Insider Sell Alert: Director Steven Bunger Sells 4,000 Shares of Cavco Industries Inc (CVCO)

Director Steven Bunger of Cavco Industries Inc (NASDAQ:CVCO) has recently sold 4,000 shares of the company's stock, according to the latest SEC filings. This transaction, which took place on November 15, 2023, has caught the attention of investors and market analysts, prompting a closer look at the insider's trading behavior and the potential implications for the stock's future performance.

Who is Steven Bunger?

Steven Bunger is a notable figure within Cavco Industries Inc, serving as a member of the company's board of directors. His role in the company provides him with a deep understanding of Cavco's operations, strategic direction, and financial health. As a director, Bunger is privy to insider information that could influence his decisions to buy or sell company stock, making his trading activities a point of interest for investors seeking insights into the company's prospects.

About Cavco Industries Inc

Cavco Industries Inc is a prominent player in the manufacturing of housing products, including manufactured homes, modular homes, park model RVs, commercial structures, and vacation cabins. The company operates through various subsidiaries and has a reputation for quality and innovation in the design and production of factory-built housing. With a diverse product lineup and a commitment to sustainability and affordability, Cavco Industries Inc has established itself as a leader in the housing industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

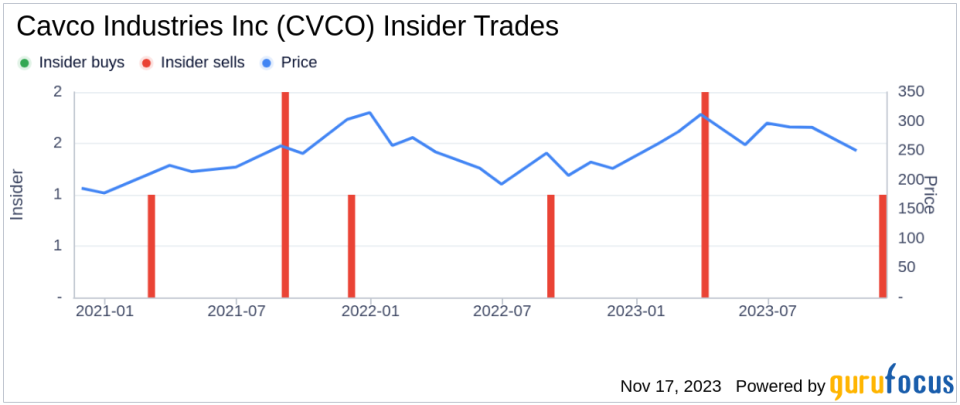

Insider trading activities, such as those of Steven Bunger, can provide valuable clues about a company's internal perspective on its stock's valuation. Over the past year, Bunger has sold a total of 4,000 shares and has not made any purchases. This one-sided activity could suggest that the insider perceives the stock's current price as favorable for selling, or it may reflect personal financial planning decisions unrelated to the company's performance.

The broader insider transaction history for Cavco Industries Inc shows a lack of insider buys over the past year, with a total of 3 insider sells during the same period. This trend might raise questions about the insiders' confidence in the company's near-term growth prospects or valuation.

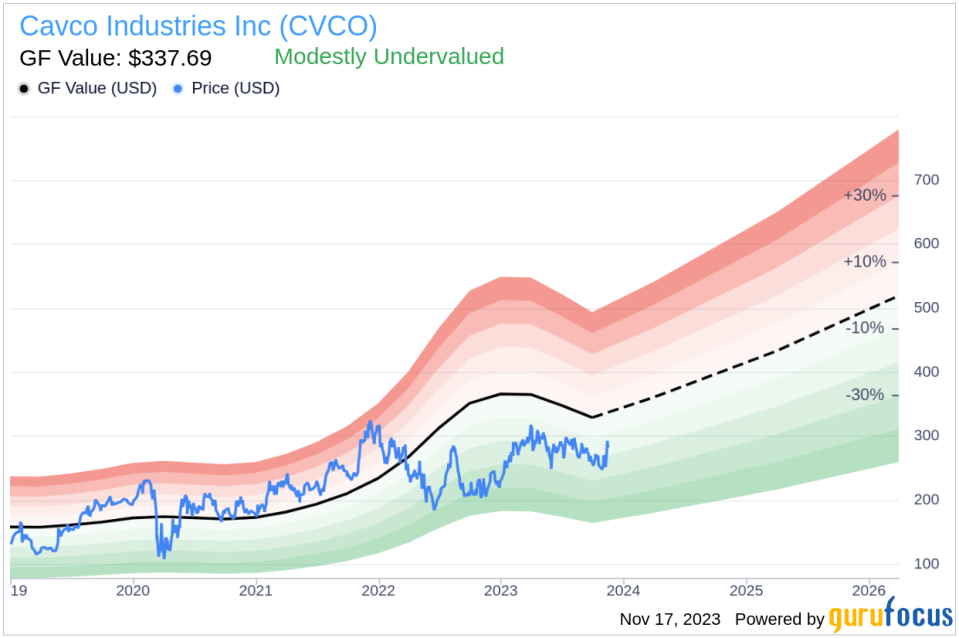

On the day of Bunger's recent sale, Cavco Industries Inc's shares were trading at $292.79, giving the company a market cap of $2.382 billion. The price-earnings ratio stood at 12.95, which is higher than the industry median of 8.69 but lower than the company's historical median price-earnings ratio. This mixed signal suggests that while the stock may be priced higher than its industry peers, it could still be undervalued compared to its own historical standards.

Adding to the valuation analysis, the price-to-GF-Value ratio of 0.87 indicates that Cavco Industries Inc is modestly undervalued based on its GF Value of $337.69. The GF Value, which factors in historical trading multiples, a GuruFocus adjustment for past performance, and future business estimates, suggests that the stock has room for potential upside.

The insider trend image above provides a visual representation of the recent insider trading activities, highlighting the absence of buys and the presence of a few sells, including Bunger's transaction.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value estimate, reinforcing the notion that Cavco Industries Inc may be undervalued at its current trading price.

Conclusion

Director Steven Bunger's sale of 4,000 shares of Cavco Industries Inc is a significant event that warrants attention from investors. While the insider's actions alone should not be the sole basis for investment decisions, they can provide context when considered alongside other financial metrics and market analyses. Given the company's modest undervaluation based on the GF Value and the mixed signals from the price-earnings ratio, investors may want to conduct further research to determine the appropriate course of action for their investment strategies.

As always, it is important to consider the broader market conditions, the company's financial performance, and any recent news or developments that could impact the stock's future trajectory. By staying informed and analyzing insider trading patterns in conjunction with other data, investors can make more educated decisions about their investments in Cavco Industries Inc and the stock market at large.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.