Insider Sell Alert: Director Roxanne Austin Offloads 6,303 Shares of Freshworks Inc (FRSH)

In the dynamic landscape of the stock market, insider transactions often serve as a valuable indicator for investors. The recent sale of 6,303 shares of Freshworks Inc (NASDAQ:FRSH) by Director Roxanne Austin on December 11, 2023, has caught the attention of market participants. This transaction is particularly noteworthy as it adds to a series of insider sales over the past year, potentially signaling investor sentiment and company outlook.

Who is Roxanne Austin?

Roxanne Austin is a distinguished member of the board of directors at Freshworks Inc. With a seasoned background in corporate leadership and governance, Austin's decisions and actions carry significant weight. Her role at Freshworks involves oversight and strategic guidance, which makes her trading activities in the company's stock a point of interest for shareholders and potential investors alike.

About Freshworks Inc

Freshworks Inc is a customer engagement software company that provides innovative solutions designed to simplify business processes. The company's suite of products includes customer support, IT service management, CRM, and marketing automation tools. Freshworks' mission is to enable organizations of all sizes to deliver a better customer experience through intuitive and scalable software. With a focus on ease of use and customer-centricity, Freshworks has established itself as a key player in the software industry.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions can provide insights into a company's financial health and future prospects. A consistent pattern of insider sales, such as the one observed with Roxanne Austin's recent sell, may raise questions about the insiders' confidence in the company's growth potential. Over the past year, Austin has sold a total of 70,987 shares and has not made any purchases. This one-sided activity could be interpreted in various ways, but it often suggests that insiders might believe the stock is fully valued or that they are diversifying their personal portfolios.

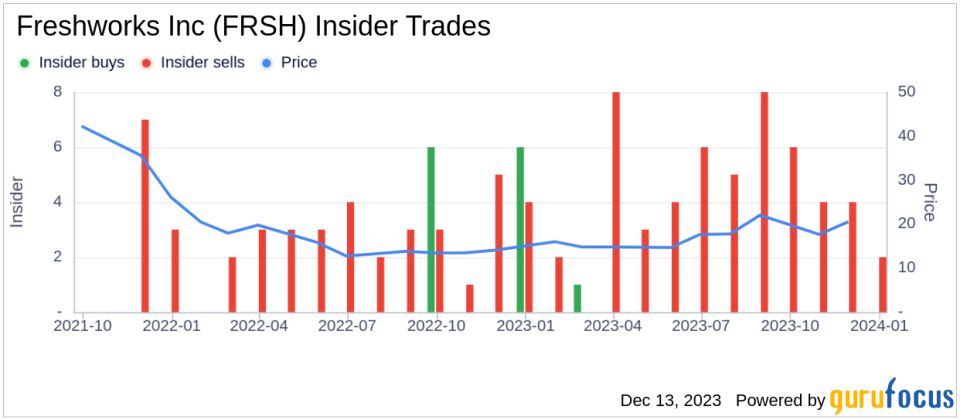

Comparing insider buying and selling trends can also be telling. Freshworks Inc has seen 3 insider buys and 53 insider sells over the past year. This imbalance leans heavily towards selling, which might indicate that those with the most intimate knowledge of the company see limited upside or prefer to lock in gains.

On the day of Austin's recent sale, Freshworks Inc shares were trading at $20.1, giving the company a market cap of $6.271 billion. The stock price in proximity to insider transactions can offer context. If insiders sell after a significant run-up in the stock price, it could be a sign of them considering the stock to be overvalued. Conversely, sales at lower price levels might suggest a lack of confidence in the stock's ability to rebound.

It is important to note that insider sales can be motivated by various factors that may not necessarily relate to the company's performance, such as personal financial planning or diversifying investments. Therefore, while insider transactions are an important piece of the puzzle, they should not be the sole basis for investment decisions.

Insider Trend Analysis

Observing the insider trend image below, we can visualize the pattern of insider transactions over time. This graphical representation can help investors discern whether the recent sale by Roxanne Austin is part of a broader trend among insiders at Freshworks Inc.

The image suggests a consistent pattern of insider selling, which could be interpreted as a bearish signal. However, without additional context, such as the company's financial performance, market conditions, and insider holdings post-transaction, it is difficult to draw definitive conclusions.

Conclusion

Roxanne Austin's sale of 6,303 shares of Freshworks Inc adds to a notable trend of insider selling at the company. While this activity may raise questions about the insiders' outlook on the stock, it is essential for investors to consider a range of factors before making investment decisions. Insider transactions are just one of many tools that can help investors gauge the sentiment of those closest to the company. As always, a thorough analysis of the company's fundamentals, competitive position, and market dynamics is crucial for a well-rounded investment strategy.

Investors should continue to monitor insider transactions, alongside other financial metrics and market news, to maintain a comprehensive understanding of their investments. The actions of insiders like Roxanne Austin can provide valuable clues, but they are just one piece of the complex puzzle that is the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.