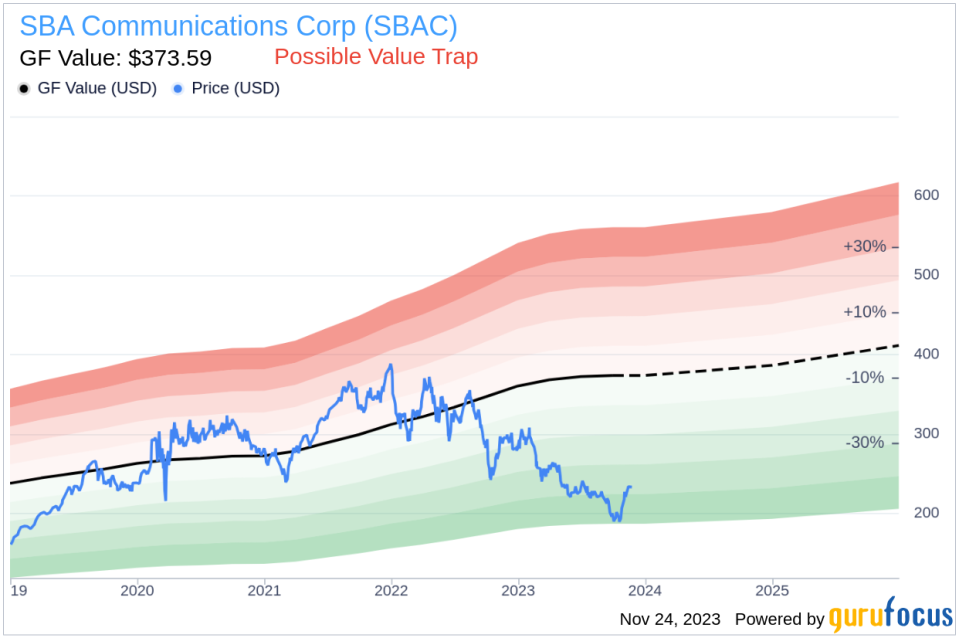

When considering the price-to-GF-Value ratio of 0.63, with a GF Value of $373.59, the stock appears to be a possible value trap, and investors should think twice. This assessment suggests that the stock might be undervalued based on intrinsic value estimates, but the market has not recognized this potential, possibly due to underlying issues or a general market undervaluation of the company's prospects.

The GF Value is a composite of historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. It's a metric that attempts to determine the true intrinsic value of a stock beyond the surface-level price movements.

The insider trend image above provides a visual representation of the insider trading activities, which can be a useful tool for investors trying to gauge the sentiment of company executives and directors.

The GF Value image further illustrates the relationship between the current stock price and the estimated intrinsic value, offering another perspective for investors considering whether the stock is a buy, hold, or sell.

Conclusion

Director Krouse George R Jr's recent sale of SBA Communications Corp shares may raise questions among investors about the stock's valuation and future performance. While insider selling can be a red flag, it's essential to consider the broader context, including the company's valuation metrics and market performance. With a high price-earnings ratio and a price-to-GF-Value ratio suggesting the stock might be undervalued, investors should conduct thorough due diligence and consider both the insider trading trends and the company's fundamentals before making investment decisions.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It's crucial to look at a comprehensive analysis that includes financial health, industry position, and broader market conditions. Investors should keep an eye on further insider transactions and other developments within SBA Communications Corp to stay informed and make educated investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.