Insider Sell Alert: Director Stanley Tang Offloads 186,000 Shares of DoorDash Inc (DASH)

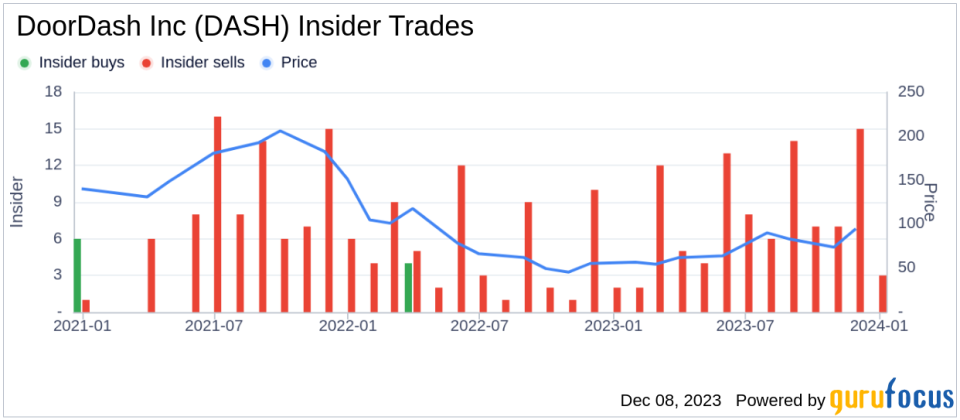

DoorDash Inc (NASDAQ:DASH), a leading food delivery service company, has recently witnessed a significant insider sell by Director Stanley Tang. On December 6, 2023, Stanley Tang sold 186,000 shares of the company, a transaction that has caught the attention of investors and market analysts alike. This article delves into the details of the sell, the insider's background, the company's business description, and the potential implications of this insider activity on the stock's performance.Who is Stanley Tang of DoorDash Inc?Stanley Tang is one of the co-founders of DoorDash Inc and has been instrumental in the company's growth and success. As a Director, Tang has been involved in strategic decision-making and has had a significant impact on the company's direction. His insider transactions are closely monitored by investors as they can provide insights into his confidence in the company's future prospects.DoorDash Inc's Business DescriptionDoorDash Inc operates an online food ordering and delivery platform that connects customers with their favorite local and national restaurants. The company has expanded its services to include grocery delivery, catering to the growing demand for convenience and quick delivery services. DoorDash's innovative approach to logistics and its expansive network of delivery drivers, known as Dashers, have positioned it as a leader in the on-demand delivery space.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe insider transaction history for DoorDash Inc shows a trend of more insider sells than buys over the past year. Specifically, there have been 97 insider sells and no insider buys, indicating that insiders may perceive the stock's current price as a favorable selling point or are diversifying their personal investment portfolios.

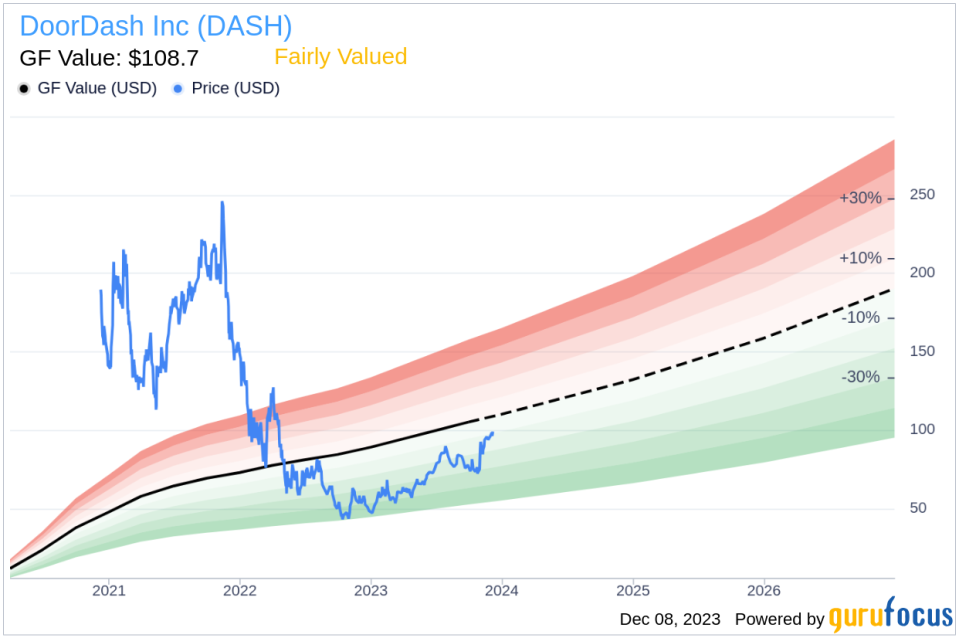

Stanley Tang's recent sell of 186,000 shares follows a pattern of his trading activities over the past year, where he has sold a total of 2,057,743 shares and has not made any purchases. This could suggest that the insider is taking profits or reallocating assets, which is not uncommon among company executives and directors.When analyzing the relationship between insider selling and stock price, it is important to consider the context of each transaction. While insider sells can sometimes signal a lack of confidence in the company's future, they can also be motivated by personal financial planning or portfolio diversification. In the case of Stanley Tang, without additional context, it is challenging to draw definitive conclusions about his outlook on DoorDash Inc based solely on his selling activity.DoorDash Inc's Stock ValuationOn the day of Stanley Tang's sell, DoorDash Inc's shares were trading at $97.08, giving the company a market cap of $39.41 billion. The stock's price-to-GF-Value ratio stands at 0.89, indicating that it is Fairly Valued based on its GF Value of $108.70.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With DoorDash Inc's stock trading below its GF Value, it suggests that the stock may be reasonably priced, and any significant insider selling at this level could be perceived as a missed opportunity for potential gains should the stock's value align with the GF Value in the future.ConclusionThe insider sell by Stanley Tang at DoorDash Inc is a notable event that warrants attention from investors. While the reasons behind the sell are not publicly disclosed, the transaction adds to a pattern of insider selling at the company. Given the stock's current valuation and its position as Fairly Valued according to the GF Value, investors should consider the broader market conditions, the company's performance, and other insider transactions when evaluating the potential impact of this sell on their investment decisions.As with any insider activity, it is essential to view these transactions as part of a larger investment picture. Investors are encouraged to conduct their own due diligence and consider multiple factors, including company fundamentals, industry trends, and broader economic indicators, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.