Insider Sell Alert: Director Thomas Noonan Sells Shares of Manhattan Associates Inc

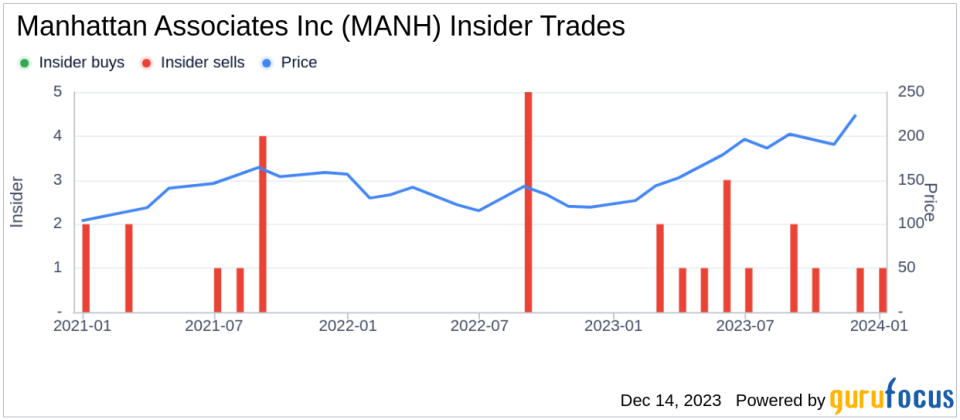

In the intricate dance of the stock market, insider transactions often attract the attention of investors looking for signals about a company's future prospects. Recently, Director Thomas Noonan made a notable move by selling 2,515 shares of Manhattan Associates Inc (NASDAQ:MANH) on December 11, 2023. This transaction has sparked interest in the investment community, prompting a closer look at the implications of such insider activity.Who is Thomas Noonan?Thomas Noonan is a seasoned executive with a history of leadership roles in the technology sector. His experience spans various companies, where he has been instrumental in driving growth and innovation. At Manhattan Associates Inc, Noonan serves as a member of the board of directors, bringing his extensive knowledge and strategic insight to the table. His decisions, including stock transactions, are closely watched as they may reflect his confidence in the company's direction and financial health.About Manhattan Associates IncManhattan Associates Inc is a global leader in providing supply chain and omnichannel commerce solutions. The company's software, technology, and expertise help organizations optimize their supply chains, improve customer service, and drive profitability. With a focus on innovation, Manhattan Associates Inc offers solutions that are designed to be adaptable to the ever-changing landscape of commerce and logistics.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sale by the insider, Thomas Noonan, is part of a broader pattern observed over the past year. During this period, Noonan has sold a total of 2,515 shares and has not made any purchases. This one-sided activity raises questions about the insider's perspective on the company's valuation and future performance.When examining the insider transaction history for Manhattan Associates Inc, it becomes evident that there have been no insider buys in the past year, contrasted with 13 insider sells. This trend could suggest that insiders, including Noonan, may believe the stock is fully valued or potentially overvalued, prompting them to lock in profits.

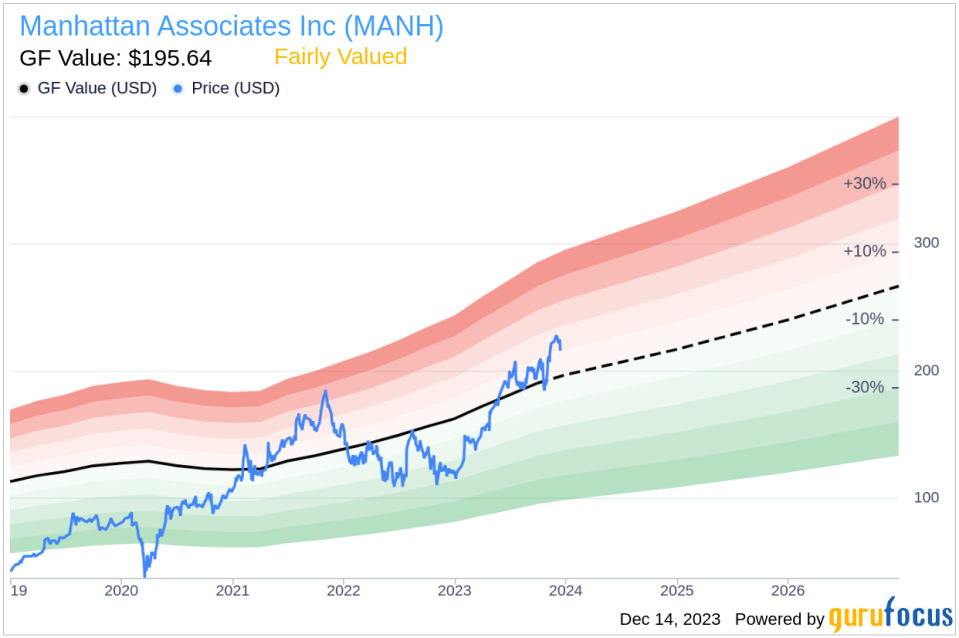

The relationship between insider selling and stock price is not always straightforward. However, consistent selling by insiders can sometimes be interpreted as a lack of confidence in the company's short-term growth prospects or a belief that the stock is not undervalued.Valuation and Market CapOn the day of Noonan's recent sale, shares of Manhattan Associates Inc were trading at $222.13, giving the company a substantial market cap of $13.295 billion. This valuation places the company at a price-earnings ratio of 81.80, significantly higher than the industry median of 26.73 and above the company's historical median price-earnings ratio. Such a high price-earnings ratio could indicate that the stock is priced optimistically relative to its earnings, which may have influenced the insider's decision to sell.Price-to-GF-Value RatioThe price-to-GF-Value ratio is a metric used to determine whether a stock is undervalued or overvalued compared to its intrinsic value. With a price of $222.13 and a GuruFocus Value of $195.64, Manhattan Associates Inc has a price-to-GF-Value ratio of 1.14, suggesting that the stock is Fairly Valued based on its GF Value.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. While the current price-to-GF-Value ratio does not indicate a significant overvaluation, it does not present a compelling bargain either, which may partly explain the insider's decision to sell shares.ConclusionThe sale of shares by Director Thomas Noonan is a transaction that warrants attention from investors. While insider selling does not always convey a negative outlook, the absence of insider buys over the past year, coupled with the high price-earnings ratio and a Fairly Valued GF Value ratio, could suggest that insiders like Noonan are taking a cautious stance on the company's current stock valuation.Investors should consider these insider trends alongside broader market analysis and individual investment strategies. As always, insider transactions are just one piece of the puzzle when evaluating a company's investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.