Insider Sell Alert: Director Teresa Harris Sells 1,800 Shares of Altair Engineering Inc (ALTR)

In the realm of stock market movements, insider transactions hold a special place for investors seeking clues about a company's health and the confidence level of its senior executives and directors. Recently, an insider sell event has caught the attention of market watchers. Teresa Harris, a director at Altair Engineering Inc (NASDAQ:ALTR), sold 1,800 shares of the company on November 14, 2023. This transaction has prompted a closer look into the details surrounding the sale and its implications for investors.

Who is Teresa Harris at Altair Engineering Inc?

Teresa Harris is known to hold a significant position within Altair Engineering Inc as a director. Directors are tasked with overseeing the strategic direction of a company and ensuring that it operates in the best interest of its shareholders. While the specific background and role of Teresa Harris within Altair Engineering Inc are not detailed here, it is clear that as a director, Harris would have an informed perspective on the company's operations and prospects.

Altair Engineering Inc's Business Description

Altair Engineering Inc is a global technology company that provides software and cloud solutions in simulation, high-performance computing (HPC), data analytics, and artificial intelligence (AI). The company caters to a diverse clientele across various industries, including automotive, aerospace, government and defense, electronics, and more. Altair's suite of products enables innovation and decision-making through technology that optimizes the analysis, management, and visualization of business and engineering information.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sells, can be interpreted in various ways. While an insider sell does not necessarily indicate a lack of confidence in the company, a high volume of sells over buys could signal caution to investors. Over the past year, Teresa Harris has exclusively sold shares, with a total of 1,800 shares sold and no recorded purchases. This one-sided transaction history may lead to speculation about the insider's long-term view of the company's stock.

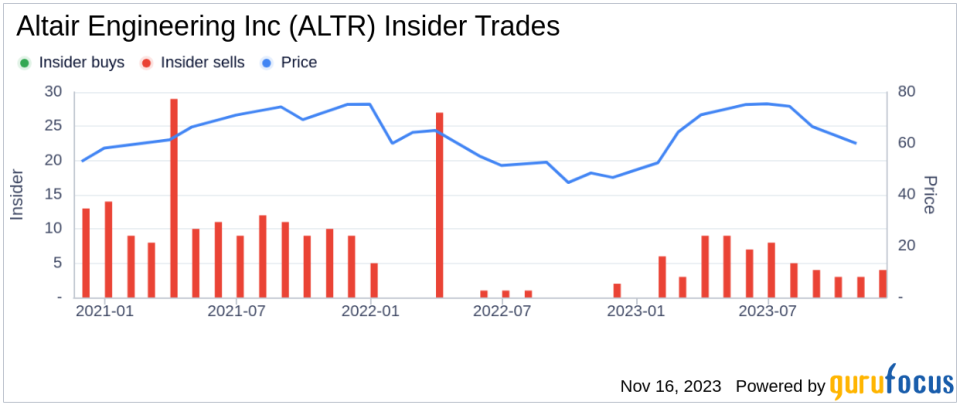

When examining the broader insider transaction history for Altair Engineering Inc, there have been no insider buys and 62 insider sells over the past year. This trend could suggest that insiders, on the whole, are choosing to decrease their holdings, potentially seeing the current market conditions as an opportune time to realize gains or reallocate their investments.

On the day of the insider's recent sell, shares of Altair Engineering Inc were trading at $73.16, giving the company a market cap of $5.939 billion. This price point is slightly above the GuruFocus Value (GF Value) of $70.42, indicating that the stock is Fairly Valued. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The price-to-GF-Value ratio stands at 1.04, suggesting that the stock is trading at a fair value relative to its estimated intrinsic value. This could mean that the insider's decision to sell was not motivated by an assessment that the stock is overvalued but perhaps by other personal or strategic considerations.

The insider trend image above provides a visual representation of the selling and buying patterns of insiders at Altair Engineering Inc. The absence of buys and the prevalence of sells could be a point of analysis for investors trying to gauge insider sentiment.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. With the stock trading close to its GF Value, it appears that the market is pricing Altair Engineering Inc appropriately, considering its historical performance and future growth prospects.

Conclusion

Director Teresa Harris's recent sale of 1,800 shares of Altair Engineering Inc may raise questions among investors about the insider's confidence in the company's future. However, with the stock trading at a fair value and the company's solid footing in the technology sector, the sell-off could be attributed to reasons other than a bearish outlook. Investors should consider the insider transaction trends and the company's valuation in the context of their overall investment strategy and the performance of the technology sector as a whole.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. It's important for investors to conduct thorough research, considering a company's financial health, market position, and growth prospects before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.