Insider Sell Alert: Director Morgan Wood Sells 25,000 Shares of PROCEPT BioRobotics Corp (PRCT)

In the realm of stock market movements, insider transactions hold a significant place as they can provide insights into a company's internal perspective. Recently, a notable transaction occurred at PROCEPT BioRobotics Corp (NASDAQ:PRCT), where Director Morgan Wood sold a substantial number of shares, prompting a closer look at the implications of this insider activity.

Who is Morgan Wood?

Morgan Wood serves as a Director at PROCEPT BioRobotics Corp, a company that operates at the forefront of medical technology. Directors like Wood are responsible for overseeing the strategic direction of the company and ensuring that it adheres to its mission and goals. Their insight into the company's operations and future prospects is invaluable, making their trading activities a focal point for investors seeking to understand the internal sentiment towards the company's stock.

About PROCEPT BioRobotics Corp

PROCEPT BioRobotics Corp is a pioneering company in the field of urology, focusing on the development and commercialization of innovative surgical robots designed to improve the lives of patients suffering from benign prostatic hyperplasia (BPH). Their flagship product, the AquaBeam Robotic System, utilizes a proprietary waterjet ablation therapy to provide a minimally invasive treatment for BPH, commonly known as an enlarged prostate. The company's commitment to advancing urological care through robotic technology positions it as a key player in the medical device industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

On November 13, 2023, Morgan Wood sold 25,000 shares of PROCEPT BioRobotics Corp at a price of $32.19 per share. This transaction reduced Wood's holdings in the company and is part of a broader pattern of insider selling at PRCT. Over the past year, Wood has sold a total of 40,000 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's short-term growth prospects.

Insider selling can have various motivations, such as diversification of personal investments, tax planning, or other personal financial needs. However, when insiders sell shares, it can sometimes be interpreted as a lack of confidence in the company's future performance. In the case of PRCT, the absence of insider purchases over the past year, coupled with multiple instances of selling, may suggest that insiders are cautious about the company's valuation or future growth.

It is important to consider the stock's performance in relation to these insider transactions. On the day of Wood's recent sale, PRCT shares were trading at $32.19, giving the company a market cap of $1.685 billion. While the stock price at the time of the sale provides a snapshot of the company's valuation, investors should also look at the stock's historical performance and future potential to fully understand the implications of insider selling.

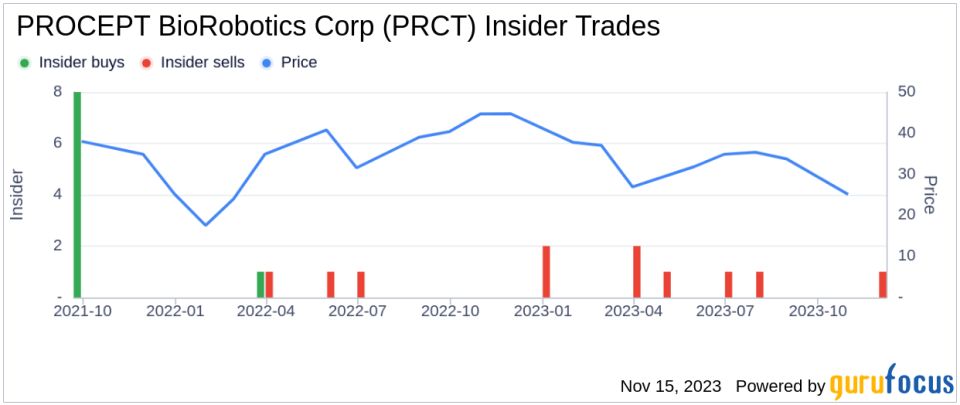

Insider trends can also be a valuable indicator of the stock's potential direction. The following insider trend image illustrates the recent pattern of insider transactions at PROCEPT BioRobotics Corp:

As depicted, the insider has consistently chosen to sell shares over the past year, which may lead investors to scrutinize the company's financial health, growth trajectory, and overall market conditions. While insider selling does not always predict a downturn, it is a factor that should be weighed alongside other fundamental and technical analyses.

Conclusion

The recent insider sell by Director Morgan Wood at PROCEPT BioRobotics Corp is a significant event that warrants attention from the investment community. While the reasons behind the insider's decision to sell shares may vary, the pattern of selling without corresponding buys could be a signal for investors to conduct a more thorough evaluation of the company's prospects. As with any investment decision, it is crucial to consider a comprehensive range of factors, including insider trends, company performance, industry developments, and broader market conditions, before drawing conclusions or making investment choices.

Investors should continue to monitor insider activity at PROCEPT BioRobotics Corp and other companies of interest, as these transactions can provide valuable insights into the internal dynamics of a company and potentially influence investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.