Insider Sell Alert: Director Philip Maritz Sells Shares of Asbury Automotive Group Inc (ABG)

Asbury Automotive Group Inc (NYSE:ABG), a prominent player in the automotive retail industry, has recently witnessed an insider sell transaction that has caught the attention of market watchers. On November 15, 2023, Director Philip Maritz sold 667 shares of the company, a move that prompts a closer look into the insider's trading behavior and the potential implications for investors.

Who is Philip Maritz?

Philip Maritz is a respected member of the board of directors at Asbury Automotive Group Inc. His role within the company involves providing strategic guidance and oversight, ensuring that the company's operations align with the broader objectives and interests of its shareholders. Maritz's insider transactions are closely monitored, as they can provide valuable insights into the company's internal perspective on its stock's valuation and future prospects.

About Asbury Automotive Group Inc

Asbury Automotive Group Inc is a leading automotive retailer in the United States, offering a comprehensive range of automotive products and services, including new and used vehicles, vehicle maintenance and repair services, replacement parts, and finance and insurance products. The company operates numerous dealership locations across the country, representing various automotive brands. Asbury's business model focuses on providing a high-quality customer experience and leveraging technology to enhance operational efficiency.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, particularly those involving key executives and directors, are often scrutinized for insights into a company's health and future performance. In the case of Asbury Automotive Group Inc, the insider transaction history reveals a pattern of more sells than buys over the past year. Specifically, there have been 9 insider sells and 0 insider buys, indicating that insiders may perceive the stock's current price as being relatively high or that they are taking profits off the table.

On the day of the insider's recent sell, shares of Asbury Automotive Group Inc were trading at $223.2, giving the company a market cap of $4.314 billion. This price level is particularly interesting when considering the company's valuation metrics. With a price-earnings ratio of 5.01, Asbury Automotive Group Inc is trading at a discount compared to the industry median of 16.16 and its historical median price-earnings ratio. This suggests that the stock may be undervalued based on traditional earnings metrics.

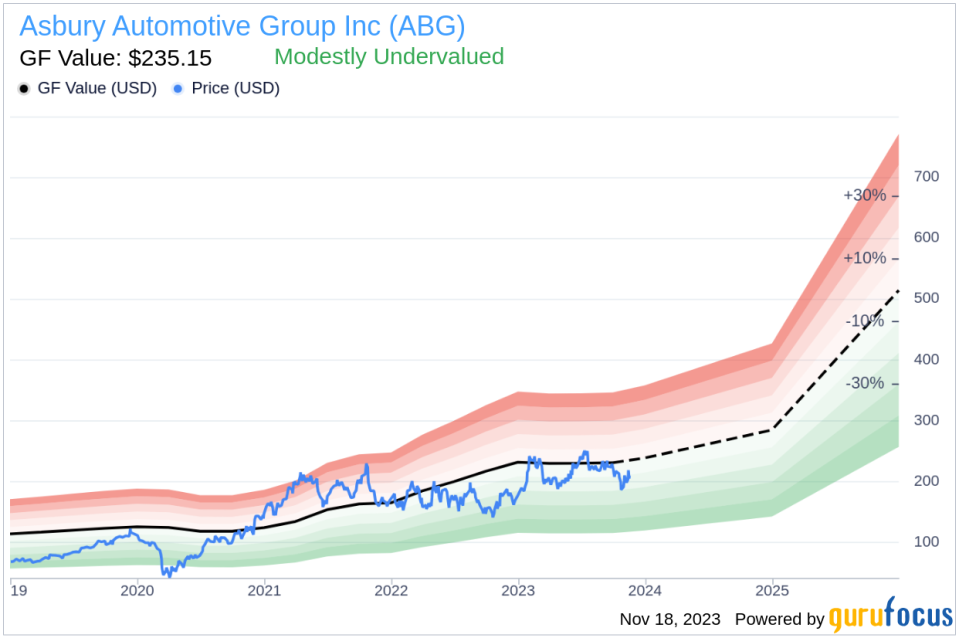

However, the price-to-GF-Value ratio stands at 0.95, with the GF Value at $235.15, indicating that the stock is modestly undervalued. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the insider trading activities at Asbury Automotive Group Inc. The absence of insider buys over the past year, coupled with the consistent selling, could be interpreted in various ways. It might suggest that insiders are confident in the company's ability to generate value but are choosing to diversify their personal investment portfolios. Alternatively, it could signal that insiders believe the stock has reached a peak or that there are better investment opportunities elsewhere.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value estimate. The modest undervaluation presents a potential opportunity for investors who believe in the company's fundamentals and are looking for an entry point into the stock.

Conclusion

Philip Maritz's recent sale of 667 shares of Asbury Automotive Group Inc is a transaction that warrants attention from investors. While the insider's actions alone should not be the sole factor in making investment decisions, they do offer a piece of the puzzle when assessing the stock's attractiveness. Considering the company's lower-than-industry-average price-earnings ratio and its modest undervaluation based on the GF Value, Asbury Automotive Group Inc may still present a compelling investment opportunity for those who are bullish on the automotive retail sector and the company's strategic initiatives.

Investors should continue to monitor insider trading activities, along with broader market trends and company-specific developments, to make informed decisions. As always, a well-rounded investment approach that considers multiple factors, including insider sentiment, valuation metrics, and industry dynamics, is recommended for those looking to navigate the complexities of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.