Insider Sell Alert: Director Stacy Smith Sells 10,000 Shares of Autodesk Inc (ADSK)

Autodesk Inc (NASDAQ:ADSK), a leader in 3D design, engineering, and entertainment software, has recently witnessed a significant insider sell by one of its directors. On December 13, 2023, Stacy Smith, a seasoned member of Autodesk's board, sold 10,000 shares of the company's stock. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Stacy Smith of Autodesk Inc?

Stacy Smith is a respected figure in the technology sector, known for his extensive experience and strategic insight. His tenure at Autodesk Inc has positioned him as a key player in the company's decision-making processes. Prior to his involvement with Autodesk, Smith held various leadership roles at other major tech companies, further solidifying his reputation in the industry. His recent sell-off of Autodesk shares has raised questions about his confidence in the company's short-term performance or potential shifts in his personal investment strategy.

Autodesk Inc's Business Description

Autodesk Inc is a global powerhouse in software solutions for the architecture, engineering, construction, manufacturing, media, education, and entertainment industries. The company's products, such as AutoCAD, Revit, and Maya, are staples in professional environments, enabling users to design, visualize, and simulate their ideas with precision and efficiency. Autodesk's commitment to innovation has kept it at the forefront of the digital design space, catering to professionals who demand the highest level of performance and reliability from their software tools.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sells, can be interpreted in various ways by the market. While some may view a sell as a lack of confidence in the company's future, others consider it a normal part of personal portfolio management. In the case of Stacy Smith's recent sell, it is important to analyze the context and frequency of insider transactions at Autodesk Inc.

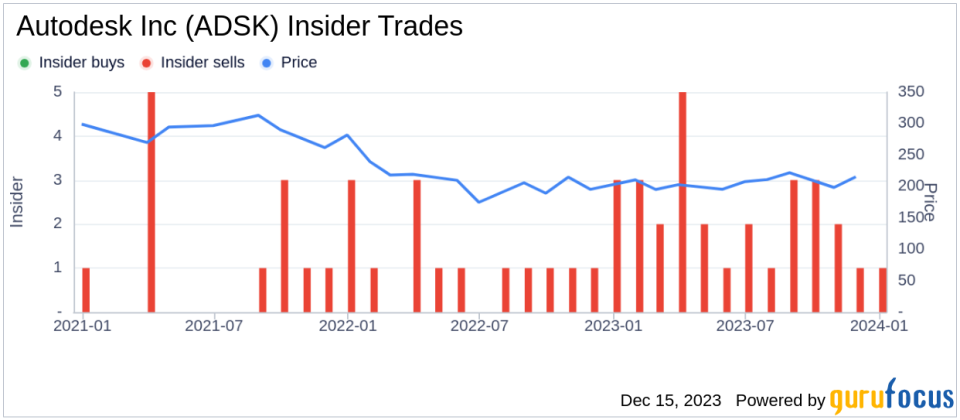

Over the past year, Stacy Smith has exclusively sold shares, with a total of 10,000 shares sold and no recorded purchases. This pattern of behavior could suggest a strategic rebalancing of his investments rather than a bearish outlook on the company's future. Furthermore, the broader insider transaction history for Autodesk Inc shows a trend of more insider sells than buys over the past year, with 30 insider sells and no insider buys. This trend could indicate that insiders, as a group, are taking profits or reallocating their investments, which is not uncommon in a company with a high stock valuation.

On the day of the insider's recent sell, shares of Autodesk Inc were trading at $234, giving the company a market cap of $51,829,541,000. This valuation places Autodesk among the larger players in the tech sector, reflecting its strong market position and robust financial performance.

The price-earnings ratio of Autodesk Inc stands at 57.01, which is higher than the industry median of 26.73. This elevated ratio may suggest that the stock is priced optimistically in relation to its earnings, potentially justifying some insider sells as a response to perceived overvaluation. However, it is also lower than the company's historical median price-earnings ratio, indicating that the stock may still be attractive compared to its own past performance.

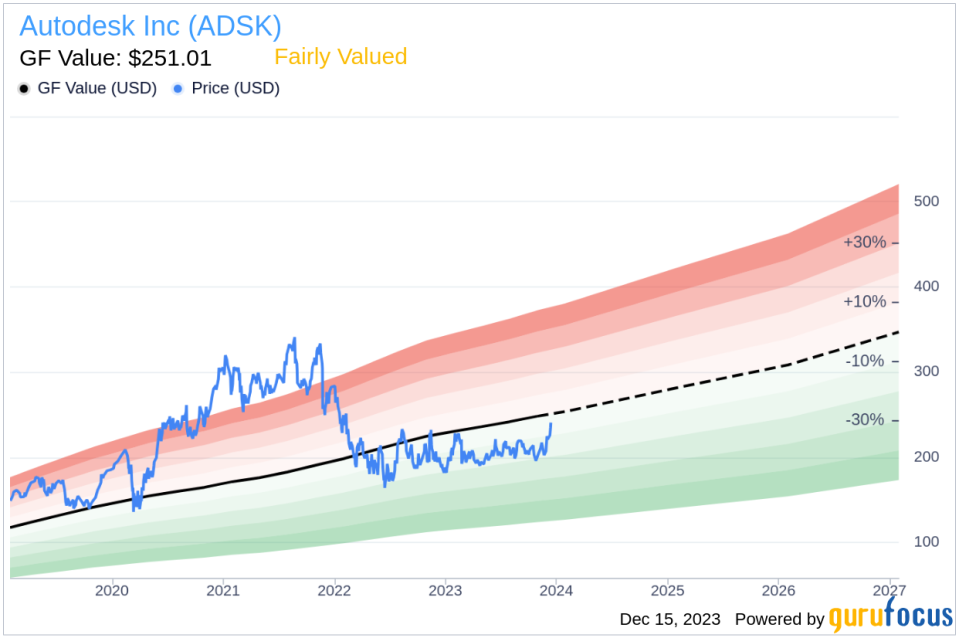

When considering the company's valuation, the price-to-GF-Value ratio is a critical metric. With a stock price of $234 and a GuruFocus Value of $251.01, Autodesk Inc has a price-to-GF-Value ratio of 0.93, signifying that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders at Autodesk Inc. This data can be instrumental in understanding the sentiment of those with the most intimate knowledge of the company's operations and future outlook.

The GF Value image further illustrates the relationship between Autodesk Inc's current stock price and its estimated intrinsic value. This comparison can help investors determine if the stock is trading at a discount or premium to its intrinsic worth.

Conclusion

Director Stacy Smith's sale of 10,000 shares of Autodesk Inc may prompt investors to scrutinize the company's valuation and future growth prospects. While insider sells can be part of normal portfolio management, the absence of insider buys over the past year could be a signal for investors to watch closely. Autodesk's strong market position and consistent innovation in software solutions continue to make it a key player in its industry. However, as with any investment, it is crucial for investors to conduct their own due diligence and consider the broader market context when interpreting insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.