Insider Sell Alert: Director Scott Garrett Sells 10,000 Shares of Hologic Inc (HOLX)

In a recent transaction on December 11, 2023, Scott Garrett, a director at Hologic Inc (NASDAQ:HOLX), sold 10,000 shares of the company's stock. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the sentiment of its top executives.Who is Scott Garrett of Hologic Inc?Scott Garrett is known for his role as a director at Hologic Inc, a leading developer, manufacturer, and supplier of diagnostic products, medical imaging systems, and surgical products focused on women's health and well-being. With a career that spans various leadership positions in the healthcare industry, Garrett's actions in the market are closely watched. His experience and understanding of the company's operations make his trading activities a point of interest for those following Hologic's stock.Hologic Inc's Business DescriptionHologic Inc is a global healthcare and diagnostics company with a strong emphasis on women's health. The company's portfolio includes technologies for breast health, diagnostics, GYN surgical health, and skeletal health. Hologic's products are designed to help with early detection and treatment of diseases, contributing to improved patient outcomes. The company's commitment to innovation and patient care has positioned it as a leader in the medical technology field.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceInsider transactions, such as the recent sale by Scott Garrett, can be a double-edged sword when it comes to interpreting their impact on a company's stock price. On one hand, a sale might indicate that the insider believes the stock is fully valued or potentially overvalued, prompting them to lock in profits. On the other hand, insiders might sell shares for personal reasons that have no bearing on their outlook for the company.In the case of Hologic Inc, the insider transaction history over the past year shows a pattern of more sells than buys among insiders. Specifically, there have been 0 insider buys and 7 insider sells. This could suggest that insiders, on balance, have been more inclined to sell their shares than to acquire more.

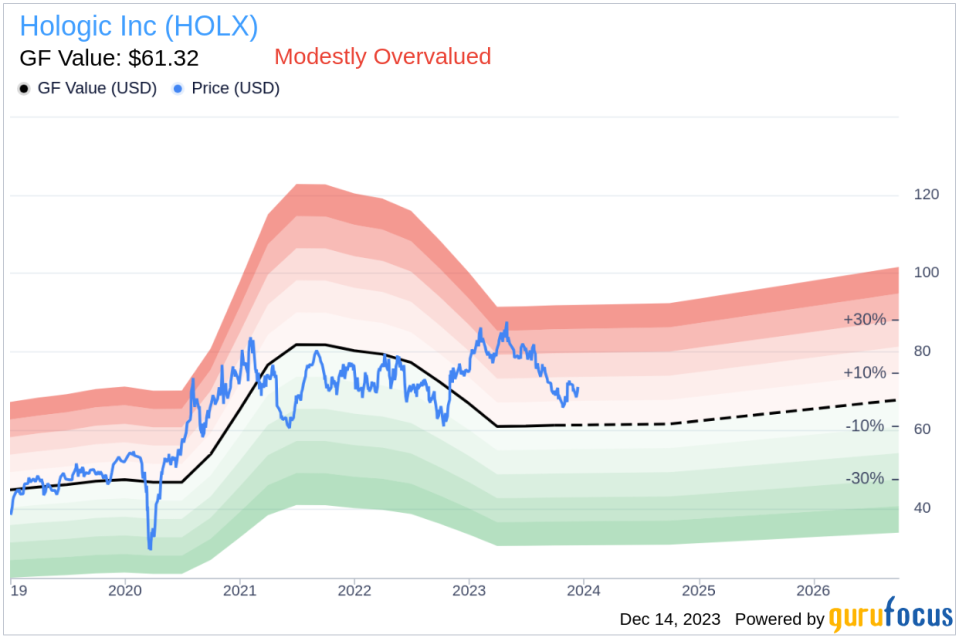

When analyzing Scott Garrett's recent sale of 10,000 shares, it's important to consider the context of his trading history. Over the past year, Garrett has sold a total of 20,000 shares and has not made any purchases. This continued selling trend might raise questions about his long-term confidence in the company's stock performance.Valuation and Market ReactionOn the day of the insider's recent sale, shares of Hologic Inc were trading at $68.71, giving the company a market cap of $17.061 billion. The price-earnings ratio of 38.85 is higher than both the industry median of 30.715 and Hologic's historical median, suggesting a premium valuation compared to its peers and its own past.Moreover, with a price of $68.71 and a GuruFocus Value of $61.32, Hologic Inc has a price-to-GF-Value ratio of 1.12. This indicates that the stock is modestly overvalued based on its GF Value.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When the price-to-GF-Value ratio exceeds 1, it suggests that the stock may be overvalued relative to its intrinsic value.ConclusionThe recent insider sale by Scott Garrett at Hologic Inc aligns with a broader trend of insider selling over the past year. While this could be a signal for investors to proceed with caution, it's also crucial to consider the broader market conditions and the company's fundamentals. Hologic's position as a leader in women's health, along with its innovative product lineup, continues to provide a strong foundation for growth.However, the current valuation metrics and the modest overvaluation based on the GF Value suggest that the stock's price may have limited upside potential in the near term. Investors should weigh these factors, along with the insider selling trend, when making decisions about their investment in Hologic Inc. As always, a diversified portfolio and a focus on long-term financial goals are key to navigating the complexities of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.