Insider Sell Alert: Director Lisa Trimberger Sells Shares of EPR Properties

In the realm of real estate investment trusts (REITs), insider transactions are often closely monitored by investors seeking clues about a company's financial health and future prospects. Recently, a notable transaction occurred at EPR Properties (NYSE:EPR), a specialty real estate investment trust. Director Lisa Trimberger sold 5,933 shares of the company on December 6, 2023, an event that warrants a closer look to understand its potential implications.Who is Lisa Trimberger of EPR Properties?Lisa Trimberger serves as a director at EPR Properties, bringing her expertise and oversight to the company's strategic decisions. Directors play a crucial role in shaping the direction of a company, and their trading activities in the company's stock are often seen as a reflection of their confidence in the company's future.EPR Properties' Business DescriptionEPR Properties is a specialty REIT that invests in properties in select market segments which require unique industry knowledge. The company focuses on investments in entertainment, recreation, and education properties, aiming to deliver strong and stable returns to its shareholders. EPR Properties' portfolio includes megaplex theatres, family entertainment centers, ski resorts, and public charter schools, among other distinctive assets.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe insider transaction history for EPR Properties shows a lack of insider purchases over the past year, with no buys recorded. However, there have been 2 insider sells during the same period, including the recent sale by Lisa Trimberger. This pattern of insider selling could be interpreted in various ways by market participants. Some may view it as a lack of confidence by insiders in the company's near-term growth prospects, while others may consider it as routine profit-taking or portfolio management.On the day of the insider's recent sale, shares of EPR Properties were trading at $46.39, giving the stock a market cap of $3.41 billion. The price-earnings ratio stood at 23.46, higher than the industry median of 17.27 and also above the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is priced optimistically relative to its earnings, which might be a factor in the insider's decision to sell shares.

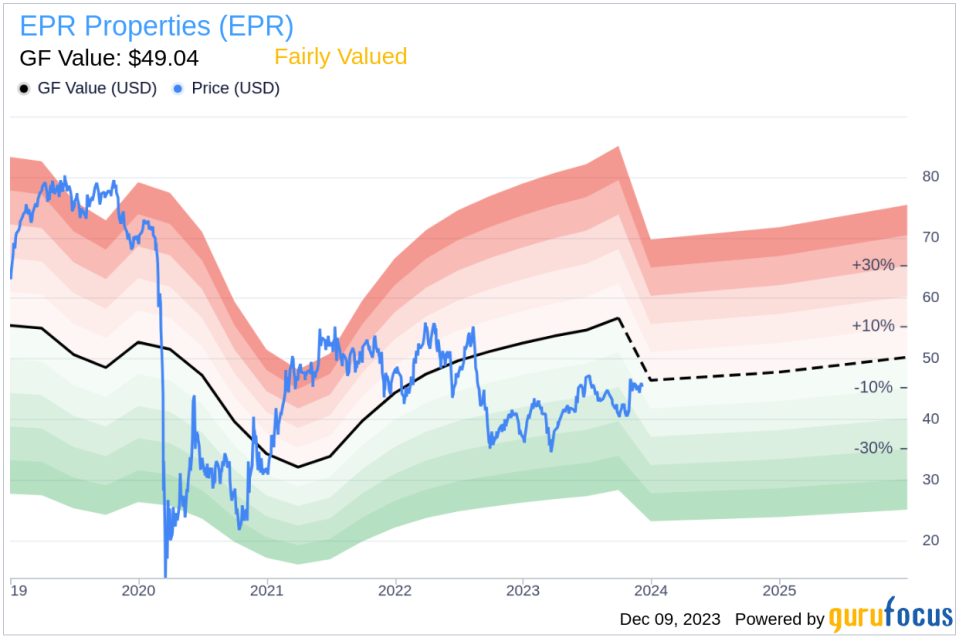

The insider trend image above provides a visual representation of the insider trading activities at EPR Properties. The absence of insider buying, coupled with the recent selling, could be a signal for investors to approach the stock with caution, as insider sentiment appears to be leaning towards selling rather than buying.Valuation and GF Value AnalysisWith a stock price of $46.39 and a GuruFocus Value (GF Value) of $49.04, EPR Properties has a price-to-GF-Value ratio of 0.95, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The GF Value image above illustrates the stock's valuation in relation to its intrinsic value estimate. The proximity of the stock price to the GF Value suggests that the market has priced EPR Properties reasonably, neither undervalued nor overvalued. This fair valuation might provide some reassurance to investors that the stock is trading at a level consistent with its fundamental worth, despite the recent insider selling activity.ConclusionThe sale of 5,933 shares by Director Lisa Trimberger is a development that investors in EPR Properties should consider as part of their overall analysis of the stock. While insider selling can have various motivations, it is essential to view these transactions in the context of the company's valuation, business prospects, and overall market conditions. As EPR Properties continues to navigate the specialized segments of the real estate market, shareholders and potential investors should stay informed about insider activities and other significant developments that could impact the company's stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.