Insider Sell Alert: Director MOORE DAN T III Sells 6,316 Shares of Park-Ohio Holdings Corp (PKOH)

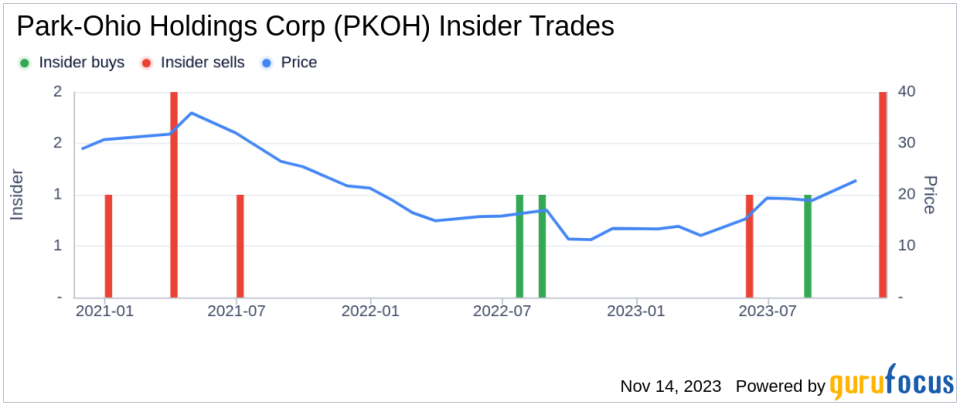

In a notable insider transaction, Director MOORE DAN T III has parted with 6,316 shares of Park-Ohio Holdings Corp (NASDAQ:PKOH), a significant move that warrants a closer look by investors and market analysts. This sale, executed on November 10, 2023, has caught the attention of the investment community, particularly because insider actions can often provide valuable insights into a company's prospects and valuation.Who is MOORE DAN T III?MOORE DAN T III serves as a Director of Park-Ohio Holdings Corp, bringing his expertise and leadership to the company's board. Directors like MOORE DAN T III are responsible for overseeing the company's strategic direction and ensuring that it operates in the best interest of its shareholders. Their insider transactions are closely monitored as they have an intimate understanding of the company's operations, challenges, and opportunities.Park-Ohio Holdings Corp's Business DescriptionPark-Ohio Holdings Corp is an industrial supply chain logistics and diversified manufacturing company that operates through three segments: Supply Technologies, Assembly Components, and Engineered Products. The company provides its customers with a comprehensive range of products and services, including supply chain management, aluminum products, and manufactured components for various industries such as automotive, heavy-duty truck, aerospace, and electronics.Analysis of Insider Buy/Sell and Relationship with Stock PriceOver the past year, MOORE DAN T III has sold a total of 16,555 shares and has not made any purchases, indicating a trend of divestment. This pattern of selling could suggest that the insider perceives the stock's current price as favorable for selling or potentially overvalued relative to future growth prospects.The insider transaction history for Park-Ohio Holdings Corp shows a disparity between insider buys and sells, with only 1 insider buy compared to 3 insider sells over the same timeframe. This trend can sometimes be interpreted as a lack of confidence among insiders about the company's future performance or valuation.

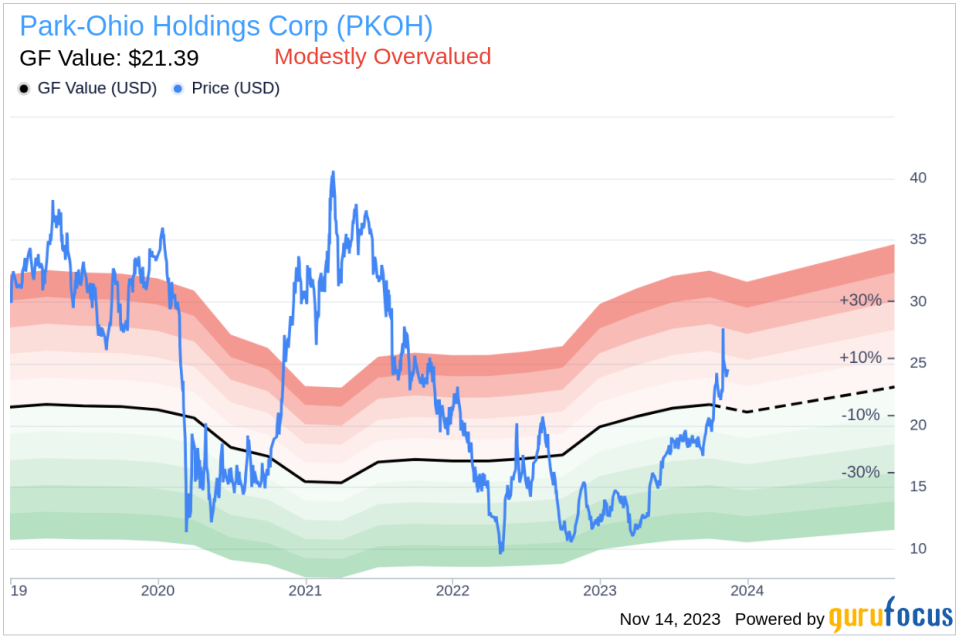

On the day of the insider's recent sale, shares of Park-Ohio Holdings Corp were trading at $24.28, giving the company a market cap of $321.317 million. This price point is particularly interesting when considering the company's valuation in relation to the GuruFocus Value (GF Value).Valuation and GF Value AnalysisWith a stock price of $24.28 and a GF Value of $21.39, Park-Ohio Holdings Corp has a price-to-GF-Value ratio of 1.14, categorizing the stock as Modestly Overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The current price-to-GF-Value ratio suggests that the stock is trading slightly above its estimated intrinsic value, which could be a contributing factor to the insider's decision to sell shares. However, it is important to note that the GF Value is just one of many tools investors can use to assess a stock's valuation, and it should not be the sole basis for investment decisions.ConclusionThe recent insider sell by Director MOORE DAN T III of Park-Ohio Holdings Corp is a transaction that merits attention. While insider selling does not always imply negative prospects for a company, the consistent selling pattern by the insider, coupled with the stock's modest overvaluation based on the GF Value, may prompt investors to take a closer look at the company's financials, future growth estimates, and overall market position. As always, investors should conduct their own due diligence and consider a variety of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.