Insider Sell Alert: Director Richard Bressler Sells 12,813 Shares of Gartner Inc (IT)

In a notable insider transaction, Director Richard Bressler sold 12,813 shares of Gartner Inc (NYSE:IT) on November 14, 2023. This move has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance. In this article, we will delve into the details of the transaction, provide background on Richard Bressler and Gartner Inc, and analyze the implications of this insider sell.

Who is Richard Bressler?

Richard Bressler is a distinguished member of the board of directors at Gartner Inc, a leading research and advisory company. Bressler's experience in the industry and his role at Gartner give him a unique perspective on the company's operations and strategic direction. His decision to sell a significant number of shares is therefore of particular interest to those following the company's insider trading activity.

Gartner Inc's Business Description

Gartner Inc is a global leader in providing actionable, objective insight for executives and their teams. The company's research and advisory services cover a vast array of sectors, including IT, finance, HR, legal and compliance, marketing, sales, and supply chain functions. Gartner equips business leaders with indispensable insights, advice, and tools to achieve their mission-critical priorities and build the successful organizations of tomorrow. With its finger on the pulse of technological trends and market shifts, Gartner is a go-to resource for organizations seeking to navigate the complex and ever-evolving business landscape.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading patterns, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's valuation. Over the past year, Richard Bressler has sold a total of 12,813 shares and has not made any purchases. This one-sided activity could suggest that insiders, including Bressler, may believe the stock is fully valued or potentially overvalued at current prices.

When analyzing insider transactions, it's important to consider the broader context of insider trends. For Gartner Inc, there have been no insider buys in the past year, while there have been 44 insider sells. This trend could indicate that insiders are taking advantage of the stock's market performance to realize gains.

On the day of the insider's recent sell, shares of Gartner Inc were trading at $421.63, giving the company a market cap of $32.746 billion. The price-earnings ratio stood at 36.12, which is above the industry median of 26.58, suggesting a premium valuation compared to peers. However, it is lower than the company's historical median price-earnings ratio, indicating that the stock may not be as overvalued relative to its own trading history.

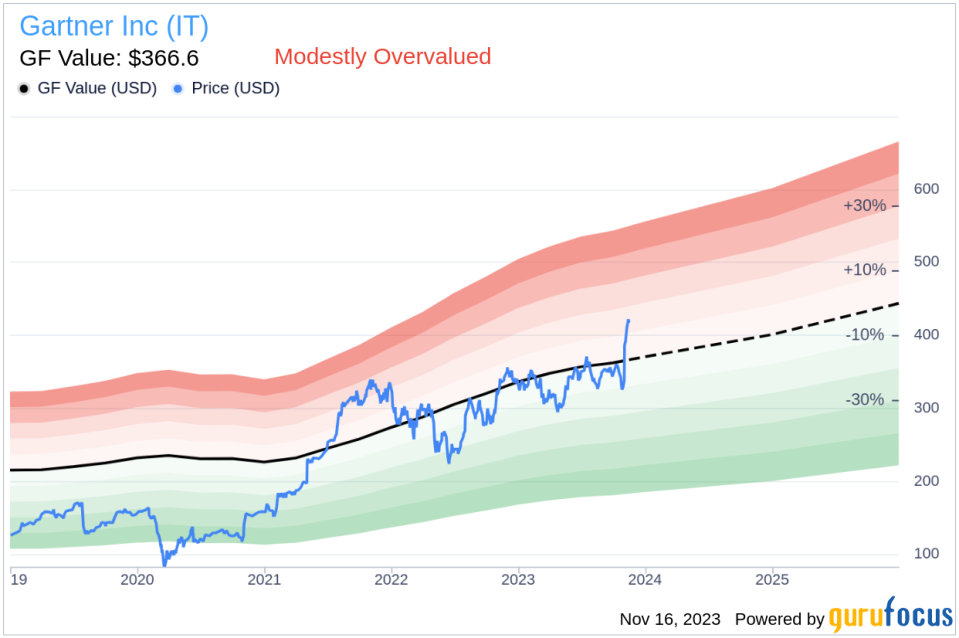

The price-to-GF-Value ratio of 1.15, with the stock trading at $421.63 and a GF Value of $366.60, labels Gartner Inc as modestly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling pattern among Gartner Inc's insiders. The consistent selling could be interpreted as a signal that insiders might perceive the stock's current valuation as being on the higher end.

The GF Value image further supports the notion that Gartner Inc's stock might be trading above its intrinsic value, as calculated by GuruFocus. This could be a contributing factor to the insider's decision to sell shares.

Conclusion

Director Richard Bressler's recent sale of 12,813 shares of Gartner Inc is a significant transaction that warrants attention from investors. While insider selling does not always indicate a lack of confidence in the company, the absence of insider buys over the past year, coupled with multiple sells, could suggest that insiders like Bressler believe the stock may not have much room for upward price movement in the near term.

Investors should consider insider trends, the company's valuation metrics, and the broader market context when interpreting insider activities. While the sale by Bressler does not necessarily predict a downturn for Gartner Inc's stock, it is an important piece of information that should be factored into an investor's analysis of the company.

As always, insider transactions are just one aspect of a comprehensive investment decision-making process, which should include an evaluation of financial performance, industry trends, and macroeconomic factors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.