Insider Sell Alert: Director Robert Mackay Sells 4,000 Shares of Customers Bancorp Inc (CUBI)

Director Robert Mackay of Customers Bancorp Inc (NYSE:CUBI) has recently made a significant change to his holdings in the company by selling 4,000 shares. This transaction, which took place on December 12, 2023, has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Robert Mackay?

Robert Mackay is a seasoned member of the board of directors at Customers Bancorp Inc. His experience and insights have been valuable to the company's strategic direction and governance. As a director, Mackay has a unique perspective on the company's operations and financial health, making his trading activities particularly noteworthy to investors.

About Customers Bancorp Inc

Customers Bancorp Inc, the parent company of Customers Bank, is a bank holding company engaged in banking and related services. The company operates through its subsidiary, providing a range of banking products and services to individual and corporate customers. Customers Bancorp Inc is known for its personalized banking experience, innovative technology, and a suite of financial products that cater to the needs of its clients.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sale by Robert Mackay, can provide valuable insights into a company's internal perspective on its stock's value. Over the past year, Mackay has sold a total of 4,000 shares and has not made any purchases. This could signal that the insider believes the stock may be fully valued or overvalued at current prices.

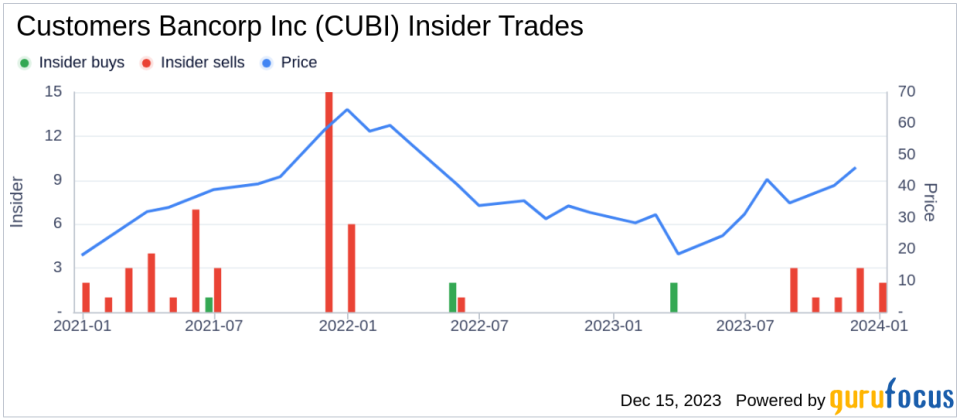

The insider transaction history for Customers Bancorp Inc shows a trend of more insider selling than buying over the past year, with 11 insider sells and only 2 insider buys. This pattern of insider behavior can sometimes suggest that those with the most intimate knowledge of the company's prospects are taking profits or reducing their positions, which may raise questions among investors.

On the day of Mackay's recent sale, shares of Customers Bancorp Inc were trading at $48.89, giving the company a market cap of $1.691 billion. The price-earnings ratio stood at 8.56, which is lower than both the industry median of 8.74 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings.

However, when considering the GuruFocus Value (GF Value), which is an intrinsic value estimate, Customers Bancorp Inc appears to be Significantly Overvalued. With a stock price of $48.89 and a GF Value of $40.78, the price-to-GF-Value ratio is 1.2. The GF Value is calculated considering historical multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent insider selling and buying patterns, providing a visual representation of the transactions over the past year.

The GF Value image provides a graphical view of the stock's current valuation in relation to its intrinsic value, as estimated by GuruFocus.

Conclusion

The sale of 4,000 shares by Director Robert Mackay may be interpreted in various ways by investors. While the lower price-earnings ratio compared to the industry could suggest an undervaluation based on earnings, the GF Value indicates that the stock is currently overvalued. The insider selling trend, particularly when not accompanied by insider buying, could be a signal for investors to proceed with caution.

Investors should consider these insider transactions as part of a broader investment analysis, taking into account the company's financial health, market conditions, and other relevant factors. As always, it is recommended to consult with financial advisors or conduct thorough research before making any investment decisions.

Insider trading activities, such as those of Robert Mackay, offer a glimpse into the perspectives of those closest to the company. While not the sole indicator of a stock's potential, they are a piece of the puzzle that can help investors form a more complete picture of Customers Bancorp Inc's valuation and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.