Insider Sell Alert: Director Sue Taylor Sells Shares of Boise Cascade Co

In the world of stock market transactions, insider selling can often provide valuable clues about a company's financial health and the sentiment of its top executives. Recently, Boise Cascade Co (NYSE:BCC) witnessed a notable insider sell that has caught the attention of investors and market analysts alike. On December 5, 2023, Director Sue Taylor sold 1,503 shares of the company, an action that merits a closer look to understand its implications.

Who is Sue Taylor of Boise Cascade Co?

Sue Taylor is a key figure at Boise Cascade Co, serving as a director. Directors are responsible for overseeing the strategic direction of a company and ensuring that it operates in the best interest of its shareholders. Taylor's role puts her in a position to be well-informed about the company's operations, financial status, and future prospects. Her decision to sell shares could be interpreted in various ways, but it is essential to consider the broader context of her trading history and the company's performance.

Boise Cascade Co's Business Description

Boise Cascade Co is a leading manufacturer and distributor of building materials, primarily focused on engineered wood products, plywood, lumber, and particleboard. The company operates through two main segments: Wood Products and Building Materials Distribution. Boise Cascade's products are essential for residential and commercial construction, repair, and remodeling projects, making it a significant player in the construction supply chain. With a market cap of $4.400 billion, Boise Cascade Co is a substantial entity in the industry, known for its commitment to sustainability and innovation.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

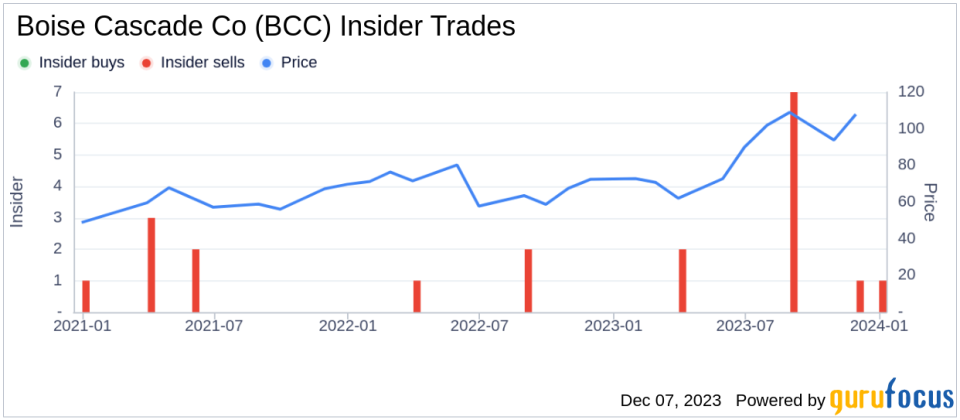

Insider trading patterns, such as buys and sells, can be indicative of a company's internal perspective on its stock's value. Over the past year, Sue Taylor has sold a total of 1,803 shares and has not made any purchases. This could suggest that the insider sees the current stock price as a favorable selling point, possibly due to personal financial planning or a belief that the stock is fully valued.

The insider transaction history for Boise Cascade Co shows a trend of more insider selling than buying over the past year, with 11 insider sells and no insider buys. This pattern may raise questions among investors about the confidence insiders have in the company's future growth potential or stock price appreciation.

On the day of Taylor's recent sell, shares of Boise Cascade Co were trading at $113.49, giving the company a market cap of $4.400 billion. The price-earnings ratio stood at 8.80, lower than both the industry median of 14.83 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued based on earnings, presenting a potentially attractive entry point for value investors.

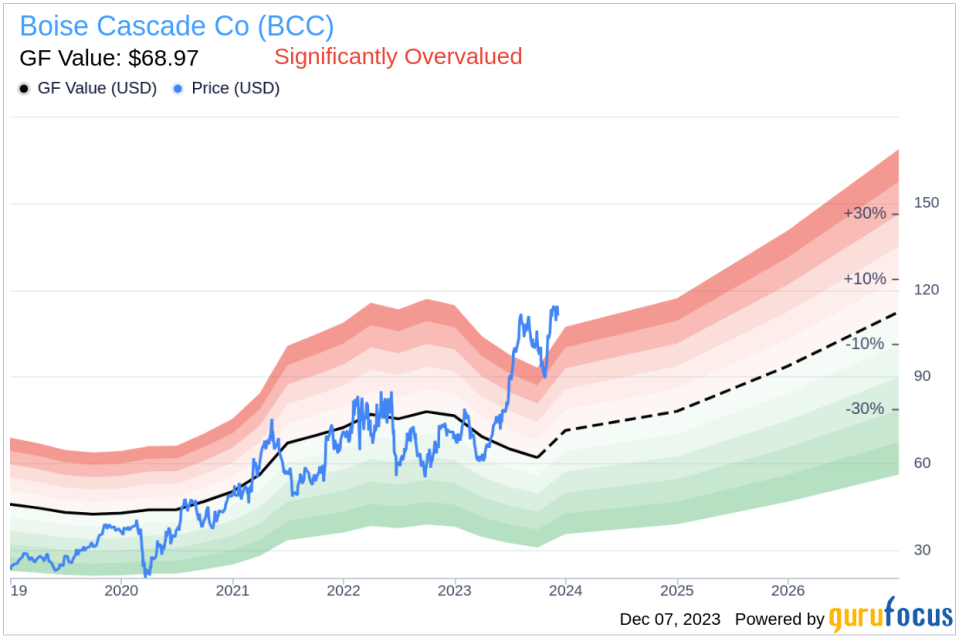

However, with a price of $113.49 and a GuruFocus Value of $68.97, Boise Cascade Co has a price-to-GF-Value ratio of 1.65, suggesting that the stock is Significantly Overvalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling and buying activities of insiders, reinforcing the notion that there has been a clear preference for selling over buying in the recent past.

The GF Value image further illustrates the disparity between the current stock price and the estimated intrinsic value, which could be a factor influencing the insider's decision to sell.

Conclusion

Director Sue Taylor's recent sale of 1,503 shares of Boise Cascade Co is a transaction that warrants attention from the investment community. While insider selling alone should not be the sole factor in making investment decisions, it is a piece of the puzzle that can provide insights into the company's valuation and insider sentiment. Given the company's lower-than-industry-average price-earnings ratio and the significant overvaluation suggested by the GF Value, investors should conduct thorough due diligence and consider a range of factors before making any investment decisions regarding Boise Cascade Co.

As always, it is crucial to look beyond insider transactions and consider the company's fundamentals, industry trends, and broader market conditions. By doing so, investors can form a more comprehensive view of the potential risks and rewards associated with investing in Boise Cascade Co.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.