Insider Sell Alert: Director Mike Brooks Sells 4,000 Shares of Rocky Brands Inc (RCKY)

In a recent transaction on December 13, 2023, Director Mike Brooks sold 4,000 shares of Rocky Brands Inc (NASDAQ:RCKY), a leading company in the design, manufacture, and marketing of premium footwear and apparel. This insider sell has caught the attention of investors and market analysts, prompting a closer look at the implications of such a move and its potential impact on the company's stock price.

Who is Mike Brooks of Rocky Brands Inc?

Mike Brooks has been a significant figure at Rocky Brands Inc, serving as a director with a deep understanding of the company's operations and market strategies. His tenure at Rocky Brands has provided him with an insider's perspective on the company's performance and future prospects. The insider's decision to sell shares is often scrutinized by investors as it may signal their confidence in the company's current valuation and future growth potential.

Rocky Brands Inc's Business Description

Rocky Brands Inc is a well-established player in the footwear industry, known for its high-quality outdoor, work, and military footwear, as well as its hunting apparel. The company's portfolio includes several respected brands such as Rocky, Georgia Boot, Durango, Lehigh, and the licensed brand Michelin footwear. With a focus on durability, safety, and comfort, Rocky Brands caters to a diverse customer base that values performance and reliability in their footwear choices.

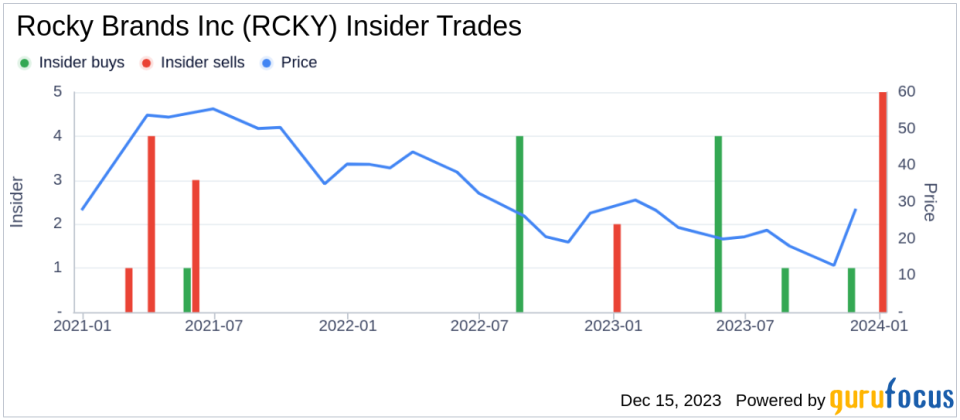

Analysis of Insider Buy/Sell and Relationship with Stock Price

The insider transaction history for Rocky Brands Inc reveals a balanced pattern of insider activity over the past year, with an equal number of insider buys and sells. This mixed signal can be interpreted in various ways, but it is essential to consider the context and timing of these transactions. The insider's recent sell of 4,000 shares follows a year where no shares were purchased by the insider, which could indicate a shift in the insider's assessment of the company's valuation or a personal portfolio decision.

The relationship between insider trading activity and stock price is complex. While insider sells do not always indicate a lack of confidence in the company, they can sometimes lead to negative market sentiment, potentially affecting the stock price. However, it is crucial to analyze these transactions alongside other financial metrics and market conditions to gain a comprehensive understanding of their impact.

Valuation and Market Cap

On the day of the insider's sell, shares of Rocky Brands Inc were trading at $29.27, giving the company a market cap of $215.874 million. This valuation places the company in the small-cap category, which can be subject to higher volatility and market fluctuations.The price-earnings ratio of Rocky Brands Inc stands at 20.90, which is above the industry median of 18.97 and also higher than the company's historical median price-earnings ratio. This elevated P/E ratio could suggest that the stock is priced at a premium compared to its peers and its own historical standards, potentially justifying the insider's decision to sell at this point.

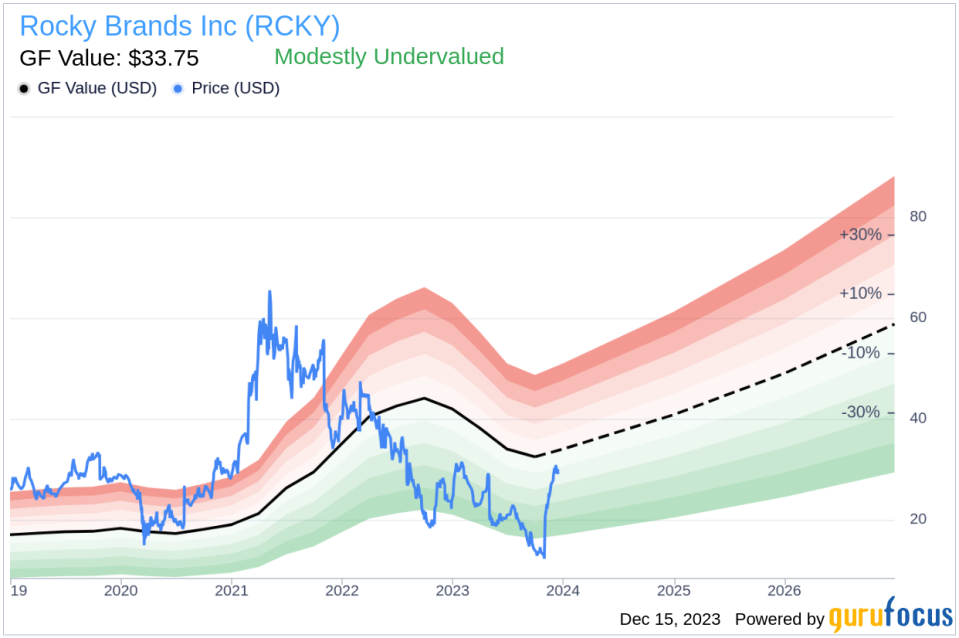

GF Value and Stock Assessment

Rocky Brands Inc's current price-to-GF-Value ratio is 0.87, with a GF Value of $33.75, indicating that the stock is modestly undervalued based on GuruFocus's intrinsic value estimate. This assessment suggests that despite the insider's sell, the stock may still offer value to potential investors.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation provides a benchmark for investors to compare the current stock price against an estimated fair value.

Conclusion

The recent insider sell by Director Mike Brooks of Rocky Brands Inc is a noteworthy event that warrants attention from investors and market analysts. While the insider's sell could be interpreted in various ways, it is essential to consider the broader financial context, including the company's valuation, market cap, and GF Value. As the stock appears modestly undervalued based on the GF Value, investors may find an opportunity despite the insider's decision to reduce their holdings. It is always recommended to conduct thorough research and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.