Insider Sell Alert: Director Negrini Beffa Sells 5,000 Shares of PC Connection Inc (CNXN)

In a recent transaction on December 4, 2023, Director Negrini Beffa sold 5,000 shares of PC Connection Inc (NASDAQ:CNXN), a leading provider of a wide range of information technology solutions. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Negrini Beffa of PC Connection Inc?

Negrini Beffa is a notable figure within PC Connection Inc, serving as a director. Directors play a critical role in shaping the strategic direction of a company and are privy to in-depth knowledge about the company's operations, challenges, and opportunities. Their transactions are closely monitored as they can reflect their confidence in the company's future performance.

PC Connection Inc's Business Description

PC Connection Inc is a provider of a broad range of information technology (IT) solutions. The company caters to a variety of customers, including small- to medium-sized businesses, enterprise customers, government and educational institutions. PC Connection Inc offers products such as computer systems, software and peripheral equipment, networking communications, and other products and accessories that they source from a wide array of manufacturers. The company prides itself on providing specialized IT services and solutions while maintaining a commitment to customer service.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

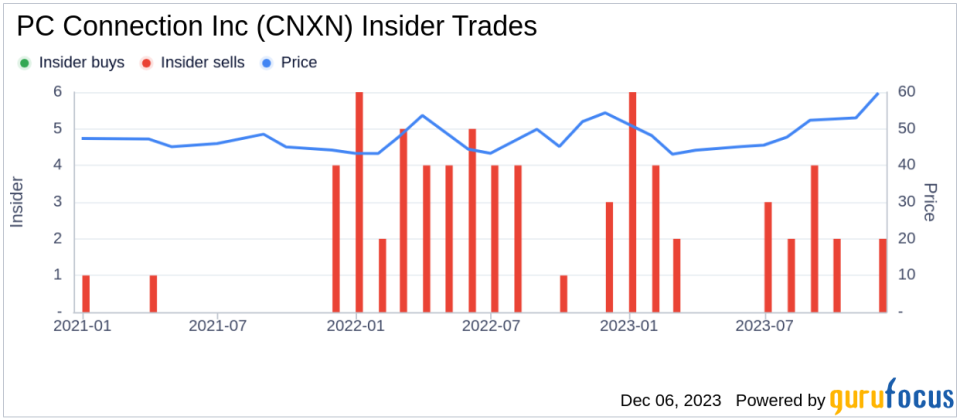

The insider transaction history for PC Connection Inc shows a pattern of insider sells over the past year, with 25 insider sells and no insider buys. This could be interpreted in several ways. On one hand, it may suggest that insiders are taking profits or diversifying their investments, which is a normal part of personal financial management. On the other hand, a consistent pattern of sells, without any offsetting buys, might raise questions about insiders' long-term confidence in the company's stock.

The recent sale by the insider, Negrini Beffa, who disposed of 5,000 shares, adds to the sell trend. Over the past year, the insider has sold a total of 10,250 shares and has not made any purchases. This could be a signal to investors to monitor the company's performance and future outlook more closely.

Valuation and Market Response

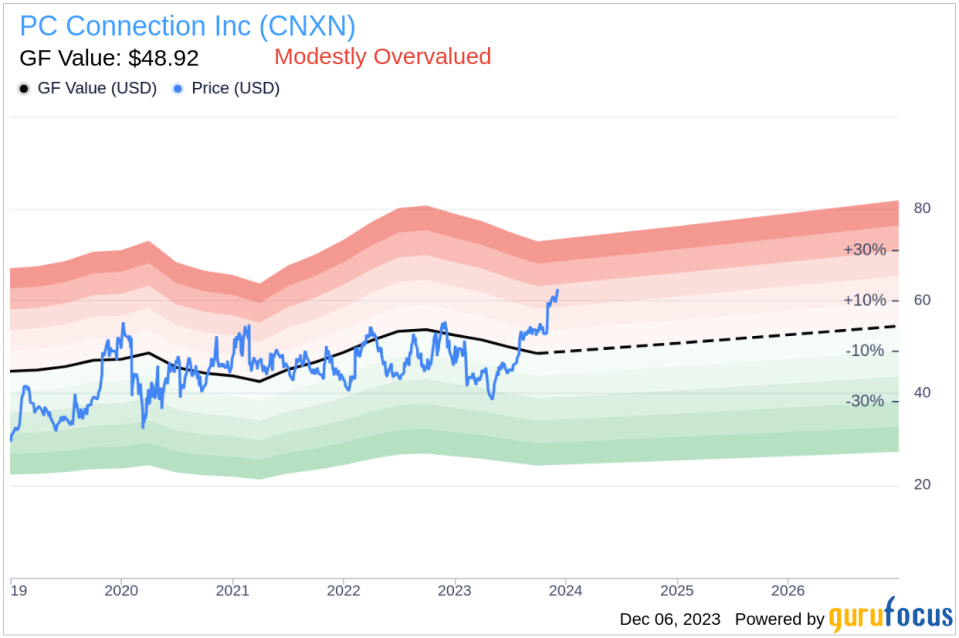

On the day of the insider's recent sale, shares of PC Connection Inc were trading at $60.97, giving the company a market cap of $1.643 billion. The price-earnings ratio of 21.06 is slightly lower than the industry median of 22.61, indicating that the stock might be reasonably valued compared to its peers. However, it is higher than the company's historical median price-earnings ratio, suggesting that the stock may be more expensive than it has been historically.With a current price of $60.97 and a GuruFocus Value of $48.92, PC Connection Inc has a price-to-GF-Value ratio of 1.25. This indicates that the stock is modestly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, an adjustment factor based on the company's past returns and growth, and future business performance estimates from analysts. The fact that PC Connection Inc is trading above its GF Value suggests that the market is currently assigning a premium to the stock, which could be due to expectations of future growth or other positive factors.

Conclusion

The recent insider sale by Director Negrini Beffa of PC Connection Inc is a development that warrants attention from investors. While insider sells are not uncommon, the lack of insider buys over the past year, coupled with the stock's modest overvaluation according to the GF Value, suggests that investors should keep a close eye on the company's performance and future guidance. As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock, and they should be considered alongside other financial metrics and market analyses.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.